- Coles Liquor Stores ‘card only’ from March 27 to April 5

- The supermarket giant stressed that the measure is only “temporary”

- Measure due to “industry-wide” cash flow problems

- READ MORE: Hidden ‘tap-and-go’ payment fees

<!–

<!–

<!– <!–

<!–

<!–

<!–

Supermarket Coles could potentially run out of cash over the long Easter weekend as a “temporary” measure amid industry-wide cash flow problems.

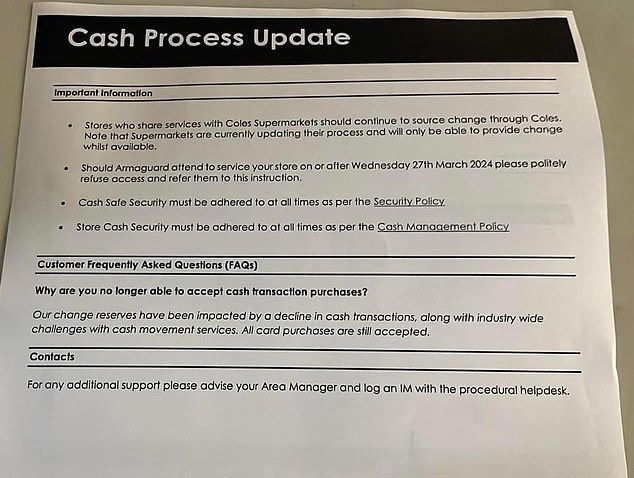

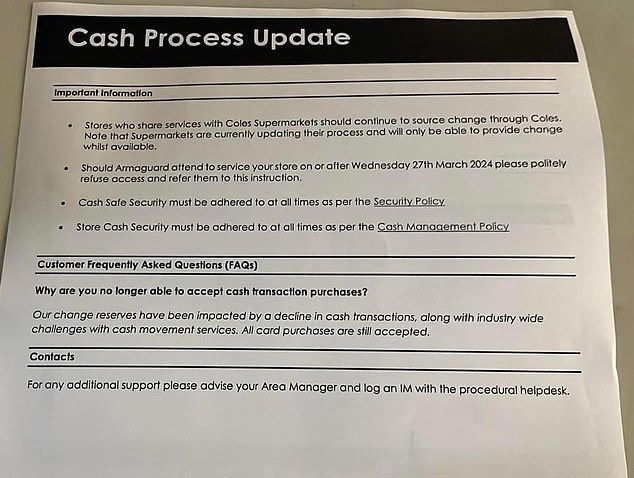

A “cash process update” memo was sent to Coles staff across the country warning that the supermarket’s liquor stores would temporarily be “card only” from March 27 to April 5.

Daily Mail Australia understands the measure will only be implemented in stores if cash reserves decline over the 10-day period.

Coles reaffirmed that it will not run out of cash and that cash transactions will continue to be available to customers in all Coles supermarkets over the long weekend.

The memo, shared on social media by a Coles liquor store worker, advised staff to print and display “card only” notices at open tills if cash reserves dwindle.

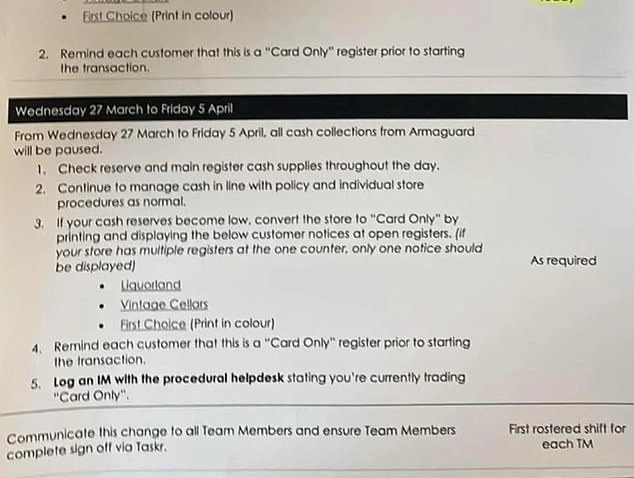

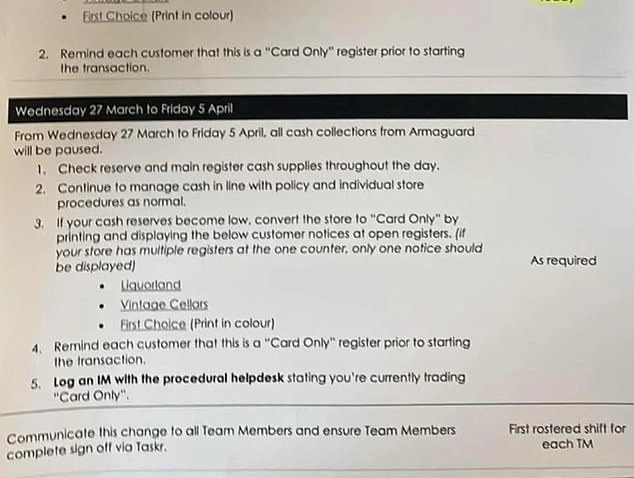

Coles Liquor stores, including Liquorland, Vintage Cellars and First Choice, will temporarily go cashless from March 27 to April 5 amid industry-wide issues with cash movements.

Employees were also advised to consolidate the use of cash in a cash register, as cash collections from Armaguard would be suspended.

According to the memo, customers should be reminded before initiating their transaction that cash cannot be used.

Workers also received an answer to use if a customer asks why cash is not accepted.

Staff should respond: ‘Our exchange reserves have been affected by a decline in cash transactions, along with industry-wide challenges with cash movement services. All card purchases are still accepted.

The temporary measure applies to Coles Liquor stores, including Liquorland, Vintage Cellars and First Choice.

The memo advised staff that stores sharing services with Coles Supermarket should continue to source exchanges through Coles for as long as they are available.

A Coles liquor store worker shared the ‘cash process update’ memo on social media (pictured)

The memo instructed workers to convert to ‘card only’ if cash reserves fell (pictured)

It comes amid claims that Armaguard, which is the country’s largest banknote delivery company, is at risk of insolvency as cash usage across the country has declined.

Last week, Australia’s major banks and major retailers, including Coles, Woolworths, Wesfarmers and Australia Post, pushed through an emergency funding package.

If accepted by Armaguard, the last-minute lifeline would provide the cash delivery service with financial support of tens of millions of dollars, enough until the second half of the year.

Coles told Daily Mail Australia the temporary measure was due to “industry-wide challenges” with cash movements across the country.

“We are not transitioning to cashless transactions,” Coles said.

‘Due to industry-wide challenges with cash movements, we are taking some temporary measures to prepare for the disruption of Armaguard services.

“Cash transactions remain available in all Coles supermarkets and liquor stores.”