Table of Contents

Waterstones could list in London or New York under plans being drawn up by its US private equity owner.

A source close to Elliott Advisors told the Mail that an initial public offering is an option on the table for the bookstore.

It comes after boss James Daunt, who joined Waterstones in 2011 and also runs US retailer Barnes & Noble, told the Financial Times a combined listing would be “logical”.

The decision is up to Elliott, which acquired Waterstones in 2018 and Barnes & Noble the following year.

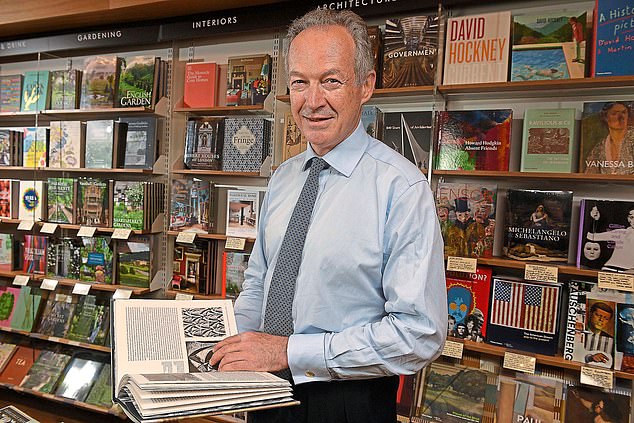

Combined listing: Waterstones boss James Daunt (pictured) also runs US retailer Barnes & Noble

There is no imminent plan to list the companies, but it is a possible option in the future, a source close to the fund manager said.

A listing in London would be a big boost for the City, but it would be a blow to the stock market if Waterstones listed in New York.

Elliott declined to comment. Waterstones did not respond to a request for comment.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.