Local Social Security Administration (SSA) office staff are ignoring “simple requests” for months as rampant abuse of telework continues under the Biden administration.

A beneficiary worker for an organization in Sioux City, Iowa, revealed that the local Social Security office has been completely ignoring outreach activities since December.

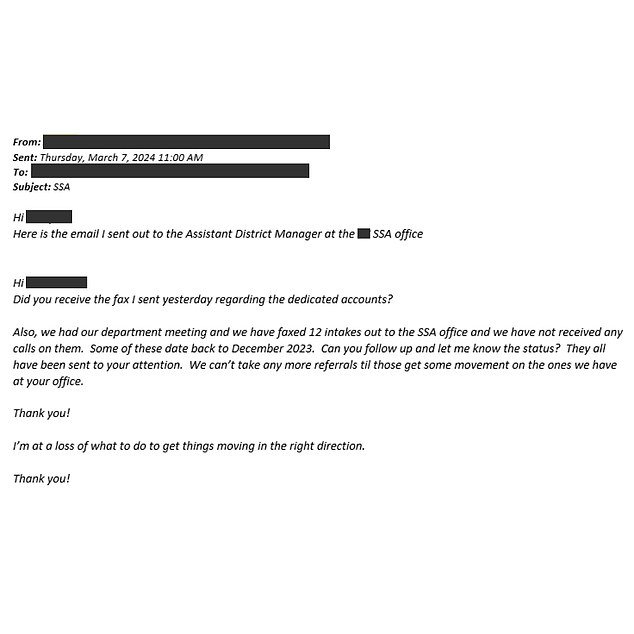

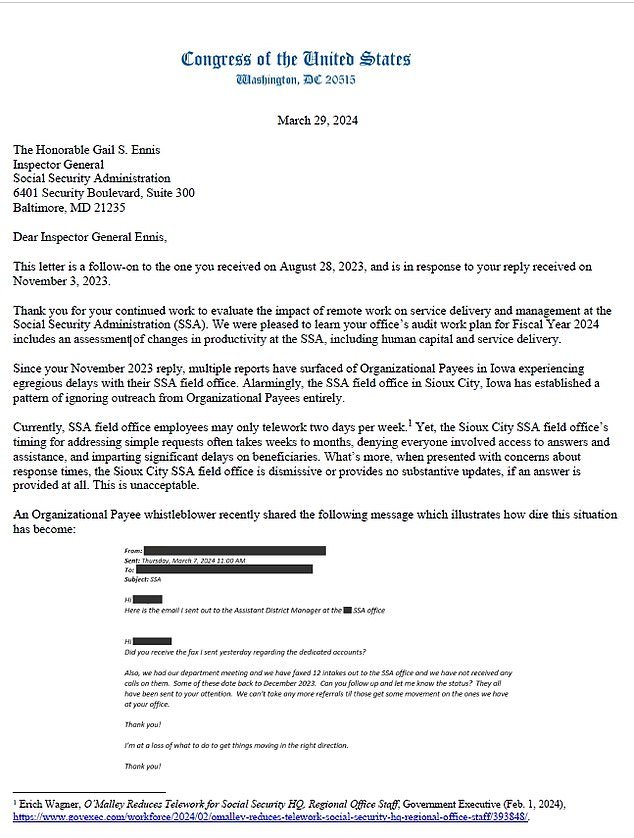

The whistleblower writes in a disclosure first obtained by DailyMail.com that his department faxed 12 applications to the SSA office but had “not received any calls about them” as of March 7.

Some of the acquisitions date back to December 2023, according to the whistleblower, allowing several months to pass without a response.

The whistleblower says his office cannot accept any more referrals until there is “movement” on the ones that were faxed months ago.

“I don’t know what to do to get things moving in the right direction,” the exasperated whistleblower writes in an email to the deputy district manager of the SSA office.

