Risky investments in cryptocurrencies are increasingly creeping into the retirement savings of ordinary Americans.

Many workplace retirement plans at well-known companies such as Vanguard, Fidelity, BlackRock, and Morgan Stanley invest in a company called MicroStrategy.

MicroStrategy is an American development company and, according to figures, holds a stake in many traditional pension stock portfolios The New York Times.

Although Americans are responsible for choosing where their 401(K) is invested, they are often unaware of the exact details of the money they hold in their accounts.

MicroStrategy started as an enterprise software provider, but has now focused on buying Bitcoin.

According to the outlet, the company has posted a gain of more than 3,000 percent since August 2020.

But it also had a catastrophic year in 2022, losing more than 74 percent, as did many companies focused on cryptocurrency due to the collapse of Sam Bankman-Fried’s FTX exchange.

Americans skeptical about the risks of cryptocurrency may be concerned because they know they are investing in these stocks indirectly through their retirement accounts, experts warn.

“You can’t achieve such enormous returns without taking excessive risks, exposing investors to dangers they may never have dreamed of in their retirement accounts,” wrote New York Times columnist Jeff Sommer.

Many workplace retirement plans at well-known companies such as Vanguard, Fidelity, BlackRock and Morgan Stanley invest in a company called MicroStrategy

MicroStrategy’s total stock returns in recent years have been significant.

By comparison, technology company Nvidia has risen 1,179.7 percent since August 10, 2020, according to The New York Times.

This year alone, shares of the Tysons Corner, Virginia-based company founded by billionaire Michael Saylor have risen more than 500 percent.

With a market value of more than $90 billion, it has surpassed major American companies, including Target, CVS and General Motors.

The company has embarked on an unconventional plan to raise capital solely to buy and own more Bitcoin Bloomberg.

It has announced billion-dollar acquisitions of the cryptocurrency every Monday for the past five weeks.

Bitcoin prices have soared in the weeks since Donald Trump won the presidential election, with the cryptocurrency rising above $100,000 for the first time.

The cryptocurrency has since fallen, but has settled around $95,000.

The president-elect, as well as those he has chosen to date for the top positions in his administration, have openly embraced digital assets, boosting investor hopes that the cryptocurrency industry’s place in the financial markets will be cemented.

According to Bloomberg, MicroStrategy now owns more than $40 billion in Bitcoin.

However, the underlying software business posted a net loss of $340 million in the third quarter of this year.

This means the company’s market capitalization is largely based on its Bitcoin buy-and-hold strategy, the outlet reported.

MicroStrategy is an American development company and is reportedly a holding company in many traditional retirement stock portfolios

Shares in MicroStrategy, founded by billionaire Michael Saylor, are up more than 500 percent this year alone

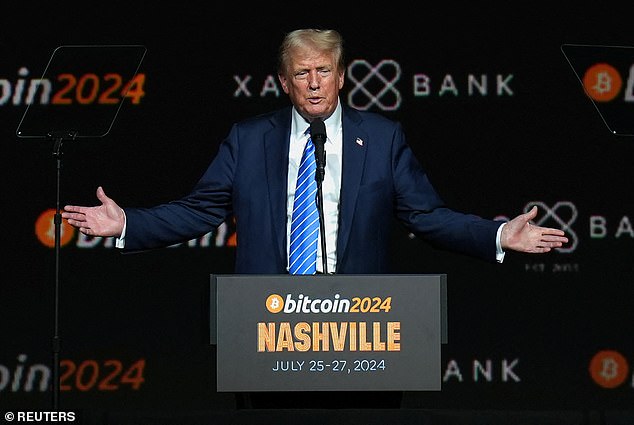

Bitcoin prices have soared in the weeks since Donald Trump won the presidential election (Image: Trump speaking at the Bitcoin 2024 event in July)

Investing in cryptocurrency is a divisive issue, with many claiming it is risky.

Financial services firm Charles Schwab says on its website: ‘We recommend that customers interested in cryptocurrency approach them as speculative investments and consider both their goals and the risks involved.

“For those who already have a diversified portfolio and a long-term investment plan, we are seeing cryptocurrency primarily used for trading purposes outside of the traditional portfolio.”

If Bitcoin’s appeal were to wane for any reason, Sommer writes in The New York Times, “MicroStrategy would spread the pain to many thousands of people.”

DailyMail.com contacted MicroStrategy for comment.