The yawning chasm between generous public sector pensions and squeezed private sector pensions could widen further next week.

Chancellor Rachel Reeves is expected to protect public sector workers from a raid on employers’ pension contributions in the Budget.

Plans to charge a new National Insurance tax on the contributions employers pay to workers’ pensions are expected to raise £15.4bn.

But it has been discovered that public sector workers will be protected from the tax raid, while private sector workers will be affected.

This would widen an already huge gap between the retirement income people receive, depending on whether they are employed in the public sector or for a private employer, experts warn.

Chancellor Rachel Reeves is expected to protect public sector workers from a raid on employers’ pension contributions in the Budget.

It has emerged that gold-plated public sector workers will be protected from the tax raid, while private sector workers will take a hit (file image)

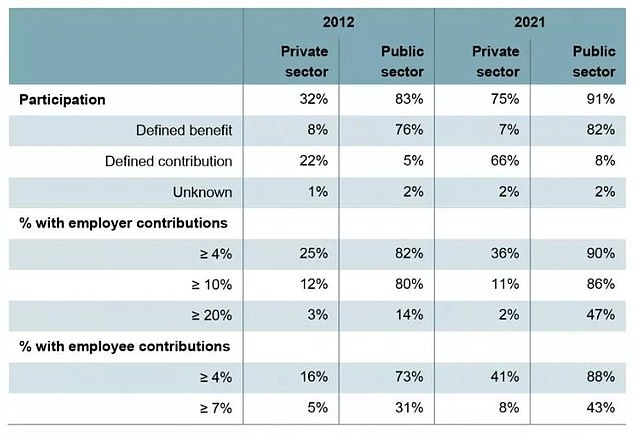

Research by the IFS think tank had already highlighted the growing gap between public and private pension provision.

Public sector workers are rewarded with pensions that are mostly taxpayer-funded and pay much more generous retirement income than private sector workers.

Calculations by wealth manager Quilter have found that for every £1 saved by a worker in a pension, some state-backed plans pay out six times more retirement income than private plans.

Civil service workers receive Britain’s most gilded pensions with the highest reward for every pound saved.

Doctors and teachers also receive generous retirement packages.

Public sector plans, known as “defined benefit” pensions, promise to pay a guaranteed income that increases with inflation from the date of retirement until death.

Meanwhile, the majority of those working in the private sector save in modern ‘defined contribution’ pensions where the responsibility for converting a pension scheme into retirement income falls on the individual, rather than the company.

Plans to charge a new National Insurance tax on the contributions employers pay to workers’ pensions are expected to raise £15.4bn (file image)

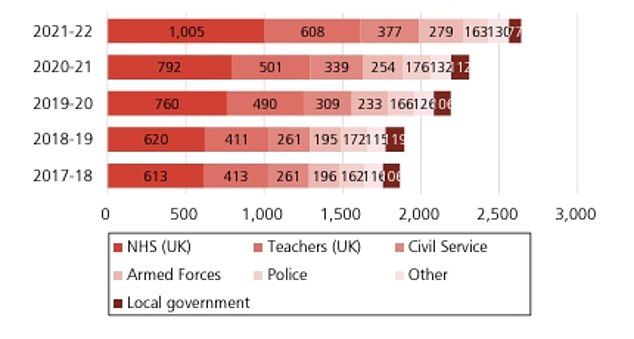

The latest Total Public Accounts published earlier this year highlight the government’s growing liabilities for public sector pensions.

Employers are required to pay into these funds the equivalent of just 3 per cent of their staff’s salaries each year.

Currently, employers do not pay any NI on the money they contribute to pensions on behalf of their staff.

If Reeves announces a new charge to private-sector employers, it would have a direct ripple effect for workers, says Tom Selby, director of public policy at stockbroker AJ Bell.

It warned that this could lead employers to cut the amount they pay into their workers’ pensions or affect future pay rises as companies absorb the new cost. This could deal a blow to workers’ future retirement income.

Someone earning £35,000 today, whose salary rises by 2 per cent a year, would be £177,000 worse off after 35 years if their employer reduced the amount they pay into their pensions from 8 per cent to the minimum of 3 per cent.

AJ Bell’s calculations found that someone earning £60,000 today would be £303,000 poorer when they retire.

The Treasury is rumored to be planning to reimburse public sector employers, including the NHS and government departments, at a cost of £5bn.

Almost half of employers who pay staff more than the minimum pension will consider reducing their contributions if the Chancellor introduces NI into employers’ pension payments, a survey by the Association of British Insurers has revealed.