A consumer expert has revealed how shoppers are hit with hidden surcharges for using their debit cards in store, costing them up to $140 in fees each year.

Finder’s Head of Consumer Research Graham Cooke told WhatsNew2Day Australia that many restaurants, bars and retail businesses do not disclose their rates to customers.

“People are using more credit and debit cards due to the greater availability of EFTPOS machines,” he said on Wednesday.

“I can get my Big Issue (a magazine that homeless people sell on the streets) with my credit card.”

Price comparison website Canstar revealed in February that total fees rose by $400 million last year to a whopping $4 billion. It is estimated that Australians spend an average of $140 on hidden fees.

Costs are one of the many reasons why more and more Australians are moving away from card payments and expressing concerns about a cashless society.

Last Tuesday, a cashless movement launched Cash Out Day, where queues of residents were seen waiting outside banks to withdraw money.

A consumer expert has revealed how shoppers are hit with hidden surcharges for using their debit cards in store, costing them up to $140 in fees each year.

Using credit and debit cards to make purchases when out and about costs Australians a staggering $1 billion a year.

The most popular way to pay by card is tap-and-go, which accounts for 95 percent of in-person transactions and is the most expensive.

While inserting a card into an Eftpos machine typically costs a merchant less than 0.5 percent per transaction using contactless Visa and Mastercard, the payout can amount to between 0.5 and 1 percent each time for cards. debit and between 1 percent and 1.5 percent for credit cards.

On a $100 purchase, the average added cost is 28c for EFTPOS, 52c to use the Mastercard network, 47c to use Visa and a whopping $1.88 for digital payments provider Square.

While some larger businesses absorb these costs into the price of their goods and services, many smaller businesses include customers with banking fees.

Even some larger companies charge for using plastic.

While supermarkets Coles and Woolworths absorb fees into their prices, discount retailer Aldi charges a small standard fee on all card transactions.

Mister Cooke said it was “almost impossible to use plastic in Australia and not face one of these tariffs”.

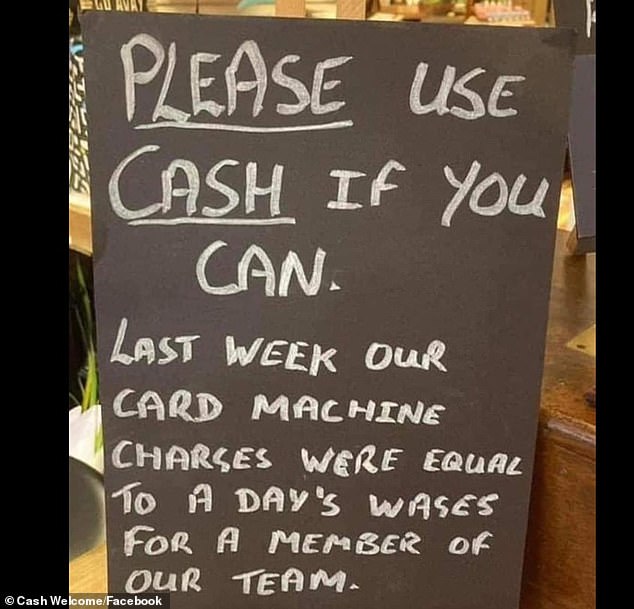

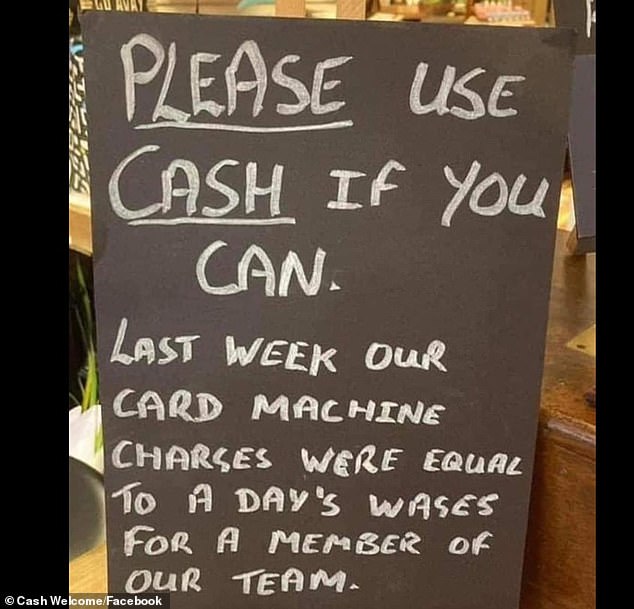

A small business owner described the financial trouble he’s in with digital payments in a Facebook post.

‘I run a small business we used Square to acquire Eftpos last year, it cost us 40,000 fees, we just can’t absorb the costs. Cash is king,’ they wrote.

Mister Cooke said the long-term trend is to move away from using cash, even if it costs more.

“It seems Australians are choosing the convenience of plastic even though they have to pay these fees,” he said.

‘It hasn’t hurt the move towards a cashless society. ATM withdrawal numbers are declining fairly steadily.

“In 2008 we are talking about 80 million withdrawals since then and it has been steadily decreasing since then.”

Companies receive commissions from the bank for each card payment and absorb those costs in their prices or directly impose a surcharge.

Those involved in the Cash Day Out protest rushed to bank branches across the country to make withdrawals on Tuesday (file image)

While many people have pointed to the Covid lockdowns as something that prompted the move away from using cash, Cooke said that was not the case in the long term.

“There was a big drop in ATM withdrawals during Covid and it has recovered since then, but if you look at where the downward trends are now, it’s exactly where you would expect it to be without Covid happening,” he said. .

“Covid has had no effect on the continued decline in cash usage in Australia.”

Cooke said he believed the path Australia will eventually have to follow is the one taken in Britain, where retailers are not allowed to charge extra fees for payments.

A Finder survey found that 74 per cent of Australians think banks and card issuers should pay the cost of card payment processing and only 6 per cent think the customer should fork out for it.

Last year, Small Business Council President Matthew Addison said the solution to high surcharges was for banks to help businesses install payment machines that apply a least-cost routing system, making them as cheap as possible. possible.

Price comparison website Finder head of consumer research Graham Cooke said long-term trends were away from using cash in Australia.

“Banks really need to get behind this and make it easy for businesses to adopt and understand,” Mr Addison said.

‘If we can keep the costs of doing business down, that means companies don’t have to raise their prices.

“Costs are rising and here is a way, at no cost to the government or the budget, to implement a system that will save costs for small businesses.”

Only about 54 per cent of businesses use the lowest cost route, worrying the Reserve Bank of Australia.

The central bank says that if there is not 80 percent adoption of the plan by the middle of this year, it will consider making it a formal regulatory requirement.

Reserve Bank Governor Michele Bullock has called on banks and payment providers to promote the scheme and make it “as easy as possible” for merchants to opt in.