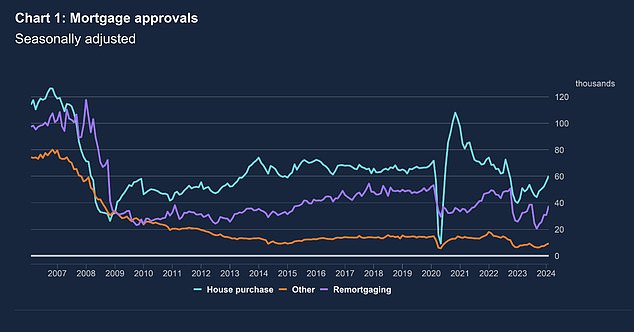

- The number of mortgage applications for the purchase of real estate amounted to 60,383 in February

- This is 7.7% more than the month before and almost 40% more than this time last year

- It marks the highest level for mortgage approvals since September 2022

<!–

<!–

<!– <!–

<!–

<!–

<!–

Mortgage approvals for home purchases reached a 17-month high in February, which could be a sign that the real estate market is bouncing back.

According to figures from the Bank of England, the number of mortgage applications has risen for five months in a row since the summer due to a fall in mortgage rates.

Today it emerged that mortgage approvals for property purchases rose 7.7 per cent to 60,383 in February, up from 56,087 in January and up 17 per cent on December’s 51,500.

It means that the number of mortgage approvals for home purchases has increased by 40 percent compared to February last year, when the number of approvals was just 43,207.

On the rise: Mortgage approvals for property purchases are at the highest level in 17 months, in one of the clearest signs yet that confidence is returning to the property market

It also marks the highest level for mortgage approvals since September 2022, when mortgage rates began to skyrocket following the disastrous mini-budget announced by then Chancellor Kwasi Kwarteng.

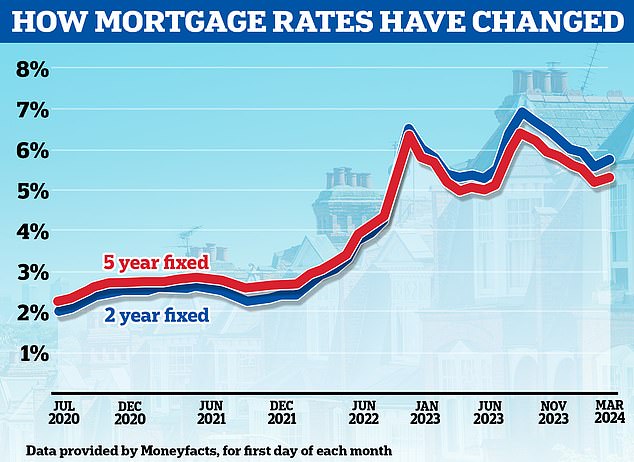

Mortgage interest rates fell sharply between August 2023 and the end of January this year. In January 2024 alone, more than fifty lenders cut mortgage rates – some more than once.

The average interest rate on new mortgages has fallen by 29 basis points to 4.9 percent, according to figures from the Bank of England – a six-month low.

Mortgage brokers across the market are also reporting a renewed willingness to lend among buyers this year.

Mark Harris, CEO of mortgage broker SPF Private Clients, said: ‘Mortgage applications for new purchases have risen again to the highest level since September 2022, as lower mortgage rates have increased affordability and borrower confidence. Our agents have definitely seen an increase in activity and inquiries.”

Habito CEO Ying Tan added: “Mortgage approvals were strong at Habito in February, as they were in January, and this is reflected in the Bank of England data.

“Consumers and homeowners benefited from a rate war early this year as lenders fought for positions.”

Is the housing market improving?

The ten-year monthly average for mortgage approvals is around 65,000, so today’s numbers represent a return to near ‘normal’ market levels.

However, mortgage rates have risen since early February, which could lead to more buyers putting their plans on hold and causing approvals to stagnate or even decline.

Much will depend on mortgage interest rates in the future. At the moment they are still much higher than two to five years ago and this limits people’s borrowing power.

“While this is solid progress, the road to recovery is long and we are not yet back to a normally functioning market,” said Stuart Cheetham, CEO of mortgage provider MPowered Mortgages.

‘If the market is to consolidate these gains and return to normal levels of lending, interest rates must fall further and faster.

‘Affordability remains extremely limited in many parts of Britain, and this is impacting both buyer confidence and sellers’ willingness to put their home on the market when they know demand will be volatile.

‘Lenders compete hard on the rates they offer, both for new borrowers and those refinancing their mortgages, but to significantly reduce rates we need a clear signal from the Bank of England that it will be prepared to maintain its tight monetary policy to relax as next sets the base interest rate at the beginning of May.’

We’re on the rise again: Mortgage rates have started to rise again after falling back from the highs they reached in the summer

Andrew Montlake, managing director at mortgage broker Coreco, added: ‘We are hopefully on the cusp of a continued decline in inflation and a stabilization of interest rate movements, allowing lenders to price more competitively and keep rates low for longer, in instead of the sharp staccato changes we’ve seen for too long.

‘The Bank of England must be brave and proactive, rather than putting itself back in a position where it has to be reactive later, holding people across the country hostage to the weight of higher interest rates.

“There is a groundswell of pent-up demand from first-time buyers, movers and people looking to remortgage who are waiting for the dam to break so they can take advantage of softer prices before they get stronger again.”