James Cooper and his twin Paul were so alike that when they started primary school their teachers made them wear name badges. “We were up to all kinds of mischief,” says James, who is older by a few minutes, “and we changed our jumpers to confuse them.”

Their identical resemblance has been accompanied throughout their lives by their closeness, felt even more intensely because the brothers were adopted when they were six-month-old babies.

“We always knew we were adopted,” says James, business coordinator at pharmaceutical giant GSK, “and we are also very close to our parents,” he adds, describing his happy childhood in Hertfordshire.

Growing up, they found their own identity and independence, but even after leaving home they talked every day and each bought a three-bedroom house near their parents.

After their parents Elaine and Roger Cooper died in 2009 and 2010, James and Paul, both single, decided to buy a house together.

“Our parents had left us some money and we sat down at the kitchen table and decided to pool our resources otherwise we would be paying double bills on everything from utilities and council tax to broadband.” . That was 11 years ago.

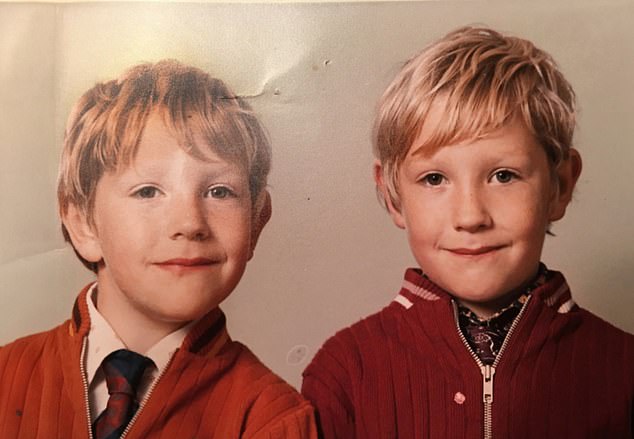

Penalized: James, right, or his twin Paul Cooper, here aged nine, will face a £150,000 inheritance tax bill when one of them dies

Today, James and Paul, 57, are in the pretty village of Braughing, Hertfordshire, enjoying a glass of wine at The Brown Bear or playing darts.

The place they call home is a four-bedroom Grade II listed house, where they are still sorting out the furniture from their parents’ house and their former separate houses.

As you approach retirement, your future feels more uncertain.

“We just have each other,” James says sadly. It is not without reason. Because their attempts to pool resources to protect their future will prove fruitless due to current legislation when one of the twins dies.

The remaining sibling will receive a £150,000 tax bill for their house, thanks to an unfair rule that means long-term cohabiting siblings do not benefit from the inheritance tax (IHT) exemption granted to spouses.

James says he and Paul, an IT consultant, have left everything to each other in their wills. In the event of the death of the second twin, they will transmit their assets to their cousin’s children. IHT rules mean assets over £325,000 are subject to 40 per cent tax, while anything within that allowance can be transferred tax-free.

Married couples and common-law couples can inherit from each other free of inheritance tax. That means when a partner dies, the survivor doesn’t face a tax bill on their shared home and savings.

But siblings who live together in old age do not receive the same protection and are treated like everyone else, meaning their entire estate is potentially subject to IHT. Like people who have been living together for a long time, if a sibling dies, they face a significant bill, and if they don’t have the funds to pay it, they will be forced to sell the house to cover the costs.

The surviving Cooper twin will have to pay £150,000 inheritance tax on the house they bought for £900,000 in 2013, but which is now worth £1.4m.

In the event of a second death, the beneficiaries will have to foot a bill of £470,000, assuming a £100,000 increase in house prices, because the twins are joint owners.

The Coopers only qualify for the nil rate band, which is £325,000, rather than the residence nil rate band, which is £175,000 and applies to property passed on to direct descendants. This is because neither of the twins is widowed or has children. James says: ‘Inheritance tax has always been on our minds. Now the Government seems to want to take, take, take.

‘We have contributed to the system all our lives. We have both had jobs since we were 16 and paid taxes. We have never claimed unemployment benefits. We are a little more comfortable now that the mortgage is paid off, but they are accepting more and more money. Then we have to worry that if one of us leaves, we will have to sell the house.

The twins could also be affected by any gifts they give to each other that exceed the £3,000 annual gift allowance. Any gifts made previously will be potentially exempt transfers (PETs), which are exempt if the individual survives for seven years.

The number of siblings required to pay inheritance tax is small, given that they represent a small proportion of the 4 per cent of families currently likely to pay it.

However, now that pensions will be included in the tax, the figure will rise to 8 per cent and cohabiting siblings will be among them.

This could increase further as higher housing prices push more people to opt for less traditional housing, such as living with siblings or friends.

Rachael Griffin, financial planner at Quilter, says: ‘This is why the nil residency rate band is so outdated. The aim, when it was introduced, was to prevent people from selling their home when a person dies.

‘Unfortunately, that only works if you are spouses or have direct descendants. People without children don’t get that benefit.”

James is angry and worried about what IHT could mean for him and Paul, particularly as they approach retirement. “The government is taking everything away from you right now,” he says.

“They take away your winter fuel subsidy before we have it and take away more money for your pension.” So is there a way to avoid IHT for cohabiting siblings?

Ian Dyall, head of estate planning at Evelyn Partners, says: “It’s worth noting that with IHT on property and illiquid assets, you only have to find 10 per cent of the liabilities and then pay in installments over ten years.”

Interest applies on the outstanding balance, but it could be an option for the surviving twin, especially if they move to a smaller property.

He adds: “The obvious solution is life insurance coverage taken out in trust that would pay out in the event of the first death.”

Rachael Griffin also suggests life insurance or taking out an equity release on the property in case you don’t have immediate access to funds.

“The key is having the money or the strategy to access the money,” he says.

But James, Paul and others like them could be forgiven for wondering why they, unlike other families, are forced to do something.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.