As an investor, sometimes it is necessary to look beyond a wall of worries.

For example, there are now many excuses to be pessimistic about continental Europe. German Finance Minister Christian Lindner says his country is simply “a tired man after a short night who needs a good cup of coffee.”

But the various ills of the eurozone’s largest economy require more than just caffeine.

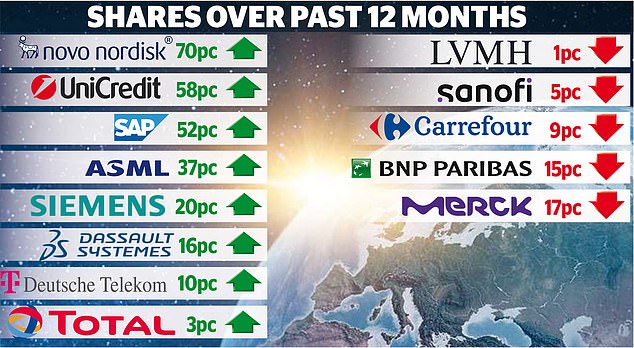

The impact of rising energy and interest costs is being felt across the bloc, while farmers’ protests in France and the Netherlands reflect broader grievances about bureaucracy and policies. But this unattractive background should not prevent you from considering the individual merits of European mega-companies, whose balance sheet strength is behind Goldman Sachs’ forecast that the pan-European Stoxx 600 index will rise 6 percent this year.

Europe’s big names include ASML, the Dutch group that is the world’s leading supplier of semiconductor equipment, luxury goods leviathan LVMH and Novo Nordisk, maker of weight-loss drugs Ozempic and Wegovy.

Such is the demand for these injectables that this week it was forecast that the $398 billion Danish company would be worth $1 trillion by 2030.

Oliver Collin, co-head of European equities at Invesco, argues that these companies and other key players in Europe are “global entities”, whose fortunes do not depend on the countries in which they are domiciled.

Companies listed in the eurozone earn less than a third of their revenue from this area.

Collin adds: “These companies are not universally loved and could therefore be considered ‘attractively priced’ or even ‘wildly cheap’.

“The opportunity set spans a wide range of sectors, from Italian bank Unicredit with its dividends and share buybacks, to French pharmaceutical giant Sanofi, whose drug development is on an upward trajectory.”

Oil company Total, one of the holdings in the Invesco European Equity fund’s portfolio, trades at seven times its forward earnings, compared to 11 times for its US counterpart Chevron.

Zehrid Osmani, manager of the Martin Currie Global Portfolio fund, which owns stocks such as ASML and L’Oreal, recognizes the problems facing Europe. Its cyclical economy will be affected by China’s slowdown, although reducing the eurozone’s dependence on this nation is one of the priorities of Ursula von der Leyen, president of the European Commission.

But Osmani believes that, despite these headwinds, “Europe could be a good place to be.”

Over the past year, US technology stock prices have soared thanks to the generative hype of Artificial Intelligence.

But Osmani says ASML’s technology is crucial to achieving the huge increase in computing power and data storage needed for the AI revolution.

Marcel Stotzel, manager of Fidelity European Fund and Fidelity European Trust, says two software companies, France’s Dassault Systemes and Germany’s SAP, are among the other “strong long-term winners” from AI innovation.

European trust Fidelity owns ASML, Novo Nordisk and SAP. All of their share prices have risen sharply over the past year, and analysts expect further increases.

However, the trust’s share price is at a discount of 8.78 per cent to its net asset value (NAV), reflecting the level of disaffection surrounding European shares whose attractions have been overshadowed by the love story with all things American.

There are even bigger discounts (10.78 percent and 10.73 percent, respectively) on the European Opportunities and Henderson European Focus trusts, although both have substantial stakes in Novo Nordisk.

These discounts reflect Britain’s disaffection with Europe, regardless of its companies’ prospects. Many investors cashed out of European funds and trusts in 2023. If they are determined to return, discounted trusts would appear to offer a bargain route not only into the eurozone, but also into the UK.

Our stock markets are also seen unfairly overshadowed by the glitzy glamor of American technology.

Around 30 per cent of European Opportunities’ portfolio is invested in the UK. Scanning the fact sheets (available online) I discovered that I have some exposure to Europe through funds and trusts such as Brunner and 3i Group, whose largest asset is a majority stake in Action, Europe’s leading convenience store chain.

I expected short-term price weakness in ASML, Novo Nordisk and SAP, but this did not materialize. The sound you hear is me gritting my teeth and preparing to buy.