Homeowners who sell are likely to face a higher tax bill than two years ago, despite the reduction in the rate of capital gains tax on the sale of second homes in the Budget by Jeremy Hunt , according to new data.

Analysis from estate agent Hamptons shows that successive cuts to the capital gains tax (CGT) personal allowance will mean the average homeowner will generally be worse off when they sell.

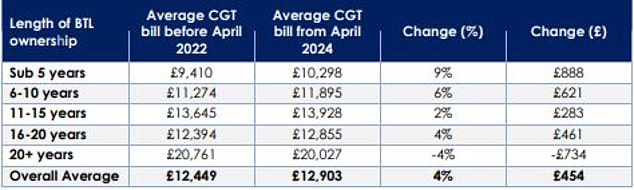

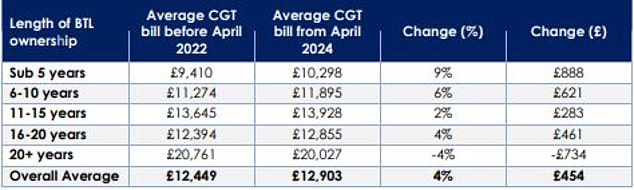

The typical homeowner on a higher rate taxpayer could pay £454 more than they would have before April 2022, while a standard rate taxpayer could pay £1,674 more.

The annual CGT personal allowance was reduced from £12,300 to £6,000 from April 6 last year and is further reduced to £3,000 from April 6 this year.

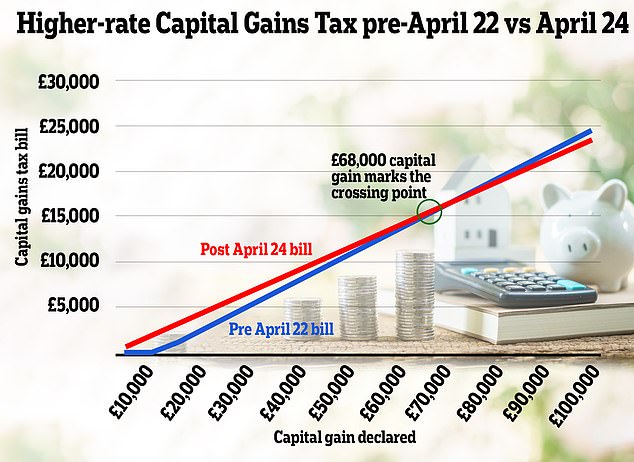

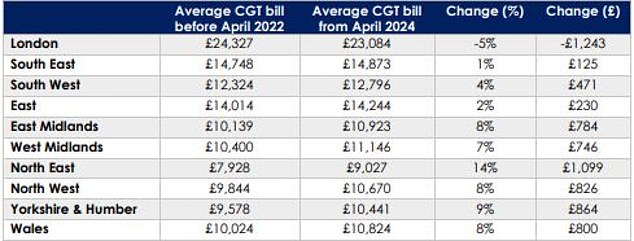

Higher capital gains tax rate before April 22, compared to April 24: This chart shows how Hunt’s tax cut will actually look more like a tax increase for many homeowners selling from April 6.

In the Budget presented earlier this month, Jeremy Hunt announced that the Government would reduce the rate of CGT for higher rate taxpayers from 28 per cent to 24 per cent, with the rate for basic rate taxpayers remaining unchanged at 18 percent.

CGT is levied on the profits that homeowners and second home owners make from a property that has increased in value when they come to sell it.

> What is capital gains tax and how much will I pay?

Hunt alluded to the “Laffer curve” after announcing the CGT cut in the Budget, saying the cut in the rate would lead to an increase in tax revenue.

The Laffer Curve refers to the idea that increasing tax rates beyond a certain point ends up being counterproductive and actually results in lower tax revenue.

He joked during his Budget speech: “Perhaps for the first time in history, the Treasury and the OBR have discovered their inner Laffer curve.”

But the Hamptons analysis suggests the opposite might be true, in that the majority of homeowners won’t feel like they’re getting a tax break at all.

Why Most Homeowners May Be Worse Off When They Sell

The reduction in the CGT rate alone from 28 per cent to 24 per cent will save the average homeowner who pays a higher rate £3,800 when selling, according to Hamptons.

This figure is based on the average landlord selling their rental property for £110,000 more than they paid last year, before deducting any allowable expenses.

However, when this reduction in the higher rate of CGT is combined with the reduction in the annual CGT personal allowance, it will add £454, or around 4 per cent, to the average CGT bill.

This table shows the average CGT bill for higher rate taxpayers based on length of rental property.

Hamptons found that 89 per cent of homeowners who pay higher taxes and sell will see their CGT bill rise in April, by £454 on average.

The change to the personal allowance also means that all homeowners who pay low rate tax will see their CGT bill rise from April, by £1,674 on average.

Aneisha Beveridge, head of research at the Hamptons, said whether an owner can gain or lose from the changes will depend on their overall asset wealth.

The lower personal allowance, combined with lower tax rates, means any owner paying a higher tax rate declaring gains below £68,000 will find themselves worse off.

Meanwhile, those who report larger gains will find themselves in a better situation.

Given that the average homeowner who sold in 2023 (having bought since 1995) reported a gross gain of £110,000, this means that almost all homeowners – whether lower or high rate taxpayers) will find themselves at pay more taxes if they sell.

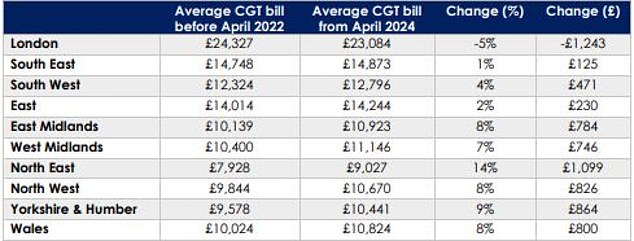

“The recent changes to CGT will hit homeowners who benefit from the smallest gains hardest,” Beveridge said.

“Typically, these will be new millennial investors who have seen less price growth, or those selling less expensive homes in less expensive parts of the country.

“Meanwhile, older investors who have been homeowners longer and have accumulated larger gains are much more likely to benefit from the tax cut.”

Beveridge also highlighted that many serious landlords will not be affected by the CGT changes because they own through a limited company, rather than in their own name.

A record 50,004 limited letting companies were set up across Britain in 2023, surpassing the previous 2022 record of 48,540 by 3%.

“The Chancellor’s changes to CGT rates only apply to landlords who pay higher rates and own homes in their own name,” she added.

“At the same time, a growing number of investors with corporate-owned homes are instead paying corporation tax on the sale proceeds after fees have been deducted.

“While tax efficiency is the main attraction of a business structure, increasingly it is also the certainty and stability it offers.

“Chancellors have generally been less willing to change corporate tax rules than individuals.”

Average CGT bill of higher rate taxpayers by region: investors selling into cheaper markets more likely to be negatively impacted by the changes

Hunt said the change to CGT was made to support the property market.

He believes this will encourage more homeowners and second home owners to sell their properties, making more properties available to buyers, including those looking to access housing for the first time.

However, Beveridge said the CGT personal allowance would have the opposite effect.

She said: “While the Chancellor has made it clear that he hopes to encourage homeowners to sell and add new housing offerings to the market for first-time buyers, the reality is that changes to the tax on over -values taken as a whole will likely act as a deterrent.

“Most homeowners who exit the market this year will end up paying more in taxes than they did two years ago, not less.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. This helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.