If you open an account using links that have an asterisk, This is Money will earn an affiliate commission. We do not allow this to affect our editorial independence.

Barclays has removed the £4 minimum monthly fee for its Smart Investor platform in a bid to simplify its pricing structure.

Instead, the platform now has a fee for its clients based on a percentage of their investment balances.

Previously, it charged 0.2 per cent on funds and 0.1 per cent on other investments, with a minimum monthly charge of £4.

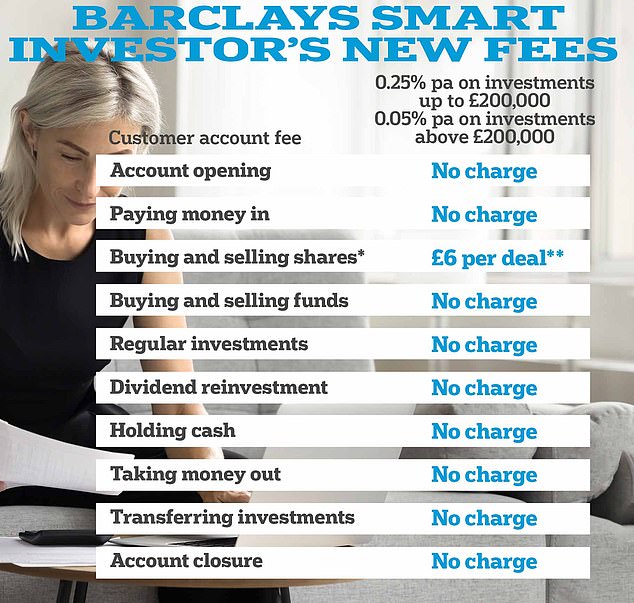

New customers will pay 0.25 per cent on investment balances up to £200,000 and 0.05 per cent above £200,000, regardless of what they decide to invest in.

Barclays Smart Investor platform has eliminated fund management fees for clients

Barclays will also scrap its monthly fee for existing customers and freeze charges at 0.2 per cent for funds and 0.1 per cent for all other investments.

The maximum monthly rate for existing customers remains capped at £125.

Chris Worle, director of Barclays Smart Investor, said: “It is more important than ever that we enable more people in the UK to invest for their future; with inflation still high and interest rates expected to peak in 2024, investing continues to offer the potential for the best long-term returns.

“These changes to Barclays Smart Investor are the start of a series of improvements we will be rolling out over the next 18 months to make investing easier, as well as more accessible and rewarding.”

Customers can invest from £50 a month.

Barclays has also made changes to its trading fees, which were previously £6 per transaction for UK and US securities and £9 for other international exchanges.

All share trades will now cost £6, while fund trades, which previously cost £3 to buy and sell, are free.

Competition between DIY investment platforms has intensified in recent years.

Platforms like Free trade* and Trading212, which offers clients commission-free stock trading, challenged the largest traditional traders.

Last year Hargreaves Lansdown* and Interactive investor* (ii) both reduced their trading rates. II has also expanded its starter plan, which costs £4.99 a month, to customers with assets up to £50,000.

We compare investment platform costs in our guide here.

How competitive is the new Barclays Smart Investor offering?

Barclays says its new flat rate will make it easier for customers to understand what they are paying for, but is it a good deal?

Smart Investor is one of the few platforms that offers free fund trading on their platforms, but share trading remains at £6, which is higher than other platforms.

Interactive Investor (ii) charges £3.99, iWeb charges £5 and Bestinvest* charges £4.95 per trade.

Freetrade’s free basic plan which grants access to a general investment account, offers commission-free trading and access to over 1,500 global stocks and ETFS, but not funds.

On the face of it, removing the £4 minimum monthly fee is a good deal. Barclays says a new customer who has £10,000 invested in funds in an Isa will pay £25 a year, compared to £48 previously.

However, by charging you a percentage of your assets, the more you invest, the more you pay.

II charges a flat fee of £4.99 per month on investments up to £50,000 and UK and US trades cost £3.99.

This means that a II customer would pay £60 a year, while a Barclays customer paying 0.25 per cent on £50,000 would pay £125 a year.

Similarly, a customer with £100,000 in investments would pay £11.99 a month with ii’s Investor plan, or £143.88 a year.

A Smart Investor customer with £100,000 will pay £20.83 a month, or £250 a year.

A new Barclays client with a portfolio valued at £250,000 would pay the lowest client fee of 0.05 per cent on the value over £200,000, meaning they would pay £43.75 a month, or £525 a year . t

This assumes that you do not have any cash inside your investment account.

Existing customers will benefit from the £125 monthly cap, but will not get the lower customer rate above £200,000.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.