Table of Contents

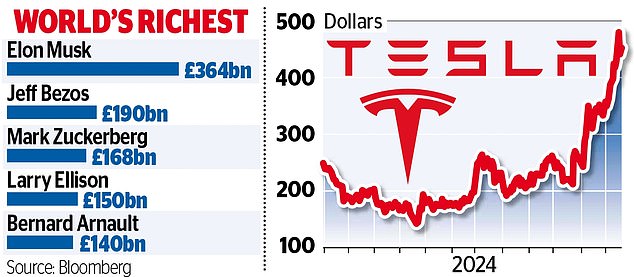

Elon Musk, with a fortune of $400 billion, is already the richest man in the world, although he chooses to live in a small $50,000 prefabricated house.

But speculation has arisen that the combative tech entrepreneur, an increasingly close associate of President-elect Donald Trump and supporter of Reform UK, could become a billionaire within the next four years.

This increase in fortune would be fueled by the growth of his main company, Tesla, the world’s number one electric car manufacturer, and by the expansion of his other key company, Space X, the designer and manufacturer of advanced rockets and spacecraft, valued at $350 billion. Among its objectives is the colonization of the planet Mars.

Do the opportunities presented by Musk’s combination of talent and friends in high places mean now is the time to go all in on this “free speech absolutist”?

After all, Trump’s presidential acceptance speech even included a mention of a Space

Cathie Wood, US fund manager at Ark Invest, says Musk is gifted with a unique understanding of “the current technology landscape”, where artificial intelligence (AI), energy storage and robotics converge. These ideas are one of the reasons Tesla’s board is fighting to give him a $56 billion pay package, even though a court ruled against the award.

Nearby: Elon Musk and Donald Trump and a Tesla Model 3

Another justification for this pay increase is the enormous benefit that could potentially come from Musk’s role as co-director of the new US Department of Government Efficiency (Doge).

If this body reduces bureaucracy, this should boost Tesla, Space and the social networking site X. formerly known as Twitter, whose value has fallen under his ownership.

However, despite the rewards that could come from an alliance with Trump, investors should take into account the opinions of those who are not part of Musk’s fan club.

They do not doubt his extraordinary intellect and capacity for seemingly endless innovation, but argue that the new political position will test even Musk’s constitution, although he happily works 100 to 120 hours a week.

David Coombs, head of multi-asset investments at Rathbones, is among the skeptics and says he would never put clients’ Isa and pension cash into Tesla, arguing it is “a cult investment”.

Coombs also says the bromance with Trump could end.

Ben Barringer, a technology analyst at wealth manager Quilter Cheviot, also says it’s worth waiting to see how the relationship between the president and the mercurial Musk develops. “The CEOs of the largest technology groups have met with Trump and Musk in an attempt to establish what the future will look like for the regulation of their industry,” says Barringer.

“These discussions are taking place behind closed doors, but it is an area where there could be considerable progress next year.”

The prospects seem interesting, possibly exciting, but also uncertain. If that fills you with excitement instead of fear, these are your options.

TESLA

At the beginning of the year, Tesla was seen as the lagging member of the ‘Magnificent Seven’ tech stocks: Alphabet, Amazon, Apple, Meta, Microsoft and Nvidia make up the rest of the group. But Tesla has pulled ahead over the past month, rising 108 percent to $476. The price is now up 1,777 percent in five years and 3,557 percent more than a decade ago.

In the summer, attention focused on the company’s rising costs and the challenge posed to its various car models by more affordable Chinese BYD cars. Conviction is now growing that Trump’s victory will allow Tesla to pursue its autonomous vehicle ambitions more freely.

Under current standards in the United States, there are obstacles to the production of large numbers of cars without pedals or a steering wheel. A Doge deregulation campaign could remove these obstacles, which

include detailed accident reports (flexible). The result could be $1 trillion in additional sales for Tesla, or so Wedbush brokers estimate.

Meanwhile, it is believed that Trump would take action to protect Musk if Beijing retaliated against the US tariffs by imposing its own tariffs on Tesla cars.

Wedbush has set a target of $515 for the stock, adding that “in a favorable scenario” the price could jump to around $650 by the end of 2025. However, other analysts are more skeptical about the autonomous vehicle revolution and rate actions like ‘hold’.

SPACE

It is not possible to buy shares directly from Space X as it is an unlisted company. Musk owns about 54 percent of the shares, with the rest held by institutions and venture capitalists.

However, you can gain exposure to the business through three investment funds owned by the Baillie Gifford management group: Scottish Mortgage, Edinburgh Worldwide and Schiehallion.

Lawrence Burns, the group’s deputy director, hails Space

Space X, founded by Musk in 2002, transports payloads for commercial partners and the US government. Its collaboration with NASA includes taking two astronauts to and from the International Space Station.

Musk would like to spend his retirement on Mars. But Space X COO Gwynne Shotwell has no such dreams.

It is more interested in attracting more terrestrial customers to Starlink, Space to bag. The company was valued at $210 billion in June. The subsequent jump to $350 billion makes it seem like an irresistible proposition.

Nowadays, however, technology companies tend to see more advantages in staying private. Perhaps deregulation can change this position.

Scottish Mortgage, a component of the FTSE 100, backs tech companies of all types, including Amazon, Nvidia and Tesla. Space

Scottish Mortgage is my personal bet on Tesla and Space X, but it’s a high-risk vehicle, despite its solid-sounding name.

Schiehallion, named after one of Munro’s mountains, is another trust only suitable for those who like gambling.

However, enthusiasm over his connection to Space

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.