Florida has long been a popular retirement destination for those seeking sunny weather, low taxes and a reasonable cost of living.

Retirees flock to the Sunshine State for its sprawling golf courses, sandy beaches and the companionship of retirement communities.

However, in the post-pandemic era, property prices have skyrocketed and the cost of living in Florida has increased significantly.

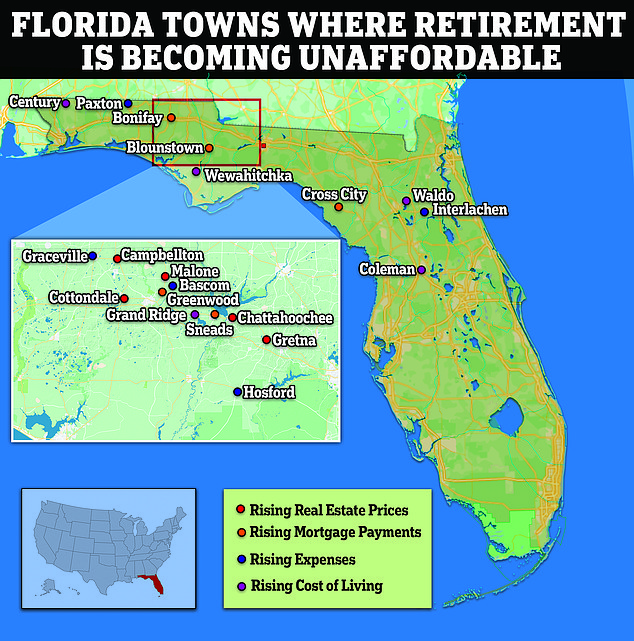

Smaller towns like Graceville, Malone and Waldo have been considered a safe bet for many who have ruled out more expensive cities like Miami, Fort Myers, Palm Beach or Key West.

However, these hot spots are increasingly becoming out of reach for retirees as the average home price in the area and the cost of monthly expenses rise, according to Data from GOBankingRates.

The 20 Small Florida Cities That Are Increasingly Unaffordable for Retirees

Florida has long been a popular retirement destination for those seeking sunny weather, low taxes and a reasonable cost of living.

In Malone, for example, home to just over 2,000 people, the median home value has skyrocketed to $136,676, GoBankingRates found.

That’s a 5 percent increase from last year, according to Zillow.

In the small town of Greenwood, which has about 700 residents, the average mortgage payment has risen to $986 a month.

Meanwhile, in Coleman, a small town located near The Villages retirement community, the average monthly cost of living has risen to $2,953.

For many retirees on fixed incomes, price increases are difficult to cope with.

A retiree fleeing Florida told Realtor.com she’s leaving because of rising costs, such as homeowners insurance.

“Everyone I know had massive rate increases last year or was laid off by their telecom companies,” said Alisa Newman He told the publication.

Insurers “want you to replace your roof if it’s more than 20 years old, even if it’s in good condition,” the 58-year-old explained.

Newman, who lives in the Miami area, already pays a staggering $10,100 a year for home insurance despite discounts for hurricane-proof windows and a burglar alarm he has installed in his home.

Wewahitchka, Florida, is among the small towns experiencing an increase in the cost of living.

A historic church in Gretna, a small town in Florida that is becoming increasingly unaffordable

The First State was recently crowned the best state to retire (pictured: downtown Wilmington)

Newman, who still works as a freelance translator, said other cost-of-living pressures, such as rising real estate prices, car insurance and the cost of eating out, are also motivations for moving.

Auto insurance has increased 24 percent on average in Florida since 2023, according to the Insurance Information Institute.

Residents aged 65 and older are most frequently moving to Georgia when they leave Florida, according to a recent analysis by Realtor.com shows.

Delaware also ranks high on the list of desirable states for retirement.

The First State was recently crowned the best state to retire due to its reasonable cost of living, affordable yet high-quality healthcare, and low crime rate.

TO Bank rate The study ranked all 50 states in terms of affordability, overall well-being, health care quality and cost, climate and crime, and found that the best and worst states for retirees were geographically divided.

The Midwest and South rank among the top five states to live, while the Northeast and West are home to the bottom five states, largely due to differences in cost of living.

Delaware is an especially tax-friendly state for retirees, as it has no state or local sales tax.

The state does not tax Social Security benefits and at the same time offers lower property taxes compared to the rest of the country, where the average is $1,940 annually.