Table of Contents

This Christmas, women from a hundred countries will unwrap something shiny from Pandora. The Danish firm, valued at 100 billion crowns, or £11.5 billion, on the Copenhagen stock exchange, is the world’s largest jeweller.

Its CEO, Alexander Lacik, says its dominance in the candy industry is based on tapping into customers’ life stories. The lab-grown diamonds and charms that dangle from her bracelets have, she maintains, as much emotional meaning as expensive gems used to celebrate important moments.

In 2023, sales at Pandora’s 7,800 outlets, including 2,800 owned stores, will reach £3.1 billion. Turnover in the United Kingdom, its second market after the United States, was £448 million.

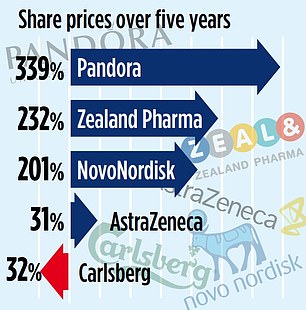

The jeweller’s adverts appear all over British television, but its stock is a hidden gem. They have soared 339 percent in the last five years; So would it be better to order Pandora stock in your stocking, rather than a trinket?

Pandora is one of the world’s leading Scandinavian super soldier stocks along with Danish company Novo Nordisk, maker of weight loss drugs Ozempic and Wegovy.

Affordability is their secret – you don’t have to be rich to buy a £25 charm for your bracelet, which is why 50 million are sold every year.

Outside the Box: Pamela Anderson Wearing Pandora Lab-Grown Diamonds at the Met Gala

The firm will sell 107 million pieces of jewelery in 2023, from those £25 pendants to the diamonds Pamela Anderson wore at the Met Gala in New York. The 57-year-old actress, a brand ambassador, was wearing 200 carats of pink and white lab-grown diamonds, believed to be worth around £1,800.

About 40 percent of Pandora sales accumulate around Christmas, so when Lacik flew to London for 48 hours this month, he was on a mission to put more Pandora gifts under British Christmas trees.

Lacik, 59, was born in Czechoslovakia. After the Russian invasion in 1968, his parents fled to Sweden, where he grew up from the age of three.

After working at consumer goods companies Procter & Gamble and Reckitt, he took over at Pandora in 2019. His predecessor resigned after a profit warning in 2018.

“There were rumors that Pandora was going away,” he recalls happily. The previous management, he says, had lost focus: they introduced too many new products that weren’t quite right, followed by a series of discounts.

With Lacik, Pandora has regained its shine, despite having to deal with the pandemic. Shares are up 36 percent this year despite pressure on profit margins from higher gold and silver prices and a tough backdrop for the broader jewelry sector as customers tighten their belts. .

Pandora has been well placed to benefit from people looking for affordable ornaments. Lacik says her jewelry is “all about feeling” rather than spending large sums of money.

“We address a deep human need to tell stories,” she adds, referring to the role of jewelry as a keepsake, token of love or badge of pride, marking some of the most important moments in women’s lives. We have found a way to do this through jewelry. If we were a technology company, we would have invented TikTok or Meta.” That sounds like an exaggerated way to describe costume jewelry. But the philosophy helped Pandora evolve to its current heights from a single store in Copenhagen opened in 1982 by goldsmith Per Enevoldsen. and his wife Winnie.

The firm is still based in Copenhagen, although its charms have been manufactured in Thailand since 1986.

The chain has 240 stores in the British Isles and three more will open next year. There will be more in the US, where there are already 479 stores.

In the group’s most recent third quarter, profits rose 7 per cent to £110 million, while sales rose 9.5 per cent to £682 million.

Skeptics may feel that the company and its stock price are vulnerable to the whims of fashion. Its best-known item is the charm bracelet, but Lacik wants to “open up a significantly larger market” by getting into the business of lab-made diamond engagement rings.

According to Statista, the annual market for these gems, considered more ethical than mined diamonds, may be £20 billion. They are up to 90 percent cheaper than mined stones, increasing their appeal to Pandora’s young, cost-conscious clientele.

Lacik insists that they are as “real” as any other diamond, but somehow they are considered less significant.

So, would you give your wife Pandora jewelry? Yes, he says. He recently gifted her a £90 North Star charm and there may be another piece wrapped under the Christmas tree this year.

But investors looking for Santa to bring them other Scandinavian-grown delicacies from their Nordic corners are spoiled for choice.

Momentum: Under boss Alexander Lacik, Pandora has regained its shine

MORE NORDIC BRIGHTNESS

Scandinavia may be small, but some of its stocks are powerful and you can invest directly through leading UK platforms such as Hargreaves Lansdown and Interactive Investor.

There are also managed funds, such as Fidelity Nordic, where an expert will pick stocks for you.

Or consider a fund that tracks the performance of a relevant index, such as the Amundi Nordic Exchange-Traded Fund (ETF).

“The charges are higher because you have to take into account the currency conversion, but in my opinion it is as easy as buying UK-listed shares,” says Ben Yearsley, director at Fairview Investing.

Novo Nordisk: 589 Danish crowns

Despite losing £82bn in value at the end of last week, the Danish maker of weight loss drug Ozempic has had a very good two years. It has been the most valuable listed company in Europe since it overtook French luxury goods giant LVMH from first place in September 2023.

Skeptics point to growing competition in the sector. But Derren Nathan, head of equity research at Hargreaves Lansdown, says that if operational issues, including huge demand, are overcome, “investors could be even more rewarded.”

Recommendation: BUY

Carlsberg: 830 Danish crowns

The Danish brewer has had a difficult 2024 after a cold, wet summer in Europe hit its sales and the poor reception of its £3.3bn acquisition of tonic water maker Britvic, which has just been given the green light by competition control agencies.

“It’s still expected to be a reasonable year,” says Jeremy Fialko, a research expert at HSBC. He adds that a revival of sales could be seen in China and calls the 19 percent drop in the share price in one year “unjustified.”

Recommendation: BUY

AstraZeneca: £102.56

Most UK investors consider AstraZeneca to be British, but it is Anglo-Swedish. The pharmaceutical powerhouse overtook Shell as Britain’s most valuable company in April.

It has done well over the past decade, although the stock has been hit lately by corruption allegations against senior officials in China.

Nathan says: ‘The reaction seems a little overblown and could represent an opportunity to gain exposure to a quality name in the sector. However, until more clarity emerges from China, greater volatility can be expected.”

Recommendation: BUY

Zeeland: 728 Danish crowns

Danish group Zealand, a minnow compared to other pharmaceutical companies, has enjoyed a 105 percent rise in its share price this year. It’s testing a new weight-loss drug that could pit it against Novo Nordisk and Eli Lilly.

Susannah Streeter, of Hargreaves Lansdown, points out the “obstacles” to bringing the drug to market, but says: “There is clearly a huge appetite for any breakthrough in this field, given that weight-loss drugs have mass appeal in developing markets”.

Recommendation: BUY

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.