Table of Contents

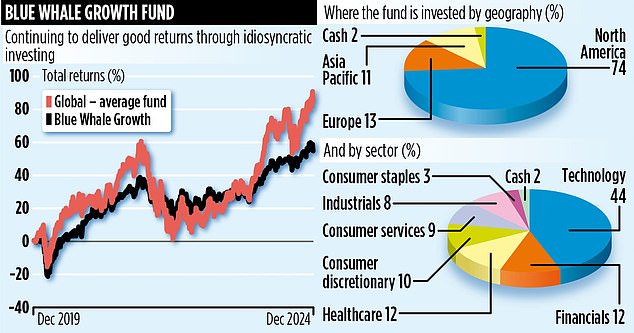

The Blue Whale Growth investment fund has made a lot of money for investors since its launch more than seven years ago, and manager Stephen Yiu is determined to maintain its impressive track record.

The £1.2bn fund, backed by billionaire Peter Hargreaves, has generated a total return of 162 per cent since its launch in September 2017, equivalent to an annual return of more than 14 per cent, net of fees.

However, Yiu is not resting on his laurels. Their aspiration is to obtain annual returns of 15 percent, although not in a straight line.

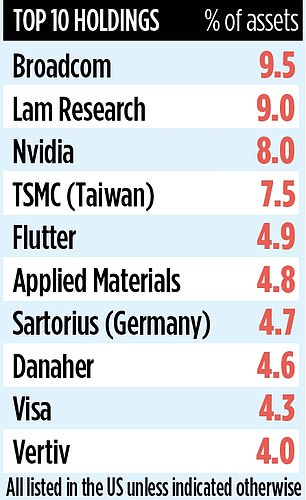

Although he manages a tight portfolio, comprising just 26 global stocks and one that remains fully invested at all times, Yiu is not afraid to make big decisions.

Unlike some global fund managers, Blue Whale Growth doesn’t pay much attention to the “magnificent seven” US stocks (big drivers of the US stock market in recent years) and pays close attention to “idiosyncratic” companies that, in In their opinion, they have businesses capable of withstanding any economic slowdown or strong market corrections.

Currently, the fund only owns shares of seven great stocks: Nvidia (8 percent), Meta (3 percent) and Microsoft (1.5 percent).

“We don’t own Alphabet, Amazon, Apple or Tesla,” Yiu says.

“In effect, we are overweight Nvidia and short on the other great six.”

This time last year, the respective holdings in Nvidia, Meta and Microsoft were 9, 4 and 8 percent.

Yiu’s view is that the “narrative could change” next year for the magnificent seven (with the exception of chipmaker Nvidia) as revenues are eroded by huge spending on artificial intelligence (AI).

This, he says, could lead to corrections in their stock prices and a “year of reckoning” for funds that track the Standard & Poor’s 500 index, of which big tech stocks are a key component.

Unlike active funds like Blue Whale Growth, these tracking or passive funds cannot reduce their exposure to the big tech giants before any liquidation.

“They should hold the S&P 500,” he says. “Perhaps next year we can see a rejuvenation of investor interest in active funds in general.”

Blue Whale Growth has exposure to the topic of AI beyond the magnificent seven. It has key stakes in US companies Broadcom (its largest holding) and Vertiv. “Broadcom,” Yiu says, “could be the new Nvidia in terms of outperforming the rest of the market.”

However, Yiu also has large interests in companies he describes as “idiosyncratic”: businesses that should grow regardless of prevailing economic conditions.

Among them is Flutter, the US-listed sports betting and gaming company that Yiu says is on a “great journey” as more US states legalize sports gambling. “American consumers like sports and gambling,” he adds.

Other idiosyncratic holdings include German company Sartorius and US-listed Danaher, both making waves in bioprocessing.

There is also the American tobacco company Philip Morris, which has diversified into nicotine pouches and smokeless alternatives to conventional cigarettes.

Blue Whale Growth’s success means that as long as the fund ends the year above £1bn, it will refund one per cent of its annual management fee to investors.

Most investors in this fund pay an annual management fee of 0.75 percent, so the redemption will reduce this fee to 0.7425 percent.

A further one per cent will be cut if – ‘when’ (Yiu’s word) – the fund reaches £2 billion.

While three-quarters of the fund’s assets are exposed to US-listed stocks, only 40 percent of the income generated by all holdings comes from the United States.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.