Table of Contents

The areas paying the most inheritance tax have been revealed, with residents of one London borough paying an exorbitant £103m in 2022 alone.

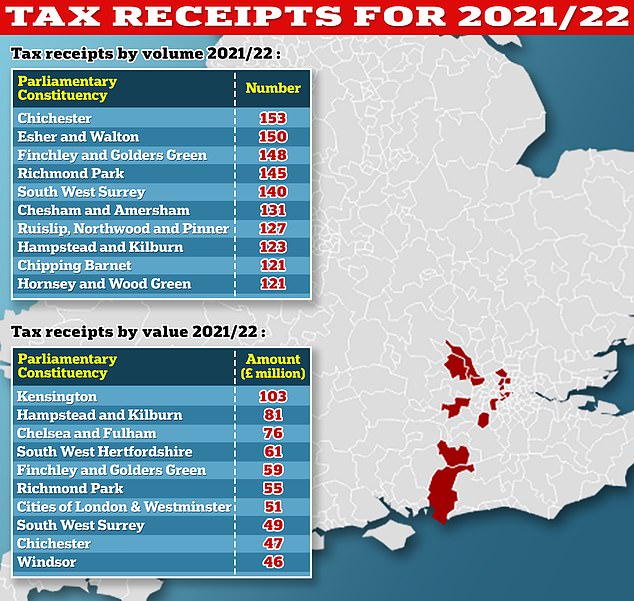

Even though just 92 properties in the west London constituency of Kensington paid inheritance tax during the 2021/2022 financial year, they were the highest payers in the country, according to analysis of HMRC figures by law firm Kingsley Napley.

But while wealthy borough families may have paid more in cash, one town in West Sussex had the highest number of properties subject to inheritance tax.

Wealthy area: Kensington residents paid £103m in inheritance tax in 2021/2022

Which areas pay more inheritance tax?

After Kensington, Hampstead and Kilburn, which come in second in north-west London, saw residents pay £81m across a total of 123 developments.

Inheritance tax is charged at a rate of 40 per cent on the tax-free threshold of £325,000.

Kensington residents paid an average of £1.1m each in inheritance tax over the period, compared with just £658,537 for those in Hampstead and Kilburn.

Also topping the list were neighbouring constituencies Hampstead and Kilburn, and Chelsea and Fulham.

Notably, Wimbledon, East Surrey, Lewes and the Cotswolds all dropped out of the top-paying list last year, while South West Hertfordshire, South West Surrey, Chichester and Windsor made an appearance.

Areas with more assets that pay inheritance tax

Despite being only the ninth most taxed constituency, paying £47m, Chichester had the highest number of taxed properties, with 153 of them feeling the sting of the taxman.

Esher and Walton had the second highest number of properties taxed, 150, and their residents paid a total of £45m.

Focus on the South: All the highest paying areas are in the South East of England.

The ten areas with the highest taxes, both in volume and value, are located in the south of the country, with the most northerly being Hertfordshire.

Sophie Voelcker, partner in Kingsley Napley’s private client practice, said: ‘Our latest ranking shows that house prices and a region’s socio-economic demographics are driving up local inheritance tax costs, so it is perhaps no surprise to see the South East take the medals.

‘We are advising an increasing number of clients who are considering reducing their estates for inheritance tax purposes and making use of the reliefs available before 30 October: specifically, use of the inheritance tax nil-rate band, the annual relief, regular gifts of surplus income, gifts of commercial or agricultural property or possible exempt transfers. Otherwise, they are advised to simply spend.’