The tax office website has crashed as too many Australians try to file at the same time to get some cost of living relief.

Australians entering their tax file number to file a return encountered delays on Monday morning, the first day of the new tax year.

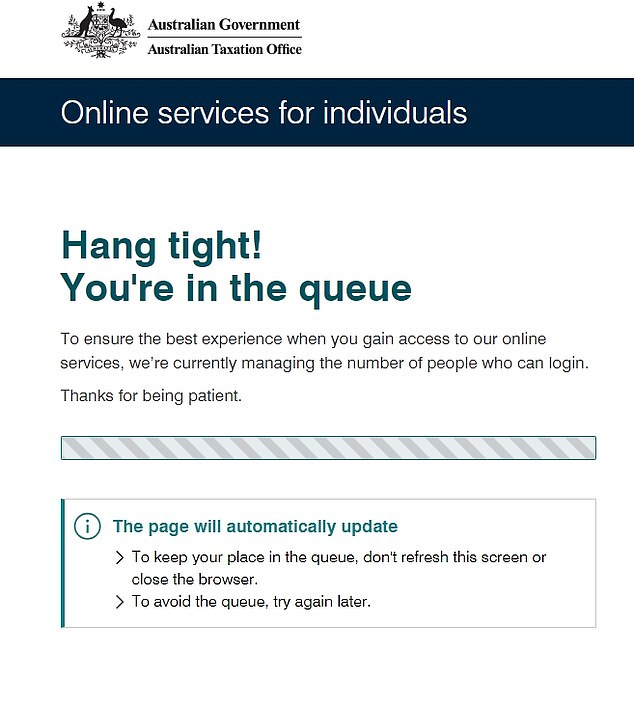

‘Hold on! You’re in line,’ one message read.

‘To ensure the best experience when accessing our online services, we are currently managing the number of people who can log in.

‘Thank you for your patience.’

Labour’s revised Stage Three tax cuts come into force on Monday, marking the start of the new 2024-25 financial year.

But Australians can only file returns for the 2023-24 year, with many hoping to claim work-related expenses in a bid to reduce their taxable income and get a refund to help pay the bills.

The Stage Three tax cuts will allow 13.6 million taxpayers to get relief after Labor revised the former Coalition government’s support package to give more benefits to people on low and middle incomes.

The tax office website has crashed as too many Australians try to file their tax returns at the same time to get some cost-of-living relief.

Part-time workers earning $45,000 a year – or less than the new full-time minimum wage of $47,627 – are receiving $805 a year instead of nothing.

Those earning $80,000 (slightly more than the average salary of $74,500) receive $1,679 instead of $875.

The Labor Party has maintained the 37 percent tax bracket for those earning between $135,000 and $190,000.

Meanwhile, the 45 percent tax bracket will kick in at $190,000 instead of $200,000.

That means high earners earning $200,000 get back $4,529 instead of the original $9,075.