Table of Contents

- REC/KPMG: British labor market suffered ‘further deterioration’ in conditions

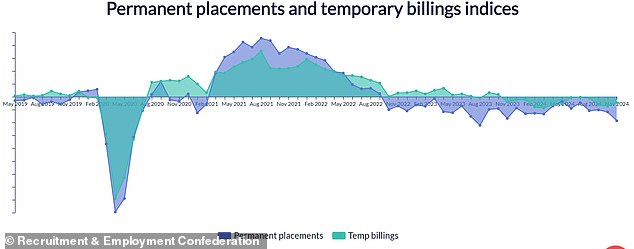

- Permanent placements contracted at their fastest rate in 15 months

Vacancies fell at the fastest rate in more than four years in November amid the fallout from the Autumn Budget, new recruitment data suggests.

KPMG and the Recruitment and Employment Confederation, a trade body for recruiters, said their employee demand index fell from 46.1 in October to 43.9 last month, the worst reading since August 2020. Any reading by Below 50 denotes a contraction in hiring.

The report identified a “further deterioration” in conditions in the UK labor market last month as the Budget made many businesses more reluctant to take on new hires.

Chancellor Rachel Reeves announced at the end of October that the national minimum wage and employers’ national insurance contributions would increase from next April.

Many companies and trade organizations have warned that the measures will lead to higher prices, store closures and job cuts.

Neil Carberry, REC chief executive, said: “It should come as no surprise to anyone that businesses took the time to reassess their recruitment needs in November following a difficult Budget for employers.”

Don’t hire: KPMG and REC said the UK labor market suffered a “further deterioration” in conditions last month as the Budget made many businesses more reluctant to take on new hires.

The latest data from KPMG and REC showed permanent placements contracted at their sharpest rate in 15 months, with the south of England recording the fastest fall of all regions.

They also revealed that full-time vacancies fell across all sub-sectors, while permanent wage growth was “little changed” from the 44-month low reported the previous month.

Jon Holt, chief executive and senior partner at KPMG UK, said the slowdown in hiring and increased availability of candidates in the market could put further “downward pressure” on wage inflation.

He added: ‘This trend will be encouraging for the Bank’s monetary policy committee ahead of its next meeting this month, although it may not be enough to offset the broader inflationary pressures we are seeing in the economy.

‘However, the prospect of further rate cuts until 2025, together with the Government’s investment plans, point to better growth in the short term.

“This should give companies greater confidence, which can help stabilize the labor market.”

Figures released last week by HR software provider Employment Hero found that full-time employment in the UK fell by 1.2 per cent in November.

Younger people were particularly hard hit, with 4.8 per cent fewer 18- to 24-year-olds working full-time last month compared to October, according to the group’s SmartMatch Wage Report.

Separately, a Bank of England survey of finance chiefs found that just over half of businesses expected to hire fewer staff and raise prices because of the Budget.

From April 2025, businesses will pay a 15 per cent National Insurance levy on staff salaries over £5,000, instead of the current 13.8 per cent tax on salaries over £9,100.

The UK government predicts that the NI increase will generate £25 billion a year, although the Institute for Fiscal Studies think tank believes it will be closer to £16 billion.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.