An escalating bidding war for the Currys property could be a sign of things to come in 2024, as weak valuations mark British retailers as ripe targets for cheap acquisitions.

Currys shares have soared over the past week after the group rejected two consecutive takeover bids from US hedge fund group Elliot Advisors, while Chinese retail giant JD.com is “in the preliminary stages” of weighing an offer.

The electrical goods retailer hopes to avoid the fate of other British retailers that have fallen into private hands in recent years, such as rival Comet, Debenhams, Phones4U and, most recently, The Body Shop.

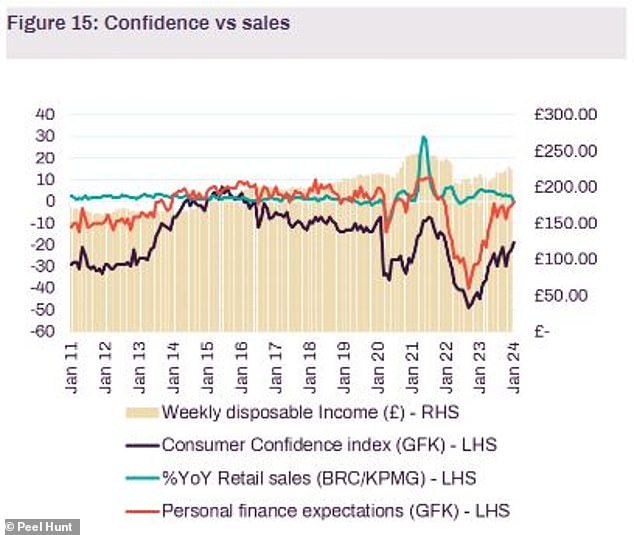

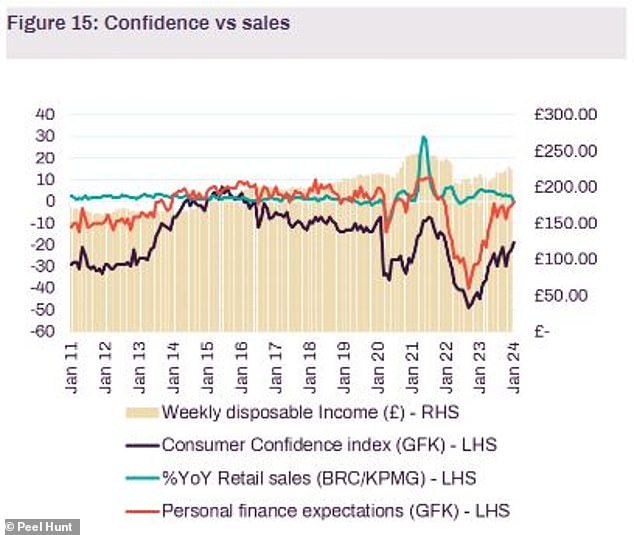

And looming interest rate cuts and easing cost-of-living pressures are also starting to lift British consumer confidence, meaning shoppers could find bargains just as the retail sector returns to full strength. .

High Street for sale: UK retailers look vulnerable to takeovers as they trade at weak valuations

Ian Lance, co-head of Redwheel’s UK value and revenue team, which owns a combined 14.6 per cent stake in Currys, said the retailer is worth “substantially more” than Elliot’s 62p offer.

He added: “(The offer highlights) a wider problem with the UK stock market which no longer appears to be fulfilling its primary purpose of determining prices and efficiently allocating capital.”

Lance said “depressed valuations”, driven by large domestic investors moving their portfolios out of the country, mean foreign corporate buyers will continue to “take advantage” and “the number of UK listed companies will continue to decline”.

Analysis by brokerage Peel Hunt suggests that consumer-focused retailers are particularly vulnerable in this regard.

The nine stocks within Peel Hunt’s “core and consumer-relevant market leader” category have an average price-to-earnings ratio (a key metric for understanding a company’s value) of just 11.8, heavily skewed to the upside by Greggs with a P/E. Single-digit P/E ratio.

The S&P Retail Select Industry Index, a basket of U.S.-listed stocks focused on retail, had a P/E ratio of about 16.4 at the end of January.

At a share price level, Greggs is the only stock in Peel Hunt’s selection of nine companies trading above the broker’s target price.

Shares trade on average 38 per cent below Peel Hunt’s share price target, with DFS Furniture the most undervalued in the broker’s eyes at 68 per cent.

Nigel Yates, portfolio manager at AXA Investment Managers, noted that valuation concerns have dogged London markets for some time, driving M&A activity on a “sector-agnostic” basis, typically at the lower end. smallest of the market, where the most “extreme” discounts are observed.

However, he said the retail sector now “appears vulnerable given the value on offer alongside improved consumer prospects”.

And retailers are bracing for better times in this regard, with falling inflation, falling interest rates and easing cost of living challenges.

Yates said: ‘Say it quietly, but easing inflationary pressures, stable employment levels and rising incomes, together with tax cuts and lower domestic gas prices have the potential to give the consumer back of the United Kingdom firmly in control.

‘Will the stock market or private equity recognize the changing landscape first?’

Are better times ahead? UK consumer confidence is improving

Peel Hunt, who believes Currys is unlikely to accept bids “below 80p” a share, added: “Cheap valuations across the sector, especially for the market leaders, many of which are trading at PE of just one digit, mean we’re likely to see a lot more M&A activity this year.

“As interest rates have peaked, M&A prospects from both private equity and commercial buyers look likely to improve, given the sector’s low level of valuations.”

Brendan Gulston, co-director of the WS Gresham House UK Multi Cap Income Fund, highlighted takeover speculation around car and bike retailer Halfords, which “has been transitioning towards a services-based business model following the acquisition of The National “.

Gulston added: “With a strong market position, improving earnings quality and significant management levers to offset potential headwinds, we believe Halfords’ earnings growth is largely within the management team’s control.” .

“This is an attractive long-term growth story and the stock is undemanding, trading at a low-to-mid single-digit earnings multiple.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.