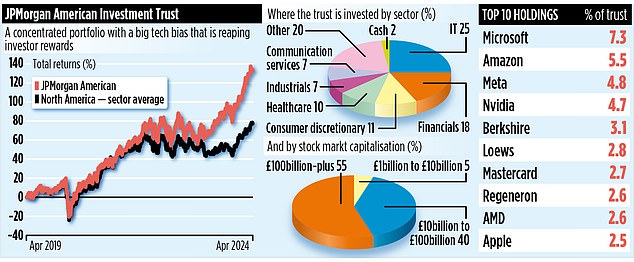

The JPMorgan American investment fund is on a roll. Over the past year, it has provided shareholders with attractive returns of 36 percent from a portfolio made up primarily of 40 U.S.-listed mega stocks.

Although the £1.8bn trust has benefited from the investment euphoria around artificial intelligence (AI), it is not a one-trick business.

In addition to owning some of the big tech stocks such as Microsoft (their largest holding), Meta and Nvidia, managers are not reluctant to invest in more “traditional” companies if their share prices appear to represent excellent long-term value for money. term. . The trust also has six per cent of its assets invested in more than 200 smaller companies.

“It is a diversified and dynamic portfolio,” says Felise Agranoff, one of the four managers who decide the composition of the fund’s assets.

‘It is a combination of our best investment ideas. We’re not tied to any one investment style, meaning we can find opportunities across the market.’

The only condition that managers must meet, set by the fund’s board, is that exposure to smaller companies must not exceed 10 percent. The trust currently owns 20 high-growth stocks and 20 high-value stocks, although the former represent the largest collective position.

Agranoff says top 10 holdings, like Microsoft and Meta, are “high-conviction” bets on the rise of AI. She describes Microsoft as one of the “early leaders in AI” and says Meta has been brilliant in using AI to develop targeted advertising.

The trust also has positions in lesser-known companies that are benefiting from the rise of AI. These include Trane Technologies, which builds the systems needed to ensure the huge data centers that AI depends on stay cool enough.

It also has a stake in Quanta Services, which is helping to build the electric power infrastructure needed to support AI.

The fund does not own all the big US technology stocks. For example, it no longer has a stake in the electric car manufacturer Tesla. “We sold it earlier this year,” Agranoff says.

‘Demand for electric cars in the United States has been disappointing. Yes, Tesla has a strong position in the market, but the market is becoming more competitive and more political.’

It also has underweight positions in both Apple and Alphabet, while it has recently taken some gains from its stake in Nvidia.

Among the value stocks he owns is EOG Resources, one of the largest oil and gas exploration companies in the United States.

“It’s a high-quality company operating in a sector of the stock market that is out of favor with investors,” Agranoff says. “It is a low-cost operator and its shares are attractively valued.”

Other key holdings include healthcare company Kenvue, which recently spun off from pharmaceutical giant Johnson & Johnson, and real estate company Regency Centers, which has done especially well developing outdoor shopping centers in Florida.

The trust’s ongoing charges are competitive at 0.38 per cent and, unlike most of its rivals, its shares do not trade at a steep discount to the value of the underlying assets. The stock market identification code is BKZGVH6 and the market symbol JAM.

Although it pays dividends twice a year, they are minimal, equivalent to 0.8 percent annually.

The trust’s management team will change next year when Jonathan Simon retires. But the impact on shareholders will be minimal.

“We have a large investment bank here,” says Agranoff.

Eytan Shapiro and Lawrence Playford, both small-cap specialists, make up the current team.