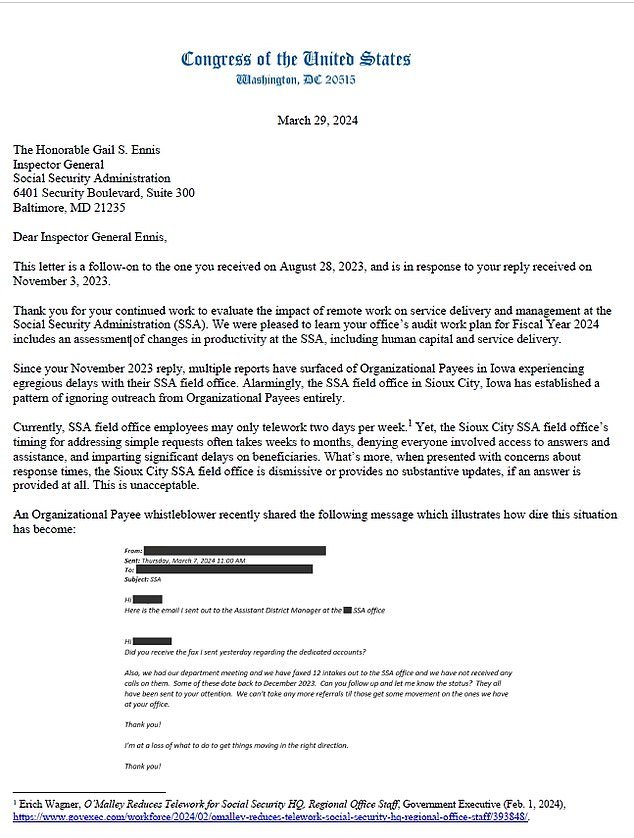

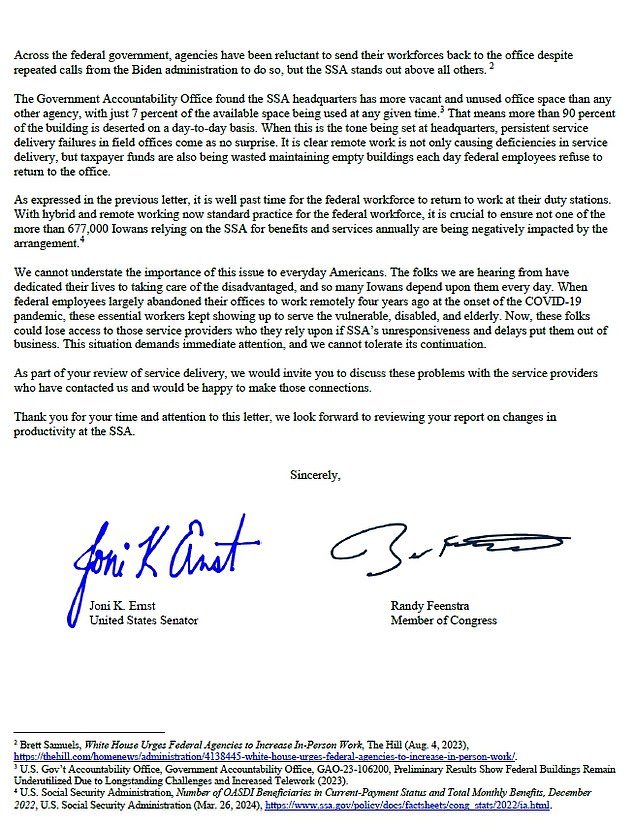

Now, Sen. Joni Ernst and Rep. Randy Feenstra, Iowa’s top Republicans, are taking food chain concerns to the agency’s top watchdog.

“I don’t know what to do to get things moving in the right direction,” the exasperated whistleblower writes in an email to the deputy district manager of the SSA office.

SSA headquarters in Washington, D.C., had the most unused office space of any Biden agency, at just 7 percent, according to a recent report, meaning 90 percent are unoccupied daily. , wasting billions of taxpayer dollars.

Ernst to the USDA inspector general on Wednesday in a letter first obtained by DailyMail.com expressing problems with the secretary’s testimony.

Biden’s chief of staff, Jeff Zients, also directed chiefs of staff to ensure their workforce returns to the office this year.

There have been “multiple reports” of beneficiary organizations in Iowa that “experienced excruciating delays with their local SSA office,” they say.

“Alarmingly, the SSA field office in Sioux City, Iowa, has established a pattern of completely ignoring contact from organizational beneficiaries,” the lawmakers write to Social Security Inspector General Gail Ennis.

Employees at local SSA offices can only telework two days a week, according to a staff directive from February.

But the Sioux City SSA field office’s time to address simple requests “often takes weeks or months, denying everyone involved access to answers and assistance, and imposing significant delays on beneficiaries.”

‘What’s more, when raised with concerns about response times, the Sioux City SSA field office is either dismissive or fails to provide substantial updates, if a response is provided at all. This is unacceptable,” say Ernst and Feenstra.

SSA headquarters has the most unused office space of any Biden agency, at just 7 percent, according to a recent report, meaning 90 percent is unoccupied daily, wasting billions of taxpayer dollars.

“It is time for the federal workforce to return to work in their duty stations,” the lawmakers write.

The focus on the Social Security Administration comes days after Biden’s Agriculture Secretary Tom Vilsack was put on the spot over the agency’s work-from-home stance.

