Table of Contents

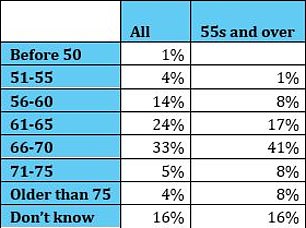

A third of adults across all age groups plan to retire between ages 66 and 70, new research reveals.

Only 5 percent hope to stop working before age 55, while 14 percent believe they could achieve this between age 56 and 60 and 24 percent aim for age 61 to 65.

Almost a fifth think they will retire before age 60.

But many people can’t or won’t set a date: 16 of them say they don’t know in a survey by Hargreaves Lansdown.

The state pension age is currently 66 and will gradually increase to 67 between 2026 and 2028. Meanwhile, the minimum age to receive a private pension will increase from 55 to 57 overnight on April 6, 2028 .

People aged between 40 and 50 should therefore start planning ahead if they want to retire early or intend to use some of their pension savings to pay off debts such as mortgages or cover other important expenses.

It’s especially important to know the age rules on your work and other personal pensions, because some people will still be able to access their funds at age 55 depending on what they say.

Do your research: It’s important to know the age rules at your workplace or other private pension, and plan ahead if you want to retire early.

“People aged 55 and over are more likely to be unaware of their retirement prospects than those aged 18 to 34,” says Helen Morrissey, head of retirement research at Hargreaves.

‘This could be for a variety of reasons. Some might love what they do and have no plans to stop, others might not have really committed yet.

‘Others may have realized that they don’t have enough right now and are trying to catch up, so they want to keep their options open.

‘It could also be that young people have confidence in when they want it to happen, before complexities such as affordability arise!’

Hargreaves surveyed 1,600 people who are not retired but are otherwise weighted to be representative of the UK adult population.

Separate research from Compare the Market found that retirement is the life milestone that people are delaying the most due to the cost of living, with an average of 3.9 years.

Buying a first home came in second place with an average delay of 2.5 years, according to a survey of 2,000 people in Great Britain.

Meanwhile, an influential industry study looks at what individuals and couples need to save for a minimal, moderate or comfortable retirement.

Couples need £22,400 for a basic lifestyle, £43,100 for a moderate standard of living and £59,000 for a more prosperous retirement.

He Study of the Association of Pensions and Lifetime Savings Both you and your partner are supposed to qualify for a full state pension, which increased to £11,500 a year in April, but the figures do not include income tax, housing costs (if you rent or are still paying a mortgage) nor the costs of care.

How to plan for retirement

Helen Morrissey from Hargreaves Lansdown offers the following advice, plus scroll down to find out what to do if you’re worried you haven’t saved enough to retire when you want.

1. Check your pension and retirement plans from time to time

Having an idea of what you want from your retirement can give you an idea of how much it will cost and this, in turn, can give you an idea of how much you need to save.

2. Use an online calculator (see box above)

You can enter your pension details and it will tell you how much you are on track to receive and how much income it will generate for you in retirement.

You can even model the long-term impact of contributing more over time if you can afford the additional contributions.

Hargreaves Lansdown survey results on when people expect to retire

3. Make sure you haven’t lost track of old workplace pensions

This is easily done as we move. That small pension you had at a job 20 years ago could well have grown to a sizeable sum and can have a big impact on how much you have.

It could even bring your retirement forward a few years. Be sure to check your documentation and, if you have lost track of a pension, contact the Government pension tracking service to see if they can help you find it.

4. Consider consolidating your pensions

Having them all in one place gives a better idea of what you have and improves retirement decision making. However, make sure you don’t incur expensive exit fees by doing so.

You should also make sure you don’t miss out on benefits like guaranteed annuity rates that could boost your retirement income.

5. Check your state pension

This forms the basis of people’s retirement planning and there are very few people who do not depend on it to some extent.

The fact that the most popular answer for when people will retire is between 66 and 70 is evidence of this, given that the state pension age is currently 66 and rising.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.