<!–

<!–

<!– <!–

<!–

<!–

<!–

Jeremy Hunt targeted tax cuts in his budget on workers by cutting 2p from National Insurance contributions, which are not paid by pensioners.

Pensioners are the Budget’s “biggest losers” – taking a collective £8bn hit, economists say.

Damning assessments came from the Institute for Fiscal Studies (IFS) and the Resolution Foundation, with those think tanks saying stealth taxes will leave older people worse off at the end of this Parliament.

Those earning more than £60,000 will also feel the pressure as a result of the freezing of income tax thresholds.

Jeremy Hunt focused tax cuts in his budget on workers, cutting National Insurance contributions, which pensioners do not pay, by 2p.

But by maintaining the freeze on income tax thresholds, pensioners – and workers earning more than £60,000 a year – will lose out.

According to the IFS, most pensioners will lose £650 a year by 2027, while higher rate pensioner taxpayers will lose more than £3,000 a year.

The institute’s director, Paul Johnson, insisted that “while many workers will be better off as a result of the tax changes in this Parliament, pensioners will be significant net losers.”

He added: “More than 60 percent of pensioners now pay income tax.”

The Resolution Foundation found that while households headed by someone aged 18-45 would gain £590 on average, those aged 66 and over would lose an average of £770.

Torsten Bell, the group’s chief executive, said: “It has been a frenetic few years for tax policy-making, with huge increases and cuts announced in quick succession.” People on average incomes have come out ahead, while taxpayers earning less than £26,000 or more than £60,000 will lose out.

“The biggest group of losers are pensioners, who face a collective £8 billion hit.”

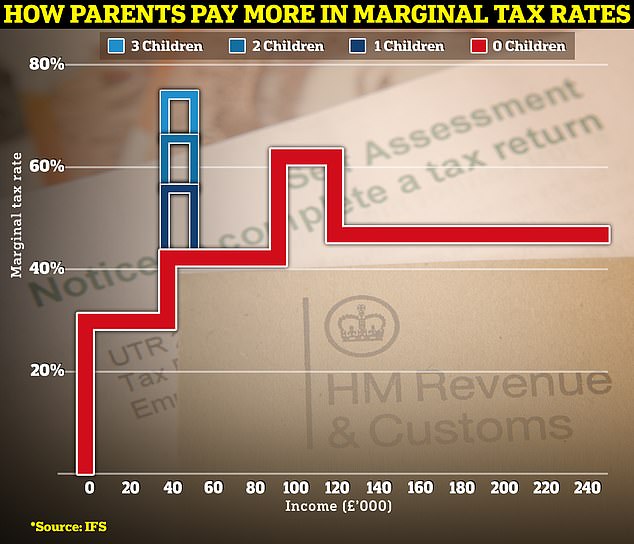

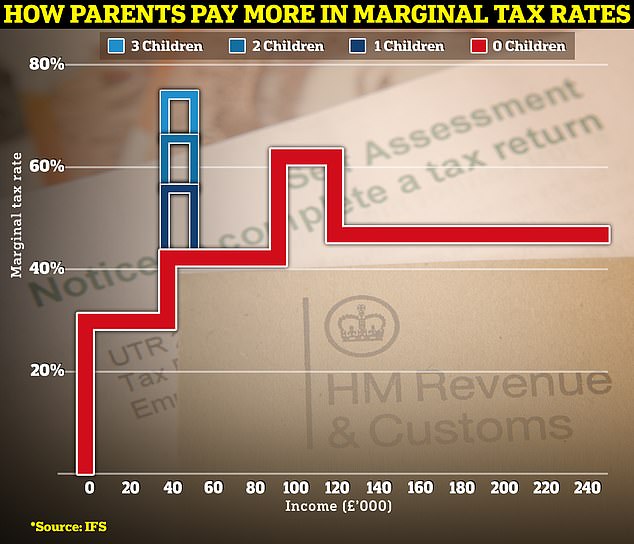

Tax traps: The graph above shows marginal tax rates for income tax and national insurance on the red line, rising to 62% between £100,000 and £125,000 due to the removal of the personal allowance. The blue lines show the effect of removing child benefit between £50,000 and £60,000.

The IFS also said planned reforms to child benefit, which would see families assessed on a household basis, are “unlikely” to be introduced.

Under the current system, a family repays child benefit gradually if only one parent earns between £50,000 and £60,000.

The payment is lost entirely if one parent earns more than £60,000.

However, the IFS was skeptical about the chances of the Government being able to base it on household income. In other developments:

- The IFS warned that the next Parliament could be the most difficult to reduce debt in 80 years due to the “combination of high debt interest payments and low expected nominal growth”.

- Citigroup said it fears the UK is £60 billion short of meeting the fiscal mandate, warning that the Office for Budget Responsibility is being too optimistic in its assumption of UK productivity growth.

- Research by the TaxPayers’ Alliance found that gold-plated public sector pensions are driving a rise in the national debt, which will reach £12.1 trillion in 2024-25, up from £9.6 trillion in 2021, a 25 percent increase.

The Chancellor’s decision to cut national insurance on top of income tax was criticized by several senior Conservative MPs.

Former Home Secretary Suella Braverman said: “The value of the triple lock has been exhausted due to the thresholds set in income tax and, in particular, the personal allowance.”

Work and Pensions spokeswoman Liz Kendall said: “Pensioners watching this week’s Budget will have felt left out and disappointed.”

What the budget means to you: use our tax calculator