Table of Contents

Record passenger numbers at Heathrow indicate that wanderlust has been reignited and crowds are expected to take to the skies over the Christmas holidays.

The results are further proof that we continue to prioritize vacations over other expenses.

For many, a getaway is not a whim, but something essential. Does this proof that post-pandemic wanderlust is here to stay mean we should consider a move in airline stocks?

Yes, but it’s important to differentiate companies that are thriving from those whose situation illustrates why this sector can be “a difficult investment destination,” as Richard Hunter of broker Interactive Investor says. But Jack Barrat, portfolio manager at investment manager Man Group, maintains there are some “exceptional opportunities” available.

The airline industry is often a source of irritation, with flight delays and poor customer service.

But the things that may bother you the most as a customer, like additional baggage costs, can be a useful source of revenue for airlines, boosting their key metric, RASK (revenue per available seat kilometer).

Flying high: IAG, or International Airlines Group, is the £14.2bn group that owns British Airways, Aer Lingus, Iberia and Vueling

Some in the industry are finding new ways to convert their planes into what have been called “winged tents.”

Earlier this year, WizzAir launched a Netflix-like subscription plan All You Can Fly for £534. The 100,000 members enjoy unlimited flights for £8.90 each, but must pay for all luggage except one small personal item .

While we can expect more innovation, investors should be aware that all airlines are vulnerable to severe turbulence caused by external factors beyond their control.

In 2010, they suffered the eruption of the Icelandic volcano Eyjafjallajokull, which caused the cancellation of thousands of flights. The pandemic also wreaked extreme havoc on the industry.

So which stocks are ready to take off and which will continue to lag?

IAG

IAG, or International Airlines Group, is the £14.2bn group that owns British Airways, Aer Lingus, Iberia and Vueling. In June, when its share price stood at 167p, this column reported that several analysts considered the stock to be undervalued. This was a reasonable assessment as the price subsequently rose to 293.2p, although it is still 50 per cent down in five years, revealing the extent of the damage caused by the pandemic.

However, the third quarter results indicated that IAG continues to put this unhappy era behind it.

Operating profits rose 15 per cent to £1.7bn, boosted by increased demand for seats on transatlantic routes, a share buyback plan, the reinstatement of the dividend and some debt reduction.

Despite this year’s rise, some analysts maintain that the stock is still rising. The average price target is 342p. However, one analyst evidently believes the sky is the limit and sets a target of 599p.

EASY JET

Shares in the £4.4bn airline have risen 16 per cent to 586.6p since January, boosted by a 34 per cent rise in full-year pre-tax profits to £610m, and the outlook for 2025 are positive.

EasyJet has been helped by a successful foray into higher-margin package travel, an initiative started by boss Johan Lundgren, who resigned last month. His successor, Kenton Jarvis, plans to attract “25 percent more customers” on this type of vacation, which caters to value-conscious families.

Most analysts think the only way out for easyJet shares is to go up from here, rating the stock a “buy.” JP Morgan analyst Harry Gower set a price target of 750p earlier this month. UBS’s Jarrod Castle has opted for 800p.

WIZZAIR

Despite the popularity of its All You Can Fly loyalty program, shares have fallen 33 percent since January and 63 percent since the start of the pandemic.

This is partly due to a series of crises at the London-listed Hungarian airline. These include problems with its Pratt & Whitney geared turbofan (GTF) engines that temporarily grounded about 40 aircraft, causing a 20 percent drop in half-year profits.

Boss and founder Jozsef Varadi has said the engine issue may not be fully resolved until 2027. But analysts believe anyone who already owns the shares should stay put.

RYANAIR

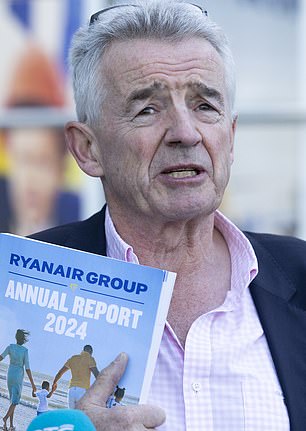

Controversial: Ryanair boss Michael O’Leary

Shares in Dublin-listed Ryanair have rallied in recent months amid perceptions the low-cost airline may be overcoming some of its problems. Last month, Michael O’Leary, the always controversial and mooted boss of Ryanair, said the airline was “overscheduled, overstaffed and overcosted” over the summer. It also revealed it was cutting passenger growth figures for 2025 in response to delivery delays of its Boeing 737 Max aircraft.

But Ryanair has resolved its dispute with online travel agencies such as Booking.com, which refused to sell its tickets after a period of conflict.

This week, Alexander Irving, of the Bernstein brokerage, advised his clients to buy Ryanair, setting a target price of 22.50 euros. Alexia Dogani, from JP Morgan, is also a fan and has set a price of 25 euros.

Since O’Leary owns a 3.9 percent stake in the company, he hopes these predictions come true.

JET 2

Ryanair and Wizz Air’s problems have been something of a blessing for AIM-listed Jet 2. Last month, the Leeds-based airline reported record revenue, profits and passenger numbers for the half-year.

The company appears to please its customers while rewarding its investors. The shares are up 30 per cent this year to 1,620 pence. You may not think any further progress is possible, but analysts rate the Jet 2 a “buy”, with an average price target of 1,996p. Investors expect the rise to this level to be smooth.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.