<!–

<!–

<!– <!–

<!–

<!–

<!–

Nearly one in two Australians have less than $1,000 in the bank during a cost of living crisis.

Finder, a financial product comparison group, found 45 per cent of consumers had saved less than $1,000, based on a large survey of 3,214 Australians from January to March.

Financial anxiety is deepening, even as unemployment fell to 3.7 percent in February, down from January’s two-year high of 4.1 percent, thanks to the creation of 116 500 new jobs.

Nearly one in two Australians have less than $1,000 in the bank during a cost of living crisis (stock image)

Graham Cooke, head of consumer research at Finder, said even something as simple as a puncture was now enough to cause anxiety.

“Australia’s cost of living pressure is at an all-time high, which is why so many Australians not having a savings buffer is a major concern,” he said.

“Even something as trivial as a puncture would currently be too difficult for many households.

“Millions of people are struggling financially, and many find themselves running out of money well before the end of the month. »

The Finder survey also showed one in five Australians, or 4.2 million people, had nothing in the bank.

A fall in Australia’s unemployment rate would generally be seen as a sign of good economic news, but at a time of cost-of-living crisis it has stoked fears of a further rise in inflation.

EY principal economist Paula Gadsby noted that unemployment was now well below the Reserve Bank’s forecast, which predicted it would reach 4.2% by June 2024.

“Today’s result shows that the unemployment rate is well below the Reserve Bank’s forecast and justifies the Council’s cautious approach,” she said.

“If anything, it presents an upside risk to the Reserve Bank in ensuring that inflation returns to its target, with a tight labor market likely to keep pressure on wages.”

Graham Cooke, head of consumer research at Finder, said even something as simple as a puncture was now enough to cause anxiety (stock image)

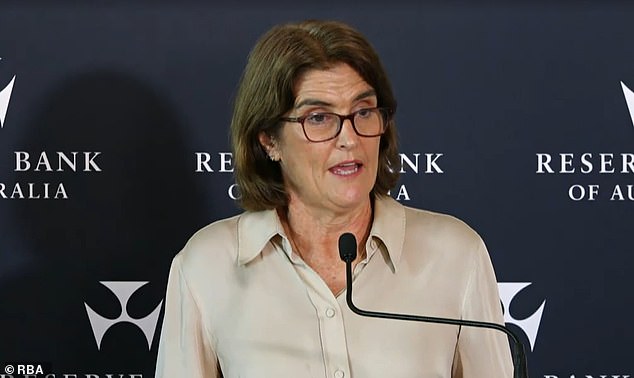

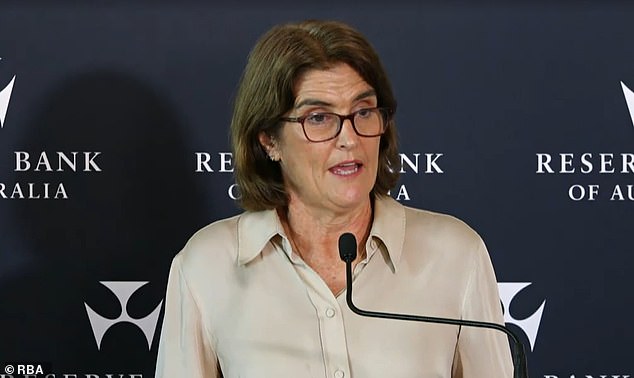

Reserve Bank of Australia Governor Michele Bullock said it was still too early to rule out another rate hike as the board left the policy rate unchanged at 4.35 percent, its highest level in 12 years.

Inflation moderated last year to 4.1 percent and with wage growth at 4.2 percent, workers are seeing their real wages rise for the first time since 2021.

But Reserve Bank of Australia Governor Michele Bullock said it was still too early to rule out a further rate hike, with the board leaving the policy rate unchanged at 4.35 percent, its highest level in 12 years.

“The war is not yet won, so we remain vigilant and we cannot exclude or exclude anything,” she said on Tuesday.

The Finder survey also showed the average Australian had $36,095 in bank savings, with big savers skewing the data.

Among those with more than $1,000 in savings, the average bank balance was $65,078 – two-thirds of Australia’s average full-time salary of $98,218.

This would be good for those managing a mortgage, but not if they are saving for a property mortgage deposit.