Do you feel a little jealous when you hear that there are people who inherit a considerable sum of money? Can you imagine them living new and exciting lives, with all their problems solved? Or at least feel much happier now that the financial burdens have been eased.

A more comfortable life was what my parents had in mind for us when, after years of astute planning, they tried to ensure that our family would benefit from their generosity, love and a lifetime of hard work. The problem was, inspired by his selfless legacy, my husband and I decided early on to share some of the spoils with our children.

After all, in these difficult financial times, why not help younger adults now? If we are lucky enough to live a long life, we will be less likely to need help at that time. And there is the not inconsiderable issue of reducing the inheritance tax.

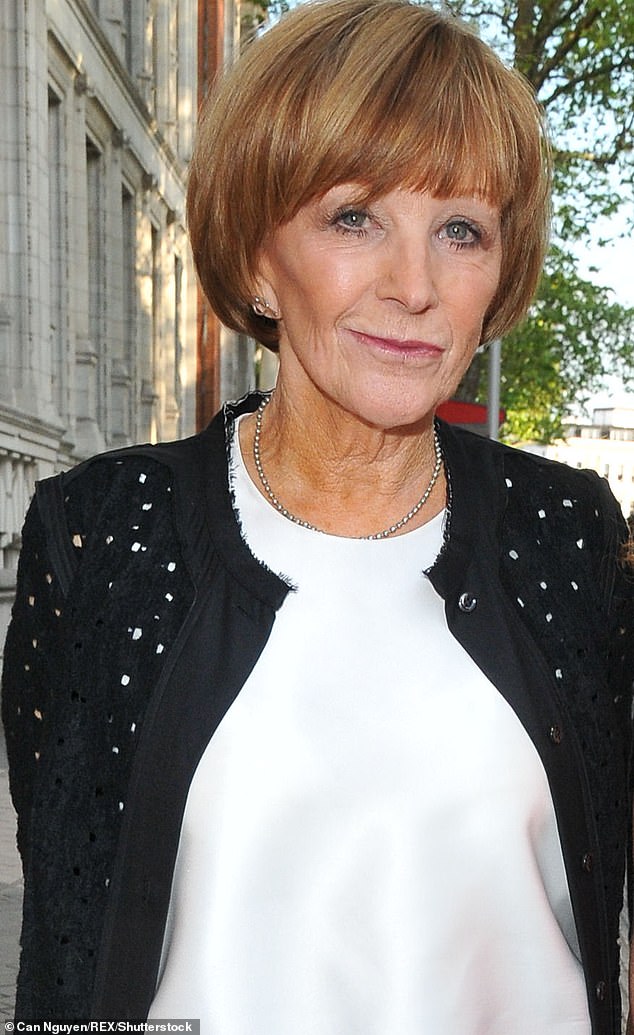

Presenter Anne Robinson, who is believed to have amassed a fortune of £50 million, recently confessed that she is doing everything she can to distribute her fortune among her family and friends before she dies, to keep it out of the hands of the taxman.

Sounds like a wonderful idea, right?

But let my story serve as a warning. Our act of generosity has driven a wedge between my children, my husband is not on speaking terms with our youngest son, while my eldest son couldn’t be further geographically apart if he tried. I can honestly say that the plan has ruined our lives.

Instead of bringing us closer, giving my three children part of their inheritance early has driven us further apart than ever.

I am an only child and mom and dad were fortunate to forge careers in the medical field. Over the decades they accumulated properties in London, Cornwall (where I live), as well as a holiday home abroad.

The television series Succession tells the saga of a wealthy family competing for their father’s legacy.

In 2012, Dad died of a heart attack, and afterward Mom was preoccupied with trying to “put everything together.” In 2014, our house in Italy was sold and the only property left was Mom’s bungalow.

Mom set up a trust fund because she didn’t want her life’s work to be affected by a hefty inheritance tax bill. She really did her homework. An aunt and I were appointed trustees: we “managed” the asset, although unlike me she was not a beneficiary.

Inheritance tax rules give a period of seven years, meaning that if the mother were to die within seven years of the fund being created, then tax would have to be paid. And usually, my dear mother, smart, organized, got the timing right.