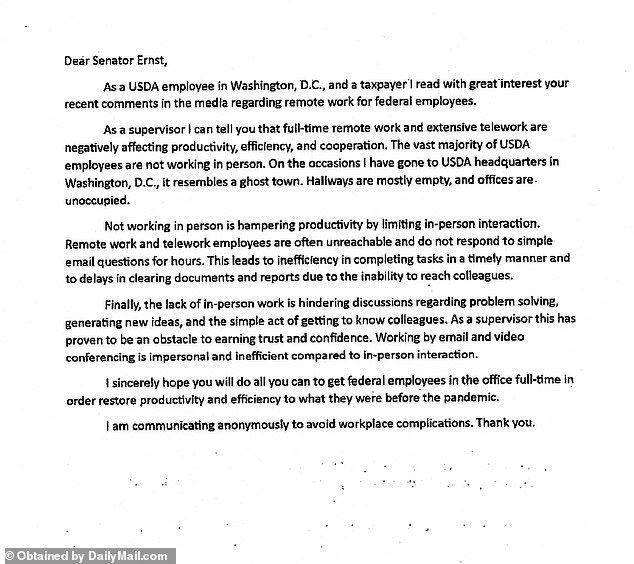

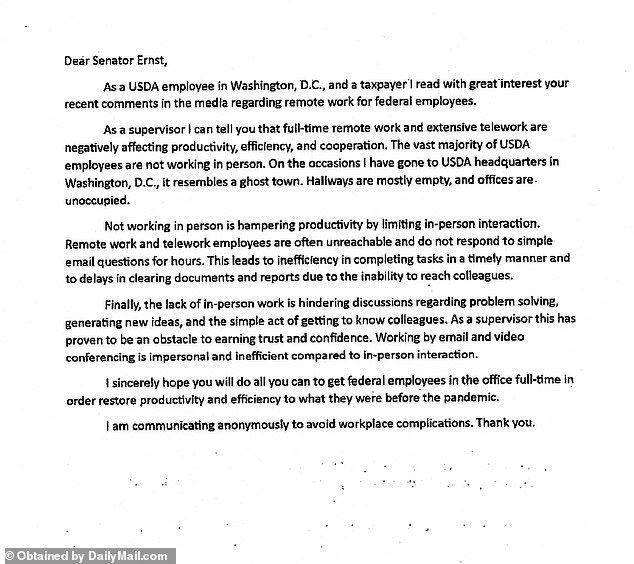

Another agency whistleblower expressed issues with the Biden administration’s “impersonal and inefficient” telework policies.

a federal An employee, who describes himself as a supervisor at the U.S. Department of Agriculture (USDA), revealed to Sen. Joni Ernst, R-Iowa, that remote work is “negatively impacting productivity, efficiency and The cooperation”.

The senator raised whistleblower concerns with Vilsack during a recent hearing, during which he insisted that employees are expected to be in the office “most of the week.”

But in practice that is not happening.

The whistleblower went on to say that the “vast majority” of USDA employees are working remotely, and that the unused federal office headquarters looks like a “ghost town” with empty hallways and empty offices.

USDA was found to be only 11 percent occupied between January and March 2023 and more than 75 percent of available office space at 17 different federal agencies is still empty, according to the Government Accountability Office (GAO).

Vilsack took issue with that statistic, saying the GAO’s estimate “isn’t even close to being correct.”

But Ernst says the agency’s estimates were based on “average space utilization taken over a three-month period less than a year ago.”

The biggest problem, according to the whistleblower, is how limited in-person interaction is “hindering productivity.”

Remote employees “are often unreachable and do not respond to simple email questions for hours,” the whistleblower continues.

“This leads to inefficiency in completing tasks on time and delays in clearing documents and reports due to inability to communicate with colleagues.”

Additionally, the lack of in-person work is “hindering discussions” about problem-solving, idea generation, and socializing with colleagues.

As a supervisor, the whistleblower says he is an “obstacle” to the “simple act” of gaining trust.

“Working via email and video conferencing is impersonal and inefficient compared to in-person interaction.”

The whistleblower says having employees back in the office full time would “restore productivity and efficiency.”

Republicans are trying to hold the administration accountable on this issue they say is plaguing the nation.

Last month, the House passed a new bill that will force the federal workforce to return to the office.

The bill led by Rep. Scott Perry, R-Pa., requires federal agencies to use their offices at a rate of 60 percent capacity or sell the buildings.

Republicans say it’s an insult to taxpayers, since agencies spend about $2 billion a year to operate and maintain more than 11,000 acres of federal office buildings and more than $5 billion a year on leases.

In addition to unused physical office space, employees face productivity challenges due to the impersonal nature of remote work.

Ernst plans to aggressively challenge the Secretary of the Department of Agriculture. Tom Vilsack today on the subject.

A current U.S. Department of Agriculture (USDA) whistleblower wrote to Sen. Joni Ernst, R-Iowa, late last year, according to a copy of the correspondence obtained exclusively by DailyMail.com.

President Joe Biden, accompanied by U.S. Secretary of Agriculture Tom Vilsack, tours Dutch Creek Farms in Northfield, Minnesota, on November 1.

Unused federal office space wastes about $2.8 million a day and is becoming a major headache for Biden, who is trying to get employees back to working in person.

Biden’s chief of staff, Jeff Zients, also directed chiefs of staff to ensure their workforce returns to the office this year.

According to a memo obtained by DailyMail.com, he wrote earlier this year that federal employees should be in the office at least 50 percent of their work time to achieve the administration’s goals.