Table of Contents

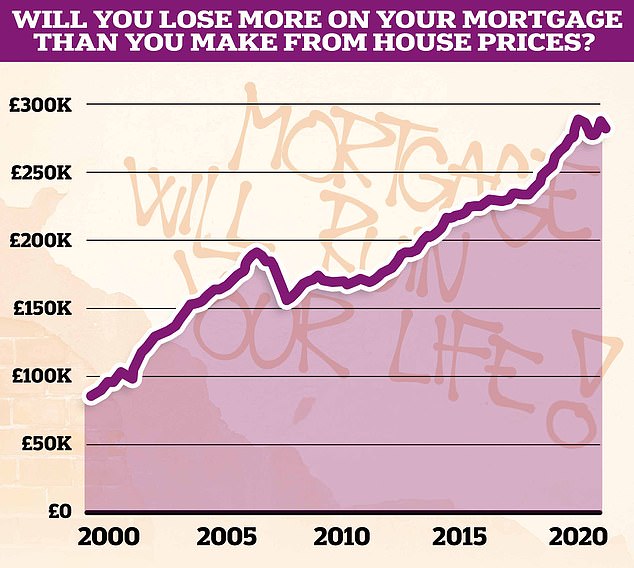

When people buy a house, they tend to think they are making a good investment, since prices tend to go up in the long term.

But unless they are cash buyers, they need a mortgage from a lender in order to purchase a property.

They will then spend decades paying off that mortgage and a large portion of their monthly payments will go toward interest.

While it’s easy to know how much they’ve made on the rising price of their home when they sell it, homeowners typically pay less attention to how much their mortgage has cost them in the meantime.

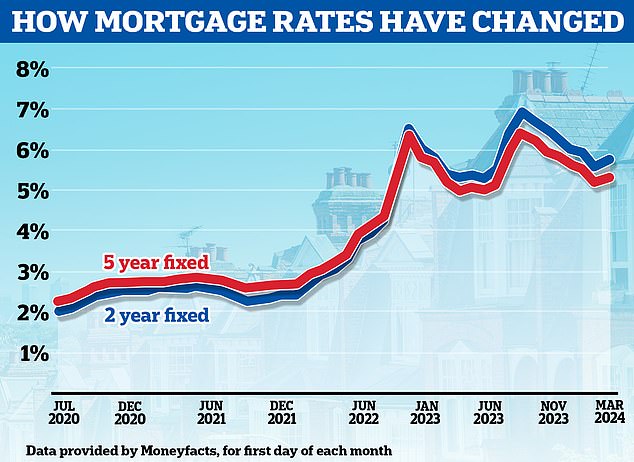

Since mortgage rates have risen over the past two years, it means that the full amount repaid is more likely to have replaced any gains made from house price growth over that time.

New research from comparison site Finder has revealed how much someone currently buying the average UK home would need to increase in value to offset mortgage costs.

That doesn’t mean buying a home is necessarily a bad idea, especially if the alternative is paying increasingly higher rents, but homeowners may be interested in knowing how much they would need their property to increase to fully offset mortgage costs.

Thanks to new research shared exclusively with This is Money by personal finance comparison site Finder, we can reveal just that.

The analysis is based on someone buying the average UK home with a 25 per cent deposit over a 30-year mortgage term, while paying the average mortgage rate over the last 30 years, which is 4.25 per cent. when you also take into account the typical fees associated with remortgage.

The average house in the UK currently costs £281,913, and someone buying it with a 30-year mortgage would end up spending £445,000 on the house and mortgage, according to Finder.

For the property to achieve this valuation, the asking price would need to increase by 58 per cent, equivalent to more than £163,000 in monetary terms over 30 years.

However, the good news for potential home buyers is that over the last 30 years, the average house price in the UK has increased by a whopping 416 per cent.

If this happened again, a house worth £281,913 today would be worth £1,454,981 in 2054, according to Finder.

What happens if mortgage rates stay where they are?

Mortgage rates are currently slightly above the 30-year average.

Currently, the most popular mortgage product among borrowers is two-year fixed rates, according to broker L&C Mortgages.

According to Finder, the current average two-year fixed mortgage rate for someone buying with a 25 per cent deposit is 4.97 per cent.

If this rate remained the same for the next 30 years, the total amount someone would have to pay would rise to £477,900. This works out to an extra £90.65 per month and over £32,600 in total.

> What’s next for mortgage rates and how long should they lock in?

According to Moneyfacts, the average two-year fixed rate mortgage is 5.81%

According to Moneyfacts, the average two-year fixed-rate mortgage across all deposit sizes is currently higher at 5.81 per cent.

