Higher costs and tighter regulations have created a gloomy atmosphere among buy-to-let homeowners.

However, new figures show that despite this, the typical property investor continues to enjoy excellent rental returns.

According to estate agent Hamptons, the average gross rental yield on a newly purchased home in England and Wales has reached a record 7.2 per cent.

The figure has increased from 6.7 percent last year and 6.2 percent in 2022.

On the rise: It’s not all bad news for landlords as gross rental yields have soared since 2022

The gross rental yield is the percentage return an investor can expect to earn on the purchase price each year, before taking into account taxes and other costs.

For example, if a landlord earned £10,000 in rent a year on a £200,000 property, the yield would be 5 per cent.

The increase in yields has occurred thanks to the increase in rental prices since 2020 and the effective stabilization of house prices from 2022.

The average rental property in the UK costs £1,331 a month, according to the latest figures from tenant benchmark company HomeLet.

Although house prices increased considerably during the pandemic, they have remained stable since the summer of 2022, according to figures from the Property Registry.

However, rents have continued to rise during that time. Average rents have increased 40 percent since June 2020, according to HomeLet, after increasing just 4.4 percent between June 2016 and 2020.

This has made it easier for homeowners to purchase properties with higher yields.

Aneisha Beveridge, head of research at Hamptons, said: “Gross yields on new rental home purchases have risen quite a bit in recent years, reaching an all-time high in 2024.

“This is mainly because rents have risen faster than house prices, but we have also seen investors focus more on yield and actively target higher-yielding properties.

We think rents are likely to continue to outpace house price growth in the coming years.

Aneisha Beveridge, Hamptons

“We think rents are likely to continue to outpace house price growth in the coming years as well, although with a slightly smaller gap than we’ve seen in recent years.”

However, for mortgaged homeowners, higher interest rates will affect their returns.

According to Moneyfacts, both the average two-year and five-year fixed-rate buy-to-let mortgages are around 5.25 per cent.

This means that a typical homeowner requiring a £200,000 interest-only mortgage over five years will have to pay £875 a month in mortgage costs if they buy or remortgage now, not including fees.

Before the interest rate increase in 2022, homeowners enjoyed average rates of around 2.5 percent. On a £200,000 interest-only mortgage, which equates to £417 a month.

“Higher mortgage costs and rates obviously offset a good portion of this growth,” said Aneisha Beveridge of Hamptons.

“Still, falling mortgage rates meant that a typical higher-tax investor who today buys a rental property in Britain with a 25 per cent deposit should make a profit in the first year, which would certainly It’s a step in the right direction.’

> Best mortgages for homeowners: should you fix or risk having a tracker?

Profits: Aneisha Beveridge, head of research at Hamptons, says that despite the higher costs, owners should still turn a profit in the first year of owning a property.

Although landlords are still likely to make money, higher rates and more regulations continue to discourage some of them.

The proportion of homes bought by owners has fallen to its lowest level in 14 years, according to independent research by Hamptons.

It reported that only one in ten homes sold during the first half of this year was to a buy-to-let investor, the lowest proportion since records began in 2010.

But Beveridge believes the situation is about to change and investors will start to see the positives again.

“Our view is that we could start to see buy-to-let investment recover somewhat over the next year, albeit from a very low base,” Beveridge added.

‘The Bank of England’s rate cuts will mean banks will rapidly reduce savings rates, which could start to make buy-to-let look more attractive as an asset class than it was.

‘But there is still uncertainty over the fiscal and regulatory context, which will mean investors will remain cautious.

“Any growth in the sector is likely to be led by experienced owners, rather than new entrants.”

Where have yields increased the most?

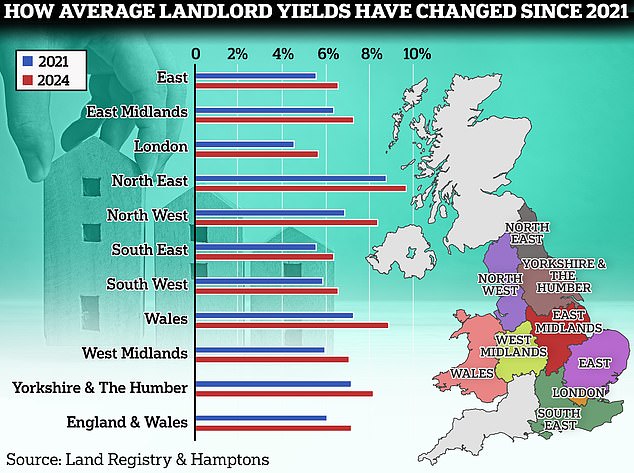

All areas of the UK have seen buy-to-let returns rise dramatically.

The North West has seen the biggest jump in average yields over the past two years, going from 7.1 per cent to 8.4 per cent.

This would mean that a typical homeowner investing in a £200,000 property would now earn £16,800 in rental income a year, compared to £14,200 two years earlier.

Wales has also seen a significant increase in rental yields, according to Hamptons. Owners earned an average return of 7.5 percent in 2022. This year they will get 8.9 percent.

One area that is starting to look a little more attractive for buy-to-let is London.

Better yields: Homeowners are enjoying higher rental yields on their investments, which is helping to offset the impact of higher mortgage rates.

The capital saw average gross yields fall to a low of 4.5 per cent in 2017, after years of high house price growth.

However, as London property prices have stagnated, rental yields have been improving.

The average London buy-to-let investor is now achieving average rental returns of 5.7 per cent.

Allison Thompson, managing director of national lettings at property company Leaders Romans Group, believes buy-to-let remains an attractive investment.

Thompson says: ‘As long as you do solid research of the local market, buy well and ensure the property is professionally rented and managed, you can still generate a rental income return above the returns you could get from other financial investments.

‘Rents are currently rising at a rate above inflation, which should help make buy-to-let more financially viable, and prices are on a steady upward trajectory, meaning your capital should also increase over time. time.

“Of course, markets and trends have natural cycles and fluctuations, so to get the best returns you need to be prepared to invest for the medium to long term, around 15 years or more.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.