A flurry of foreign deals has seen the value of deals from British companies reach almost £80bn so far this year, new figures show.

Foreign buyers accounted for £63 billion, or more than 80 per cent, of takeover bids in the UK from January to April, according to data from the London Stock Exchange Group (LSEG).

This comes as global deals are back with a vengeance, rising 31 per cent to more than $1 trillion (£850bn) in the period.

The figures include agreed and rejected offers.

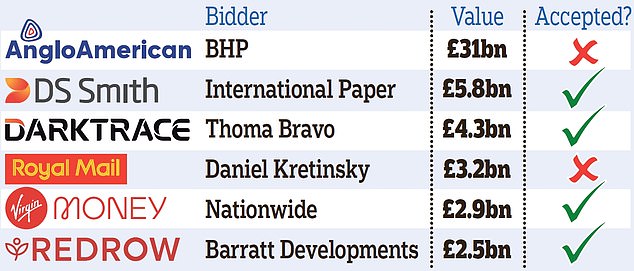

In the UK, mining giant BHP’s biggest focus was £31bn on rival Anglo American.

Go cheap: Foreign buyers accounted for £63 billion, or more than 80%, of takeover bids in the UK from January to April, according to data from the London Stock Exchange Group.

The Australian-listed bidder had its offer rejected but is considered likely to return for another opportunity.

A foreign predator is also being pursued by Royal Mail owner International Distributions Services (IDS), while others, such as cybersecurity firm Darktrace, have already succumbed.

The value of targeted acquisition activity in the UK has risen to £78 billion from just £29 billion at the same time last year.

And with four-fifths of foreign bidders, foreign companies have never been more dominant in the British mergers and acquisitions (M&A) market.

Over the last decade, they have typically accounted for around two-thirds of UK business acquisitions.

The United States dominated global negotiations, accounting for 56 percent of the total, the highest proportion in 25 years, in the latest sign that the giant of global capitalism continues to outperform its rivals.

Seventeen of the 20 largest global deals announced in the four-month period involved a U.S. target, but these were not a case of foreign predators swooping in, and all but one were domestic acquisitions.

Lucille Jones, senior manager at LSEG Deals Intelligence, said: ‘The rebound in deal making comes after a long drought.

Mergers and acquisitions fell last year to their lowest level in a decade as geopolitical tensions, rising interest rates and recession fears curbed appetite for risk-taking.

“Although many obstacles remain, improving economic conditions and a more stable financial environment appear to be stimulating trading, particularly in the United States.”

However, globally, agreements have not yet recovered to the levels seen in 2021 or 2022.

And the total of £199 billion in April alone – although up 9 per cent on last year – was down 5 per cent on March.

The figures showed that the number of deals globally in the first four months of the year (14,017) was almost a third lower than in the same period in 2024.

But the value of M&A activity was boosted by an increase in the number of mega-swoops worth $5 billion or more to 36, which was an increase from 2022 and the figure highest comparable since 2021.

In Britain, the most striking activity has been by American and other companies taking advantage of bargain valuations.

Darktrace has agreed to be taken over by US private equity firm Thoma Bravo, for £4.3bn.

And the board of packaging company DS Smith has backed a £5.8bn proposal put forward by America’s International Paper.

IDS has rejected a £3.2bn proposal from Czech businessman Daniel Kretinsky.

The takeover bids have added to much soul-searching in the City of London over the loss of British businesses to foreign ownership.

Other deals, however, have been intra-UK affairs: building society Nationwide bought Virgin Money for £2.9bn and housebuilder Barratt snapped up Redrow for £2.5bn.