Table of Contents

Private shareholders have been urged to vote on the future of seven investment funds amid an attempted coup by a US hedge fund.

Boaz Weinstein, founder of Saba Capital, is pushing for a major restructuring that would mean the trusts’ directors are replaced by him and his allies.

The Association of Investment Companies (AIC), which represents the investment trust sector, said Saba was proposing “major changes” to target companies and it was “vital” that shareholders make their voices heard.

“Investors need to understand the details of what Saba is proposing, including any changes to boards, strategy, administrator or trust fees,” said AIC boss Richard Stone.

“They should consider whether the investment trust would still meet their needs, as well as the potential tax implications.”

The AIC has written to the UK’s major retail investment platforms, “urging” them to inform investors of upcoming trust meetings so they can vote on Saba’s proposals.

Shakeup: Saba Capital founder Boaz Weinstein (pictured) is pushing for a major shakeup that would mean trust directors replaced by him and his allies

It comes as two of Saba’s target investment trusts encouraged shareholders to oppose the US company’s plans.

James Williams, chairman of The European Smaller Companies Trust, said Saba was trying to take control by “eliminating a highly qualified, independent board that acts in the interests of all shareholders”.

He added that Saba’s motives were “interesting” and could “jeopardize shareholder protection.”

Meanwhile, Wendy Colquhoun, chair of Henderson Opportunities Trust, said Saba’s plans would bring “significant” uncertainty and risk and implored investors to vote against the proposals.

“The board’s message to shareholders is clear: please exercise your vote and do not allow Saba to take unnecessary risks with your money,” Colquhoun said. It follows similar comments Tuesday from CQS Natural Resources Growth and Income, another trust in Weinstein’s sights.

Chairman Christopher Casey said Saba’s plans were “unfounded” and that the US company’s claims about the trust’s poor performance were misleading.

Saba responded by accusing Casey of making “inaccurate and unsubstantiated claims” about his record, adding that the president was putting shareholder value at risk.

The firm also turned its guns on trusts European Smaller Companies and Henderson Opportunities, saying their boards had “failed shareholders” and made some poor investment decisions.

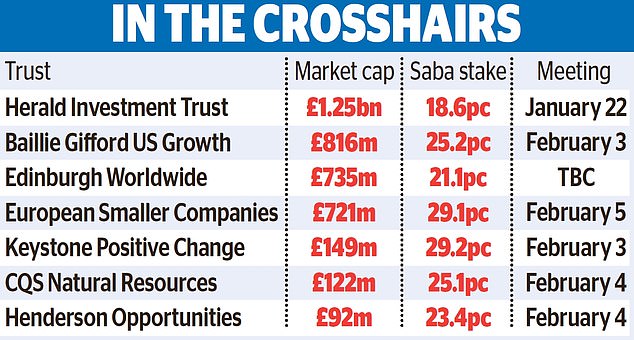

Overall, Saba is calling for a restructuring of seven London-listed investment funds, which together have a market value of around £4 billion.

On Tuesday, Evelyn Partners became the first shareholder to declare its opposition to Weinstein’s plans.

The group will vote against proposals from Baillie Gifford US Growth, where it is the fourth-largest investor with a 5 percent stake, and Herald Investment Trust, where it owns 1 percent.

He was joined yesterday by Rossie House Investment Management, which is a shareholder in five of the seven trusts targeted by Saba.

Rossie House partner Scott Baikie said the hedge fund’s proposals were “opportunistic” and would be “detrimental to trusts”.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.