Table of Contents

House price growth will slow next year thanks to higher mortgage rates and stamp duty costs, according to two leading property firms.

Property experts Zoopla and Knight Frank predict an annual increase of just 2.5 per cent in the average property price in 2025.

This would mean a slowdown in the current growth levels recorded by some housing price indices.

House prices rose 3.9 per cent year-on-year in October, according to the latest figures from Halifax, while the latest ONS data shows annual house price growth of 2.9 per cent in the 12 months until September.

Zoopla experts believe buyers facing higher stamp duty costs will want this to be reflected in the purchase price, acting as a drag on house prices in 2025.

Significantly more home buyers will pay stamp duty from April 2025, when rates in England and Northern Ireland will return to their previous levels.

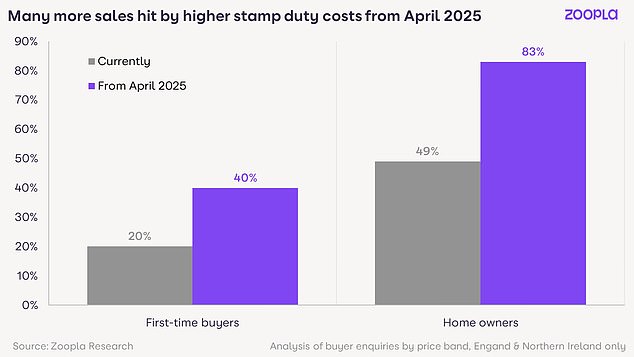

Buyers’ budgets are affected: significantly more homebuyers will pay stamp duty in 2025, which Zoopla expects will affect house price growth by up to 1%.

In total, Zoopla estimates that 83 per cent of homebuyers will pay stamp duty from April 2025, up from 49 per cent paying today.

Zoopla claims that without the stamp duty increase next year, house prices could rise by up to 3.5 per cent.

Real estate company Knight Frank sees higher mortgage rates as the other key factor weighing heavily on house price growth.

The estate agency has lowered its forecast for next year from 3 per cent annual growth to 2.5 per cent as a result of rising mortgage rates in recent weeks.

How much have mortgage rates increased?

Mortgage rates have risen since Chancellor Rachel Reeves set out her economic plans in the Budget earlier this month.

Since the beginning of October, the lowest five-year fixed-rate mortgage has increased from 3.68 percent to 4.14 percent, while the lowest two-year fixed rate has risen from 3.84 percent to 4.14 percent. .22 percent.

Knight Frank expects this to cause further downward pressure on prices and sales volumes in the near term.

For the next five years, a cumulative growth of 19.3 percent is expected. This is slightly more pessimistic than Savills, which forecast house prices to rise 23.4 per cent by early 2029 earlier this month.

Higher purchasing costs: percentage of sales affected by high stamp duty costs from April 2025

How will the increase in stamp duty affect homebuyers?

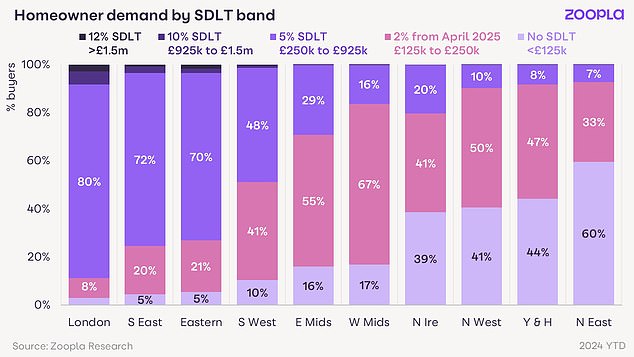

The change to the stamp duty threshold will affect existing homeowners looking to buy a home in the £125,000 to £250,000 price range, where a third of buyers are currently looking, according to Zoopla.

Currently, people moving home pay stamp duty if their home costs more than £250,000, but in March 2025 this will drop back to £125,000, the level it was at before they were made temporary changes to the 2022 mini-budget.

Buyers of homes in this price band will pay stamp duty of up to £2,500 or 1 per cent of the property value.

The impact will be felt most acutely by shoppers in the Midlands and the north of England, where up to 67 per cent of sales are in this price range.

Zoopla says the “average home” priced at £300,000 will see its stamp duty amount double to £5,000 from April 2025.

A first-time buyer purchasing a property worth up to £425,000 currently pays no stamp duty. However, this limit will revert to the old threshold of £300,000.

This means the same £425,000 purchase will be subject to a tax bill of £6,205.

Data: This shows the percentage of buyers in each region who fall into each stamp duty band.

According to Zoopla, an additional 20 per cent of first-time buyers will now be required to pay stamp duty.

This means 40 per cent of first-time buyers will pay full or partial stamp duty from April next year.

Additional costs for buyers will fall mainly on those in the south of England.

Richard Donnell, chief executive of Zoopla, said: ‘The increasing complexity of stamp duty makes it increasingly difficult to assess its impact on market activity and pricing.

‘While an additional stamp duty payment of £2,500 might be more manageable for those buying £1 million homes, it is a much higher cost for those buying cheaper homes.

‘Given this higher cost, buyers will want it to be reflected in the price they pay for their home and will seek to make offers, keeping price increases at bay during 2025 and 2026.

“These changes are likely to reduce house price growth by 0.5 to 1 percent in 2025, hurting buyers in higher value markets and reinforcing a north-south divide in property growth. prices”.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.