Engine, the technology on which Starling Bank was built, has been busy – and quietly – launching banks around the world, from Australia to Romania.

Engine sells its banking technology to startups to launch their own digital banks.

This smart move means you are expanding in a relatively risk-free way by taking a small share of each market.

The move, along with a new boss at Starling, could help it grow internationally, an important step toward a possible future IPO.

This is Money’s banking and savings reporter Helen Kirrane talks to Engine CEO Sam Everington about the new banks Engine is launching, how many more could launch and where.

Starling Bank’s technology business, Engine, has just launched Salt Bank in Romania and is halfway to launching a second in Romania.

Starling Bank is selling a portion of its success to banks around the world as the next phase of its growth.

Last month it launched Salt Bank in Romania. This is the first time a bank has launched its Engine software outside the UK.

Digital Challenge, a subsidiary of Banca Transylvania, was built and launched in just under 12 months.

Engine is now halfway through launching a second bank, this time in Australia, called AMP. It is expected to launch in 2025.

Sam Everington, CEO of Engine: ‘Now we know it works. “We’ve launched one bank and we’re halfway through launching a second, so it’s not a one-off.”

With two benches under their belt, Everington is confident Engine will release more.

He tells This is Money: ‘Now we know it works. We’ve launched one bank and are halfway to launching a second, so it’s not a one-off.

“I know we can do it again and it’s actually a lot easier the second time.”

‘Because you are taking patterns, you are practicing technology that we have tested and even the partners we are working with are gaining experience on the platform.

“So the delivery time should arrive and the risk will become less and less.”

The new banks have a 12-month delivery window, which is fast, but the delivery time is reduced because the new banks adopt the Engine patterns, practices and technology that have already been established and tested through Starling.

Given this track record, Engine could be on track to launch one bank a year.

Everington says: “Sustainable growth for new banks is really important – it’s very easy to get too ambitious with a technology company.”

“If I could have designed the perfect journey, it would have been to have a bank launch, have a sort of six-month gap, have another one up and running, have another gap and then have another one and by accident we’ve created that.

‘Given the negotiation times on these things, I have no control over it. But now that we’ve done two, we have a lot more confidence to do three, four, five, six, seven later.”

Salt has real ambitions to become a big bank in Romania and the region, Everington tells This is Money.

Their goal is to incorporate 250,000 clients in one year, a goal they have achieved by having seen 100,000 registrations in the space of two weeks. It took Starling two months to reach this enrollment figure.

Salt aims to have 1 million customers in three years.

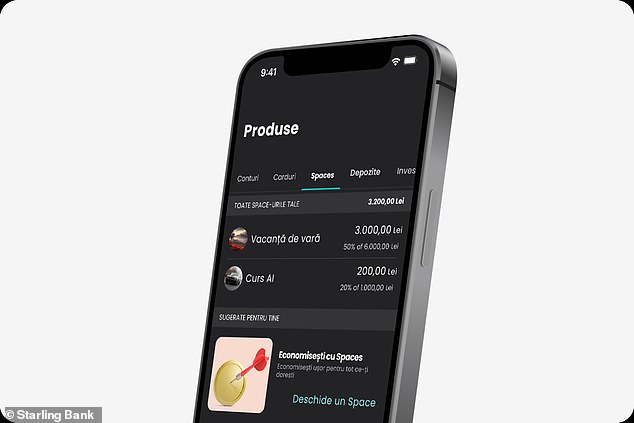

Visually, the new banks appear similar to Starling, but they have control over their appearance and which of Starling’s features they will have.

This is a roughly 75 percent split between the Starling functions and 25 percent of the new banking functions.

This takes time and risk out of the launch process.

Look familiar? Romanian Salt banks launched this year using Engine’s Starling Bank software

‘Real interest from everyone’

Now that Engine has had a presence in Europe and Australia, it is in talks with banks in Europe and has set its sights on Asia Pacific and the Middle East.

In just a few weeks, Engine’s offices have welcomed banks from six different countries to explore partnerships.

Everington says: ‘There is real interest from around the world in Starling as one of the few successful and truly profitable digital banks, apart from Nubank in Brazil.

“So banks appear from many places. “They are fascinated by what Starling has done and wish it was their product that was installed on their platform.”

Everyone is interested in making the platform as good as possible to attract customers.

Sam Everington, CEO of Engines

But that’s very different from banks being in the right place to make this kind of change and investment, Everington adds.

Because Engine is backed by Starling as a profitable organization, it can afford to be “posh” with the banks it thinks are actually going to do something with Engine’s technology, commit to getting it up and running, getting the project done, and build a business on the basis. of that, says Everington.

He says: “It’s not a small business to form a bank or launch a new digital bank and you have to really establish what you’re trying to do.” What is the ambition in this regard? What is the purpose? You need some kind of growth angle underneath.

The success of the new banks will ultimately mean achieving profitability.

Engine’s growth will not come at the expense of Starling Bank

Engine is wholly owned and financed by Starling, so all investment money comes from the board of directors of Starling’s Bank. But the intention is to make Engine independently profitable in its own right.

Engine makes money from its business model by charging the banks it works with per customer and per type of product they have on the platform.

‘As the new banks we launch grow and become more successful, we also earn more revenue.

‘It is in everyone’s interest that the platform is as good as possible to attract customers.

“We are on a path and it will take a few years to get Engine to independent profitability, but that is the goal,” says Everington.

Engine’s continued growth will help propel Starling to the IPO, but there is no set time for this.

Engine’s growth will not come at the expense of Starling’s retail business. According to Everington, “the two really benefit each other.”

“Continued growth of both businesses is our focus and will continue to be,” Everington says.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.