Table of Contents

- Cable said ministers should be cautious about Daniel Kretinsky’s offer

- Former Liberal Democrat minister Cable was in charge of privatizing Royal Mail in 2013

- He sold it for £3.3bn, or £3.30 per share.

Labor was warned this weekend not to approve the £3.6bn debt-fueled bid for Royal Mail, put forward by former Business Secretary Vince Cable, the architect of the privatization of the postal service a decade ago.

Cable said ministers should be cautious about Czech tycoon Daniel Kretinsky’s bid because of the high level of debt and his ties to the Kremlin.

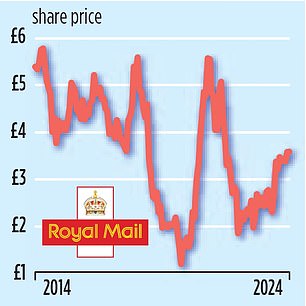

The former Liberal Democrat minister’s intervention carries weight because Cable was in charge of privatizing Royal Mail in 2013 under the Coalition Government. It sold it for 3.3 billion pounds, or 3.30 pounds per share, in a deal that saw it listed on the London stock exchange.

“It’s very sensible to be concerned about Kretinsky’s offer,” Cable told The Mail on Sunday. “The debt-driven bid and its Russian connections should give ministers pause.”

Cable, 81, faced fierce criticism 11 years ago when he was accused of accepting an IPO price that undervalued the business. The shares rose after the privatization, reaching an all-time high of almost £6.07.

Chuka Umunna, then shadow business secretary, said the group had been sold “on the cheap”. The former Labor MP has since acted as an adviser to Kretinsky.

Review: Vince Cable

The shares closed this weekend at £3.59, valuing the business at £3.43 billion, a fraction above the original sale price Cable arranged more than a decade ago.

Cable indicated he did not believe Kretinsky’s £3.6bn investment for the company was too low, saying: “This offer is slightly above the original asking price of £3.3bn.” If it’s undervalued, where are the other offers?

However, when asked if he expected a takeover like Kretinsky did when he sold Royal Mail, Cable said: “We envisaged long-term institutional shareholders.”

Cable has repeatedly defended Royal Mail’s selling price, which has growing problems. It posted a loss of £138m for the six months to September 29.

In January last year, the former Minister said the decision to sell the shares at £3.30 had been “long overdue” and that the Coalition Government “got the best possible deal”.

Kretinsky, nicknamed the Czech Sphinx for his inscrutability, made his fortune in the energy sector. It is the largest investor in Royal Mail’s parent company, International Distribution Services (IDS), with a 28 per cent stake.

It made a bold bet on Royal Mail earlier this year with a £3.6bn bid.

If it succeeds, the company will fall into foreign hands for the first time in its 508-year history.

But the candidacy has been highly controversial, as Kretinsky has already made concessions to the Labor Government.

It has agreed to maintain the company’s universal service obligation, which requires it to deliver letters six days a week.

Other commitments include not touching the Royal Mail staff pension scheme surplus.

While the deal must still pass a government investigation under the National Security and Investment Act, ministers are expected to approve the acquisition in the coming weeks.

Last month, Business Secretary Jonathan Reynolds appeared to brush aside concerns about the tycoon’s impending takeover, saying Kretinsky was a “legitimate business figure.”

But concerns remain about the billionaire’s plans and his international business ties.

In 2021, EP Group, the holding company for Kretinsky’s business empire, signed an £823 million financing deal with a syndicate of banks that included Beijing-owned Bank of China.

EP’s accounts also revealed that one of its raw materials trading companies is in a £174m dispute with a Russian company after it defaulted on a coal contract when the war in Ukraine began.

EP Resources refused to buy coal from the Russian company in line with international sanctions.

The conflict is in the arbitration process and the EP has warned that the result is impossible to predict.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.