Table of Contents

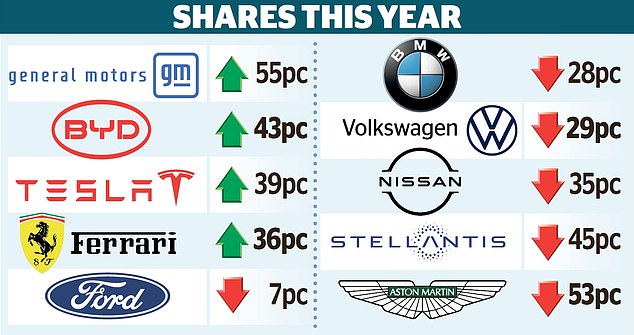

The global car industry suffered another upheaval yesterday when shares in the owner of Vauxhall plummeted following the surprise departure of its chief executive.

Shares in Stellantis, listed in Paris and Milan, fell 6.3 percent to their lowest level in more than two years when Carlos Tavares, one of the industry’s most respected figures, dramatically resigned on Sunday ahead of his retirement planned for early 2026. .

Tavares’ departure came after his reputation took a hit in September when the company issued a major profit warning amid intense competition from Chinese rivals and weak U.S. demand.

“This presents an unprecedented challenge for investors who want to invest in a company with so much volatility in the management team,” said analysts at investment bank JP Morgan.

Analysts at brokerage Jefferies added that his departure, believed to be the result of a dispute over corporate strategy between the CEO, board and major investors, would “cast doubt” on the effectiveness of Stellantis’ model that multiple car brands are owned by a single conglomerate.

The departure of Tavares, 66, came days after Stellantis, which also owns brands including Jeep, Fiat and Peugeot, announced plans to close its Vauxhall factory in Luton, putting more than 1,100 jobs at risk.

Stock market crash: Stellantis shares fell 6.3% to their lowest level in more than two years after boss Carlos Tavares (pictured) dramatically resigned on Sunday.

The problems highlight the misery facing global automakers, which find themselves caught in a perfect storm of falling demand, rising competition and growing pressure from governments to adapt their production to meet zero-emissions targets. net.

Volkswagen (VW) is embroiled in a dispute with workers over plans to close at least three of its German factories and lay off thousands of employees along with a 10 percent pay cut for those who remain.

Meanwhile, the Japanese group Nissan faces a decisive year.

Last month, it revealed plans to cut 9,000 jobs as it tries to stay afloat amid falling profits and an exodus of top executives that has left it on the brink of collapse.

Chief Makoto Uchida has presided over the company’s worst share price performance in 50 years.

The company’s fate has big implications for the UK, where Nissan employs 7,000 people, mostly in Sunderland.

Ford, the long-dominant American auto group, is also struggling to adapt.

Last week, UK boss Lisa Brankin called on the Government to introduce incentives to encourage drivers to buy electric vehicles after the company announced 4,000 job cuts in Europe over the next three years, including 800 in Great Britain. Brittany, due to low demand and competitive pressures.

Industry observers say all major auto brands are suffering from a poisonous cocktail of sluggish demand for electric cars and growing competition from China.

Chinese automakers, thanks to significant subsidies from Beijing, have begun to dominate their domestic market and are now looking to enter other countries, adding more competition to the sector.

The United States has already imposed a 100 percent tariff on imports of Chinese electric cars.

In October, the EU approved plans to impose tariffs of up to 45 percent on electric cars from China.

But the Government appears unlikely to follow the examples set in Washington and Brussels, with Prime Minister Keir Starmer recently meeting Chinese President Xi Jinping in a bid to thaw relations between the two countries.

Andy Palmer, former boss of Aston Martin, said the situation reminded him of when Japanese carmakers began to challenge their Western counterparts in the 1970s and 1980s.

He told the Mail: “At the time, it seemed like the Japanese were eating everyone’s breakfast and now it seems like the Chinese are eating everyone’s breakfast.”

Closing the business: The departure of Tavares, 66, came days after Stellantis announced plans to close its Vauxhall factory in Luton, putting more than 1,100 jobs at risk.

He added that crisis-hit automakers were now paying the price for adapting too slowly as their rivals moved ahead.

“Nissan, Ford and Stellantis reacted particularly slowly to a changing world,” he said.

Factory closures in Britain are also intensifying a row between industry and ministers over targets aimed at increasing the number of electric cars on the roads.

Electric cars must account for at least 22 percent of automakers’ sales this year, a figure that will rise to 80 percent by 2030. Companies that fail to meet that figure will face hefty fines.

Labor has also pledged to reintroduce a ban on new petrol and diesel cars by 2030, after the Conservative government previously pushed back the deadline to 2035.

But carmakers have urged the Government to rethink the targets, warning that falling consumer demand for electric vehicles means they will be forced to close factories and cut jobs instead.

The Government’s stance appeared to soften last week when Business Secretary Jonathan Reynolds admitted to MPs that the electric vehicle mandate was “not working the way anyone intended”.

David Bailey, an expert on the car industry at the University of Birmingham, said the Government needs to find ways to stimulate demand for electric cars and that “simply telling car companies to supply electric vehicles is not going to reduce it.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.