Table of Contents

Activity in Britain’s housebuilding sector continued to decline last month as high borrowing costs and weak consumer confidence weighed on demand.

The closely watched S&P Global/CIPS UK Purchasing Managers’ Index for the construction industry hit 55.2 last month, up from 54.3 in October.

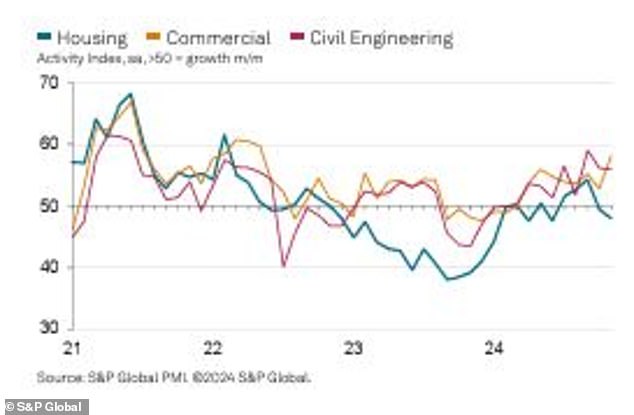

While the construction industry rebounded in November, growth was unbalanced, amid weaker residential housing construction, which is sensitive to high interest rates.

Strong demand for commercial and civil engineering projects offset the contraction in residential housing construction.

Commercial construction activity expanded at the fastest pace since May 2022.

By contrast, residential work declined at the steepest pace since June. House building companies said high borrowing costs and fragile consumer confidence were hitting demand.

Data: Activity in Britain’s housebuilding sector continued to fall last month, new data reveals

Tim Moore, chief economic officer at S&P Global Market Intelligence, said that while the construction industry has avoided the slowdown seen in other parts of the economy, the high cost of borrowing continued to weigh on new orders.

Construction companies also became less optimistic about their prospects for next year, with confidence at its lowest level since October 2023.

“The loss of momentum for new job creation, coupled with concerns about rising labor costs, led to weaker job creation and a drop in business optimism across the construction sector,” Moore added. .

The survey’s employment measure rose marginally, but the rate of job creation slowed to a three-month low.

Companies cited rising labor costs as a factor slowing hiring. Some said they used subcontractors to help mitigate rising costs.

Employers across the economy have raised concerns about the increase in national insurance contributions paid by employers which was announced by Rachel Reeves in her budget and will come into force in April 2025.

Input price inflation was the highest since May 2023, reflecting increases in the cost of raw materials and upcoming increases in labor costs.

A separate PMI survey on Wednesday also flagged service companies’ concerns about rising labor costs.

The headline PMI for all sectors, which includes previously released manufacturing and services figures, was the lowest in a year at 50.9, down from 52.0 in October.

The Bank of England is expected to keep interest rates unchanged this month after cutting them in November for the second time since 2020. Bank of England Governor Andrew Bailey reiterated on Wednesday that future rate cuts were likely to be gradual .

Huda As’ad, Accenture’s UK capital projects leader, said: “The turbulent year ends on a high note, with a powerful return of commercial construction activity in the UK, returning growth to the industry”.

‘For the sector to continue its momentum in 2025, it must be brave to do things differently and focus on digitalisation and real results driven by insightful data.

“The construction industry continues to be overly cautious in adopting modern technology and engineering practices, leaving the sector facing an uphill climb as it faces a growing pipeline of crucial projects and a skills shortage that, if not is addressed, it could hamper the economy. growth in broader terms.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.