Britain faces many pressing financial challenges. One of the worst is the unfortunate situation of those under 30 years old, known as Generation Z.

For the first time, one generation will be significantly poorer than the previous one.

This is well known, but the fact that the most viewed TED talk of 2024 was called How America is destroying the future of young people perhaps underlines how this debate is changing course.

Scott Galloway, a marketing professor at New York University, delivers a harsh rebuke that will resonate with young people, and his assessment is as relevant to the United Kingdom as it is to the United States.

The problem facing a typical twenty-something is daunting: how to buy a home and pay off debt while building an emergency fund and future savings.

The figures are sobering. First-time buyers in England put down an average of £55,372 to secure a home – a huge amount to save, and especially when the average UK salary for 22-29 year olds is £32,292.

A red-hot rental market makes the challenge more difficult. Rents have risen by around 28 per cent in four years, taking the average monthly cost to £1,330, the Office for National Statistics says.

Big staff reduction? Andrew Oxlade says ‘Great Wealth Transfer’ could begin in 2025

Buying your first home has always been difficult. But never so difficult.

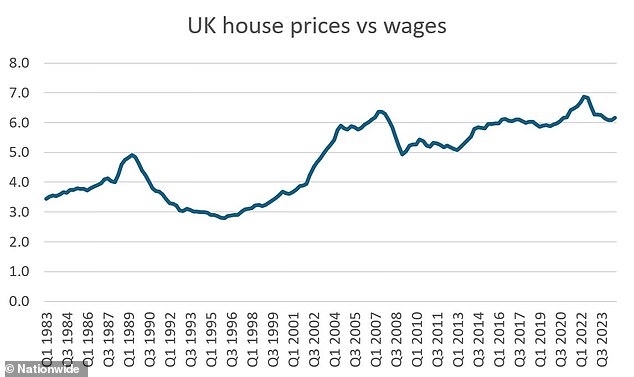

When I got on the real estate ladder in 2001 and bought a one-bedroom apartment at age 28, the median house price was 3.6 times the median salary.

Today the ratio is 6.1, according to the Nationwide Building Society (see chart below).

And student debt is also very different. My £9,000 in maintenance loans seem paltry by modern standards.

Today’s students can easily face debts of £50,000 on graduation day. They then face a 9 percent salary portion of loan repayments to cover those fees and living costs. Little or nothing is left to save.

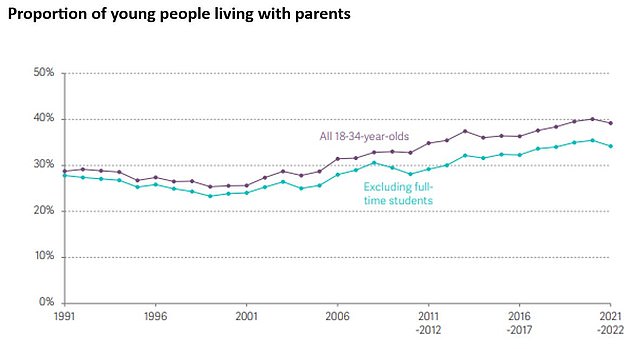

The Resolution Foundation think tank highlighted this grim situation in an ‘Intergenerational Audit’ last month.

It found that the proportion of under-35s living with their parents had increased from 26 per cent in 2000 to 39 per cent in 2022.

He blamed “expensive housing, repeated economic crises and stagnant living standards” that have defined our financial lives in the 21st century.

The numbers have likely worsened in recent years as house prices continue their relentless rise.

What can stop, stop or even reverse this trend of generational impoverishment?

Perhaps Labor will deliver on its housebuilding promises, easing pressure on house prices. Perhaps the limited levers within tax and benefits policy are tilted toward young people. Given the history of successive governments in these areas, neither seems safe.

So what could be a meaningful solution? Perhaps the obvious answer is that the generation that has more could donate to the generation that has less.

There is a mechanism for this: death. The number of adults receiving an inheritance over a two-year period increased from 1.7 million in 2008-10 to 2.1 million in 2018-20.

These two rules for gifting are key

But, of course, you can prevent death by giving away wealth in life and be able to appreciate your own acts of generosity.

In the tax world, this is known as “gifting.” It’s worth familiarizing yourself with all the rules for gifting, but I would say two of the most important are:

1. That you can donate £3,000 each year free of inheritance tax. This can be extended for a year, offering the opportunity to give away £6,000 if you miss a year.