In 2022, eight years after she set up the trust, we were devastated to learn that she had been diagnosed with a brain tumour. She was quite stoic about it and made it very clear that she did not want to undergo any surgeries or invasive treatments.

Instead, she summoned her best friends to see her to say goodbye, drank champagne most days, and we buried her that Christmas.

You could say we had won the lottery, and in a way we did. My husband and I are both over 50 and although I earned a small wage in the care system, my husband was a car mechanic and had his own business.

With the £500,000 trust fund we decided to take stock of our lives, sold the business to my husband’s employee and retired early, intending to live modestly off the trust.

We had barely welcomed 2023 when, out of the blue, my husband suggested we give the kids, all in their 20s and 30s, a lump sum each.

Hand on heart, at first I wasn’t sure why they needed to have the money right now. It is true that none of them owned properties of their own. The oldest had trained as a specialist in animal behavior, the youngest worked as a waiter and the middle one went from one caretaker job to another.

Presenter Anne Robinson, who is believed to have amassed a fortune of £50million, has confessed that she is doing everything she can to distribute her fortune among her family before she dies, to keep it out of the hands of the tax authorities.

So maybe this would be the boost they needed. And I had to admit that it would be wonderful to witness all the ways this would benefit them.

But what would be a decent amount to make a difference in their lives? I insisted that we not use more than half of the trust and my aunt agreed.

We naively assumed that giving them £75,000 each was a life-changing gesture that would allow them to get a foot on the property ladder.

When we took the children home for a rare weekend together, shortly after their grandmother died, we sat them down and explained what we were going to get them. They could have been a little more grateful!

Looking back, maybe they assumed all the money would be shared between them. I had to explain that I didn’t have the authority to do that, that it was a decision I could only make with the other trustee, her great-aunt. And, in any case, we also needed to live on something.

We didn’t set any conditions, but we did emphasize that this was the perfect time to use cash as a down payment on a property. Maybe we should have been a little firmer in our expectations about how the money would be used, because we hadn’t anticipated at all what would come next.

The day the money arrived in my youngest son’s account, he texted me: ‘Guess what? I have resigned! I only have one life and I’m going to live it the way I want.’ This was followed by an airplane emoji.

Always a bit of a hippie, he had never liked school and bounced from job to job as an adult. What was going to be a career in hospitality turned into several jobs as a waiter. He says he doesn’t want to be tied down to “working for the man,” which I’m trying to understand… to a point.

My husband called him immediately but it was too late; I had booked a one-way ticket to India. Upon arrival, he wasted no time in getting a new collection of tattoos. I have no idea how much these things cost, but I know how they were financed.

A year later, my husband is still incandescent and refuses to talk to him. And our son won’t be coming home anytime soon: ‘I’ll stay here until the money runs out, Mom!’ He’s on a five-year visa, so I doubt we’ll see him in the near future. The last time I ‘saw’ him was on a video call on my birthday: he’s thinner, long hair, tanned, and all those damn tattoos.

Our middle son, who is 32, followed in my footsteps through the care system and we have always been close. The problem is not him but his greedy girlfriend.

The moment he received his inheritance, she decided they should move in together. He’s 35 years old, but the number of years he’s actually worked can probably be added up on one hand.

Now she lets my son cover the bills and is listed on the deeds of her new property as co-owner. She was shrewd enough to make sure he also set aside some funds to buy her a new car. I privately cried when he told me.

Now that he was mostly gone, when last winter’s gas bills were through the roof (and his girlfriend was home all day with the heat on full blast), I helped him by paying some of them.

So nothing in his life has changed, other than the supposed security of co-owning a property with a woman who will continue to take money from him as long as she has the funds.

Our eldest son, now 35, bought a house on his own, but 500 miles away in the Scottish Highlands, where he is making a life for himself on a game park. It breaks my heart that he is so far away.

Neither of my children are particularly close to each other and the money only drove a bigger wedge between them, forcing their lives to take drastically different paths.

So I can’t help but think we should have waited and kept the money in trust to distribute after we were gone. That way I would have saved myself the pain of seeing the mess my family has made by spending it.

Susan Wakeford is a pseudonym.

as told to Samantha Brick