Table of Contents

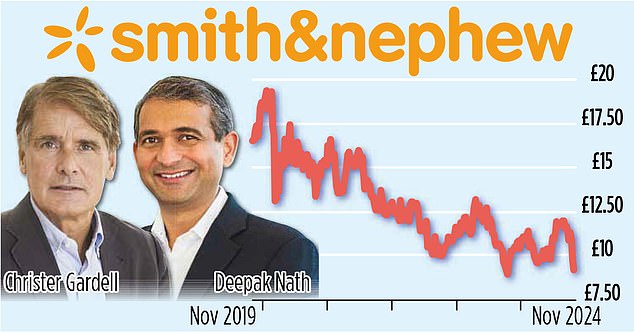

- Shareholders have notified boss Deepak Nath

- Nath was told to urgently improve the fortunes of an underperforming company or be sacked

- The stock has fallen 44% in the last five years.

Smith & Nephew is facing calls to break up the company as investors grow frustrated with its turnaround plan.

Shareholders of the medical equipment giant have put CEO Deepak Nath on notice to urgently improve the fortunes of the underperforming company or be ousted.

FTSE 100 group investors are running out of patience with the pace of Nath’s strategy, which he launched months after joining two years ago.

Smith & Nephew, founded in Hull in 1856, develops technology for surgeries such as the repair of soft tissue injuries. Its chairman is Rupert Soames, 65, former boss of subcontracting company Serco and grandson of Sir Winston Churchill.

The company is made up of three divisions: sports medicine, wound treatment and orthopedics. Its sports medicine and wound treatment branches are considered the second best in the world for those specialties.

But shareholders are hoping for a restructuring at Smith & Nephew’s orthopedics division, which is believed to be a potential spinoff candidate.

The company’s shares have fallen nearly 14 percent so far this year and have fallen 44 percent over the past five years.

Overall profit margins are around 17 percent, much lower than those of competitors such as Johnson & Johnson and Stryker.

The Mail on Sunday understands that investors are happy with Soames’ leadership on the board, but the case for US-based Nath is not yet known.

The company’s largest shareholder is BlackRock with 5 percent, while activist hedge funds Cevian Capital and Harris Associates are also the top ten shareholders. Cevian has not made its intentions for Smith & Nephew public, but under founder Christer Gardell, the hedge fund has developed a fearsome reputation.

The hedge fund is best known for its role in attempting to break up German steel giant ThyssenKrupp in 2018. Ulrich Lehner, chairman of ThyssenKrupp at the time, accused the activist investors involved of “psychoterrorism” tactics to force the resignation of several senior officials. executives.

Nath took the reins in July 2022 as the latest in a revolving door of CEOs. The London-based company has had four bosses in the last five years.

This year he faced a shareholder backlash over plans to increase his salary to more than £9m, with 43 per cent of investors opposing the move.

In the latest blow, the company last month reported “disappointing” third-quarter results and lowered its sales and profit margin forecasts. Revenue growth for the year is expected to be around 4.5 percent, a previous estimate was up to 6 percent.

It reignited investor frustration and speculation that Smith & Nephew could shed underperforming parts of the business. Deutsche Bank downgraded the stock from buy to hold, saying, “We think there will be some who revisit the breakout thesis.”

Analysts warned they were “left wondering what the immediate catalyst would be to unlock” the stock.

“In our view, the updated outlook has represented at least a one-year setback to achieving medium-term objectives,” said analyst Kane Slutzkin. And they want the company to cut core costs and reform its troubled Chinese business.

Berenberg warned this week that it is “uncertain whether the company will see a significant improvement in its finances over the next year.”

“Two years into the company’s turnaround plan, the slow pace of recovery calls into question the level of improvement we can expect from management’s 12-point medium-term plan,” the analysts said.

A Smith & Nephew spokesperson said: ‘Over the last two years we have achieved revenue growth above historical levels and increased profitability. There is clear momentum… and a continued delivery of innovation.

“While the impact of China was a challenge for us, we are confident that we are on the right path.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.