If this were the average rate over the next 30 years, the total amount someone would have to pay, when buying the average house, would rise to £517,705, which is equivalent to an extra £72,705 over the life of the mortgage, although without taking into account account Additional fees.

For house prices to equal the cost of a mortgage, they would have to rise by about 84 percent over the next 30 years.

Will housing prices continue to rise as in the past?

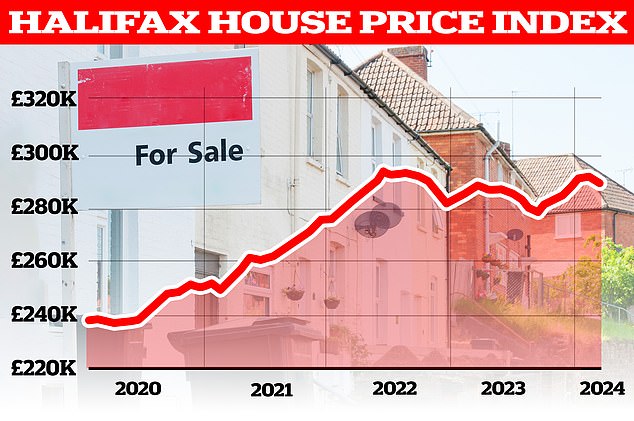

For house prices to rise over the next 30 years as quickly as they have over the past 30 years, on average they would need to rise about 5.63 percent each year, taking into account the effect of annual compounding.

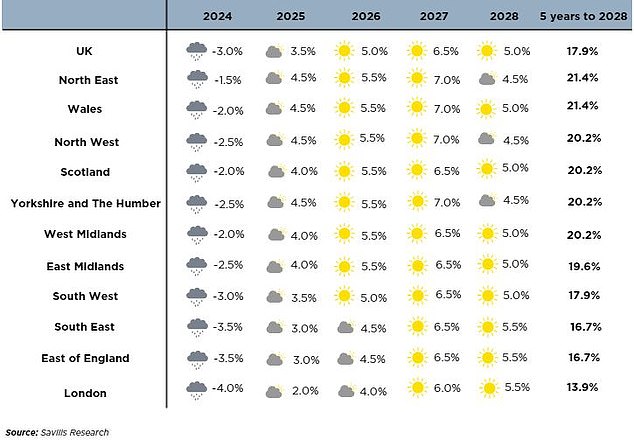

This might seem entirely possible. However, many of the leading house price forecasts paint a more pessimistic picture, at least for the next five years.

For example, estate agent Savills predicts that average UK house prices will rise by 17.9 per cent in the five years to 2028.

Savills predicts UK house prices will rise by less than 18% over the next five years

Meanwhile, Knight Frank forecasts that average UK house prices will rise by 20.5 per cent over the same period.

Real estate company JLL predicts an even flatter outlook, with average house prices rising 14 percent by 2028, representing an average increase of 2.7 percent each year.

Ultimately, house price forecasts should be taken with caution. Forecasting the next five years is difficult enough, but accurately forecasting the next 30 years is nearly impossible.

Is buying a house a good investment?

Owning your own home is often seen as more than just an investment – it’s a British obsession, and many see “climbing the ladder” as one of life’s great milestones.

Buying property is often seen as a sign of independence, security and success.

Freehold ownership is also often seen as a preferred alternative to renting, which often means paying increasing rents to a landlord who could ask tenants to leave at any time, with just two months’ notice.

Whats Next? While home prices have tended to rise over the long term, they have been drifting and even falling over the past two years thanks to higher mortgage rates.

But in purely financial terms, buying and owning a home involves more than just the cost of a mortgage.

Purchasing also carries some additional costs, such as legal and surveyor fees, and for those moving, it will also involve estate agent fees and, in most cases, stamp duty costs on future purchases.

Then there is the cost of ownership, which includes repairs and maintenance or, more often, service charges and ground rents if it is a leasehold property.

Ultimately, although purchasing property can be seen as an investment, it should not be done for that reason alone.

Liz Edwards, personal finance expert at Finder, said: “Getting on the property ladder is often a good investment for Brits, but there are some key things to consider before buying.”

‘Firstly, let’s not assume that previous house price increases will continue.

‘It is even possible that prices will suffer a prolonged decline; For example, prices plummeted and did not recover for almost eight years, between July 1989 and April 1997.

‘Secondly, it is worth remembering that the price of a house is not the only cost involved. There are additional fees such as stamp duty, legal fees and a mortgage fee.

“And as this research has shown, mortgage costs add a significant amount to the overall cost of a home, especially if interest rates rise in the future.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.