2. You can donate as much as you want and if you live seven years you will not be liable for IHT. You also pay less than the full 40 percent rate if you die three to seven years after the donation: this gradually decreases.

But there has been little incentive to give away. In fact, there has been a very good reason to hold onto your money and use your pension plan as a tool in estate planning. Pensions have been exempt from IHT.

If you die before the age of 75, the pension is transferred completely tax-free. A death after age 75 means beneficiaries escape IHT on the fund, but must pay income tax on withdrawals from it.

But significant changes are coming. The pension exemption will be removed in April 2027, as announced in October’s autumn budget, and this will alter many areas of financial planning. It could also spark an unprecedented giveaway.

As a reminder of the basic inheritance tax rules, you can leave up to £325,000 tax-free when you die, with a further allowance of £175,000 if you leave your home to your children or grandchildren.

Married couples with direct descendants can potentially leave up to £1 million tax-free as they can transfer unused allowances. The tax rate on any remaining liability is 40 percent.

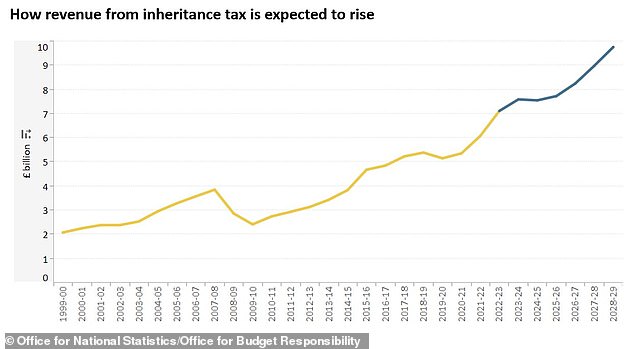

With such high limits, less than five percent of estates are liable. But that is changing.

The proportion of passive wealth was expected to rise rapidly anyway, and the change in inherited pensions will only accelerate the trend. (The chart below shows the official forecast BEFORE the pension change).

This is because conventional asset prices, such as property and stock markets, have risen, so the £1 million threshold today looks much less generous than when it was set back in 2017.

Let’s consider a married couple with a £500,000 house who have each built up £300,000 in their pensions and have built up a combined £100,000 in Isas. Before the autumn budget, they would have comfortably avoided IHT, because their pension funds would have been ignored.

Under the new system, there would be a potential liability of 40 per cent on the £200,000 portion above the combined £1 million allocations.

Of course, it is impossible to know how much your pensions and Isas will decrease as they are used to fund your retirement. You cannot predict the moment of your death.

But there are also many things you can plan for within your estate planning options. Trusts, legal structures that can protect assets from inheritance tax, are likely to become much more popular.

Estate planning is complex and one of those areas where the support of a specialist is highly recommended.

The power of giving

More than anything, the attractions of giving or spending your money will grow from 2027 onwards.

The gifts were already on the rise. The value of donations over £10,000 rose from £13.1bn in the two years to 2008-10 to £29bn in the two years to 2018-20, according to the Resolution Foundation.

Those donation amounts may seem insignificant compared to the amounts that could be given in 2030 or 2035.

Faced with the double pressure of a future tax headache and a son or daughter needing a mortgage deposit today, it will make more sense to donate.

It could even lead to an increase in downsizing among people in their 50s and 60s as they try to make their wealth more liquid.

This, in turn, could help alleviate pressure on the housing market. In combination, they could reduce the intergenerational wealth gap.

Parents want to help. Fidelity’s 2024 Global Sentiment Survey showed that the majority of Britons want to help their descendants: 61 percent made it a priority to “help my children/grandchildren with their future financial situation.”

However, only 25 percent were confident they could do so. It was in stark contrast to a global average of 40 percent.

There is a growing appetite for more radical thinking. Speaking to senior colleagues and pensions industry peers in recent weeks, most are reconsidering their plans.

Many told me they are seriously considering downsizing, whereas before it was a vague idea.

It has a double appeal: freeing up large amounts of money that can be used to contribute to the first deposits.

But it also has a more self-indulgent appeal: why delay your acts of kindness until after death? Donate now, enjoy seeing it used, and pay a lot less taxes.

Perhaps from here a greater trend towards staff reduction will begin. And perhaps the most viewed TED Talk of 2035 shows how the Great Wealth Transfer began in 2025.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.