Table of Contents

British companies face “a swarm of takeovers” next year and a third of AIM companies are vulnerable to bids, according to City experts.

In a stark warning, investment bank Peel Hunt forecast a “significant and sustained” wave of bids for London-listed companies in the new year.

And he warned that there were ‘barbarians at the door’, a reference to the bitter battle over the takeover of US conglomerate RJR Nabisco – the maker of Camel cigarettes and Oreo cookies – which was the focus of a book and a film.

The alert comes after a mass exodus from the London stock market that has left the City reeling.

This week’s figures showed the biggest net loss for companies on the UK stock market since 2009, with 88 companies exiting and just 18 entering.

Companies have resigned to list on rival stock exchanges such as New York, or have ceased trading after being taken over by acquisitions.

Corporate Greed: James Garner starred in the 1993 film Barbarians at the Gate about the bitter takeover of American conglomerate RJR Nabisco.

City biggies have called on the Government to scrap stamp duty on shares listed in London.

Richard Wilson, chief executive of Interactive Investor, said yesterday that the 0.5 per cent tax was the “elephant in the room”. “We are taxing the UK stock market until it disappears,” he said.

But 2025 will be tough with a “wave of demand approaching UK shores” from strategic buyers and private equity, according to Peel Hunt.

“Our coastal defenses feel weaker than ever,” the bank warned.

Michael Nicholson, head of mergers and acquisitions at Peel Hunt, added: “2025 looks certain to bring a significant and sustained flow of acquisitions into the UK.

‘Bid defense manuals are no longer an item to be left on the shelf. “They should be present at all board meetings.”

London junior market shares AIM are particularly at risk of takeovers in 2025, according to the report. Up to a third of AIM small and mid-cap companies could be acquired.

They are vulnerable due to lack of liquidity, depressed valuations and reduced ability to utilize capital markets.

The reduction of tax incentives to invest in AIM in Chancellor Rachel Reeves’ budget “only serves to fuel the headwinds” facing the sector.

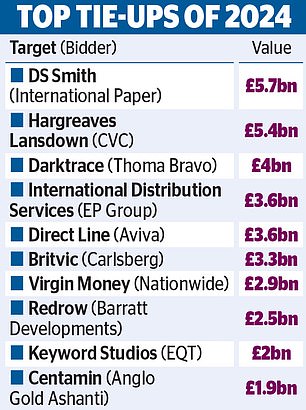

In 2024, one in 20 UK-listed companies were publicly listed on offer, Peel Hunt found.

The biggest deals include the acquisition of Royal Mail owner International Distribution Services, the merger of packaging giant DS Smith with a US rival and GXO’s purchase of logistics firm Wincanton.

But some boards defended the low offers. And while bidders are approaching shareholders directly, they have largely stopped short of being outright hostile.

“Some institutions have taken it upon themselves to become strong supporters of the cheap sale of UK companies,” said Peel Hunt.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.