Table of Contents

Two other major banks have announced they will raise mortgage rates.

Starting tomorrow, Barclays and Halifax say they will increase rates on several home loan deals.

This follows a bullish move from NatWest today and rate hikes from Santander and TSB earlier in the week.

Many of Barclays’ fixed rate operations look set to rise by 0.2 percentage points.

On the rise: Five big lenders have raised mortgage rates this week

Barclays currently has the second-lowest five-year fixation in the market for buyers buying with at least a 40 per cent deposit. Starting tomorrow, that deal will increase to 3.96 percent.

On a £200 mortgage repaid over 25 years, that’s the difference between paying £1,029 a month and £1,051 a month.

Market-leading Barclays’ offer of 3.85 per cent for those buying with a 25 per cent deposit will also rise to 4.05 per cent from tomorrow.

Homebuyers with a 10 per cent deposit will also lose out as Barclays increased the rate on its best buy to between 4.39 per cent and 4.59 per cent.

Two-year solutions are also in the line of fire. Barclays is raising interest rates at a two-year low from 3.9 per cent to 4.1 per cent.

This leaves only Santander and Nationwide offering two-year solutions below 4 per cent.

For homebuyers purchasing with a 15 per cent deposit, you will see Barclays’ market-leading rate rise from 4.4 per cent to 4.6 per cent tomorrow.

Shortly after news broke that Barclays would raise rates, Halifax followed suit.

The lender announced rate increases for two- and five-year fixed-rate products of between 0.11 and 0.24 percentage points starting tomorrow.

This is expected to lead to the demise of more deals below 4 percent.

Why are mortgage rates rising?

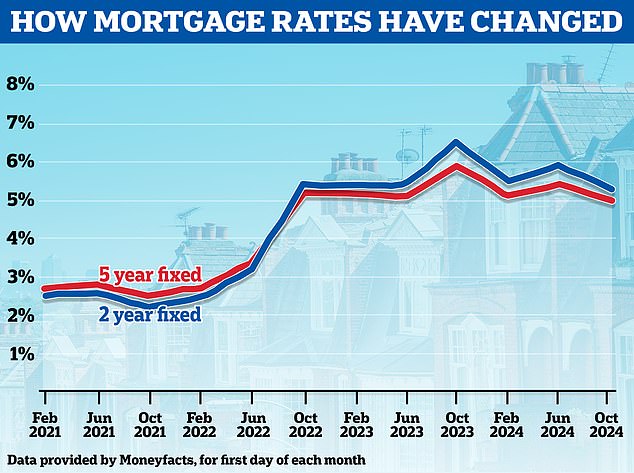

Mortgage rates have been falling at a considerable rate since the summer.

Between early July and the end of last week, the cheapest five-year fixed-rate mortgage available fell from 4.28 percent to 3.68 percent.

Meanwhile, the two-year lowest fixing fell from 4.68 percent to 3.84 percent.

However, they are now increasing again.

Lenders were expected to raise rates this week because Sonia swap rates (an interbank lending rate, based on expectations of future interest rates) have been rising in recent weeks.

When Sonia swaps rise high enough, it often results in fixed mortgage rates rising, and vice versa when they fall.

As of October 14, five-year swaps were at 3.8 percent and two-year swaps at 4.02 percent.

This was higher than a month earlier, when five-year swaps were at 3.39 percent and two-year swaps at 3.73 percent.

The rise of swaps means there is little to no room for lenders to make money, which is why some have to raise prices again.

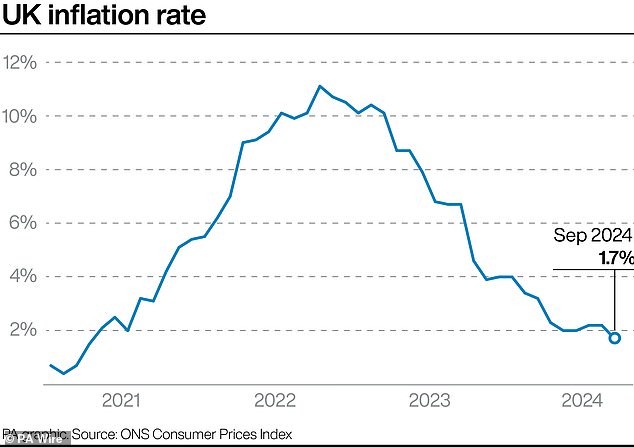

However, yesterday the ONS showed inflation fell to 1.7 per cent in the 12 months to September, down from 2.2 per cent in August.

This was the first time since April 2021 that inflation fell below target and was below what markets were forecasting at 1.9 percent.

Some experts believe this increases the chances that the Bank of England will accelerate the pace of interest rate cuts.

Inflation Watch: Inflation has fallen to 1.7%, its lowest level in more than three years

As a result, Sonia’s swaps have since fallen again, according to Mark Harris, chief executive of mortgage broker SPF Private Clients.

Still, lenders will likely temporarily raise prices again to avoid attracting too many customers with rates that won’t allow them to make money right now.

“After a good run of falling mortgage rates, several lenders have increased prices thanks to higher swap rates,” says Harris.

‘The latter have risen on budget speculation and concerns about the Middle East, but since better-than-expected inflation news and rising expectations that rates will be cut again this year, swaps have fallen again.

“Those lenders that have not been able to absorb the increase in swaps have had to increase their mortgage rates.”

‘This has forced more business from lenders who did not change prices and therefore offered market-leading products.

“As volumes have increased, service could be affected, so some lenders have modified their pricing to curb the amount of business coming in. This domino effect will continue until costs or volumes dictate a reversal.”

Therefore, Harris believes we are likely to see more lenders such as Nationwide and HSBC raise their rates in the coming days or weeks.

Up again: Mortgage lenders have been cutting rates in recent months, but this week has seen a reversal in that trend.

How long should borrowers lock in mortgages?

Harris expects rates to continue falling over the long term and says many borrowers are currently opting for shorter two-year arrangements based on the assumption that rates will be lower two years from now.

“In the short term we expect prices to continue rising, but in the long term the trend seems to be downward,” he says.

‘Borrowers should plan ahead and speak to a broker across the market. Rates can usually be reserved up to six months before you need them; If the mortgage rates have dropped when you go to contract, your broker should switch you to a cheaper product.

“We are finding that many customers are opting for short-term products in the hope that rates will be lower when it comes time to remortgage.”

However, Rachael Hunnisett, director of long-term mortgage lender April Mortgages, believes borrowers may be left disappointed if they fix their debts at two years.

She believes the era of 1 to 2 percent mortgage rates is over and says it’s important for borrowers to think carefully before adopting short-term fixed rates.

“Rising interest rates highlight the disconnect between expectations about base rates and mortgage rates,” Hunnisett says.

‘Over the past 24 months, the mortgage market has experienced considerable rate fluctuations, and mortgage rates, generally based on swap rates that take into account future market predictions, remain volatile.

‘Borrowers should carefully assess their risk tolerance and consider whether they could withstand a significant rate shock if interest rates continue to rise, especially when choosing how long to fix their mortgage.

‘Speculating on future mortgage interest rates, especially with what is often the biggest financial commitment of your life – your mortgage, is a high-risk strategy. “There is no indication that those low rates will return anytime soon.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.