Table of Contents

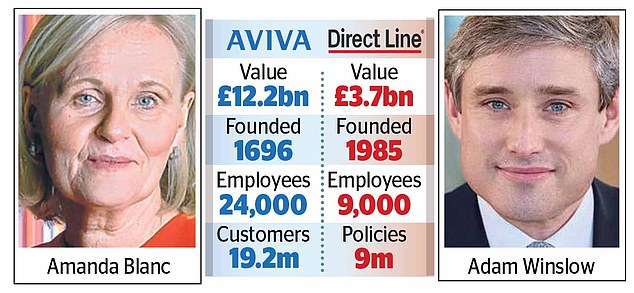

Insurance giant Aviva has agreed to acquire Direct Line in a £3.7bn deal that puts around 2,300 jobs at risk.

The offer was mooted over the weekend to beat the Christmas Day deadline.

But plans to save £125m, including thousands of job cuts, will cast a shadow over the festive period for the businesses’ 33,000 staff.

And it is the latest blow to the London stock market, as FTSE 250 company Direct Line is to cease trading.

Aviva, led by chief executive Dame Amanda Blanc, will become the UK’s second largest motor insurer behind Admiral.

It is a blockbuster acquisition for Blanc as it targets acquisitions in Aviva’s core markets after divesting overseas assets to streamline the FTSE 100 business.

Aviva boss Amanda Blanc has managed to acquire Adam Winslow’s Direct Line

Protect customers from insurance price increases

Customers must be protected from sharp price rises after Direct Line agreed to a takeover by Aviva, the former head of the competition regulator has said.

An alliance will create a company with more than a fifth of the UK home and motor insurance markets.

Lord Tyrie, former chair of the Competition and Markets Authority (CMA), said: “It will be extremely important to ensure that there are no detrimental outcomes for consumers.”

Some fear that less competition could mean higher insurance premiums, which have skyrocketed since the pandemic.

Bijal Tanna, of management consultancy Altus Consulting, said: “I think the CMA will want to look at this closely because of the impact on market share, particularly within the personal lines motor insurance market… (which). .. en It is already dominated by a few key players.

But he said there is a chance prices could drop if costs are reduced.

There has already been anger over price increases. The cost of car insurance has increased by 82 per cent since 2021, according to the Office for National Statistics.

James Daley, of campaign group Fairer Finance, has said a deal would “reduce competition”. Interactive Investor’s Keith Bowman said it would create “a financially sound insurer.”

Deal done: Direct Line has accepted Aviva’s £3.7bn offer

Aviva to increase dividends

Aviva has said it will increase expected dividends by mid-single digits upon completion.

It comes after Direct Line’s board said this month it would be “willing to accept” a £3.7bn offer from Aviva. The 275 pence per share offer was the third proposal in less than 12 months.

The board had rejected a £3.3bn bid from Aviva and rejected a takeover attempt by Belgian insurer Ageas, just weeks into new chief executive Adam Winslow’s tenure.

The documents revealed that between 1,650 and 2,300 jobs (between 5 and 7 percent of the combined company’s workforce) will be eliminated within three years of the deal.

It will cut “duplicated” jobs running back-office IT systems and corporate and head office functions, on top of the 550 job cuts announced by Winslow in a £100m cost-cutting round.

The companies say the exact number will be lower as Aviva has 800 vacancies and around 1,300 employees decide to quit each year.

The integration is expected to cost Aviva £250m over two years. It has committed to maintaining its core brands Direct Line, Churchill and Green Flag, but did not address plans for lines such as Privilege and Darwin.

Blanc said: “This deal is excellent news for Aviva and Direct Line customers and shareholders.”

He added: “The acquisition will bring together a number of leading brands into a more efficient business, very well positioned to generate strong returns for all shareholders.”

Following the deal, Aviva shareholders will own 87.5 per cent of the combined company and Direct Line investors 12.5 per cent. More details will emerge in the full offering document in February.

Shareholders vote on the deal in March and investors who own 75 percent of each company’s shares must approve the acquisition for it to be approved. Subject to regulatory approval, the acquisition will be completed in mid-2025.

Direct Line boss Adam Winslow’s future looks uncertain as there is said to be no love between him and Aviva boss Amanda Blanc.

Winslow worked for Blanc at Aviva before taking the top job at Direct Line in March.

An acquisition deprives you of the possibility of making a change of direction. But he is likely to be comforted by a package worth millions of pounds.

Winslow, described as insurance “royalty,” is the son of Compare the Market founder Peter Winslow. A source close to the deal said there was no need for two management teams.