A wristwatch that stopped when the United States dropped the world’s first atomic bomb on Hiroshima in 1945 will sell for at least $20,000 (£16,000) at auction.

The hands of the melted clock are frozen at 8:15 a.m., the moment the bomb, called Little Boy, which had been dropped from the B-29 bomber Enola Gay, detonated.

The devastating attack on the southwestern Japanese city in August 1945 led to the deaths of up to 130,000 Japanese men, women and children.

According to the seller, who wishes to remain anonymous, the watch was recovered by a British soldier who had been sent to Hiroshima to help provide emergency supplies and oversee reconstruction efforts.

The watch is being sold following the publicity generated by Christopher Nolan’s film Oppenheimer, which last night won seven BAFTAs, including best film and best director.

It tells the life story of troubled scientist Robert J. Oppenheimer, who led the development of the atomic bomb in Los Alamos, New Mexico.

A wristwatch that stopped when the US dropped the world’s first atomic bomb on Hiroshima in 1945 will sell for at least $20,000 (£16,000) at auction

The devastating attack on the city in August 1945 led to the deaths of up to 130,000 Japanese men, women and children.

The watch first went on sale in 2015 in England. It was purchased by the current owner.

It was found among the ruins of the Hiroshima Prefectural Promotion Hall.

It is being sold through American auction house RR Auction, based in Amherst, New Hampshire.

Online bidding, which has so far raised the price to $18,700 (14,800), ends on February 23.

Bobby Livingston, executive vice president of RR Auction, said: ‘Auctioning artifacts like these is not just about the items themselves; it is about preserving the stories they convey and ensuring that the lessons of history are not forgotten.

“This wristwatch, for example, marks the exact moment when history changed forever.”

It was found among the ruins of the Hiroshima Prefectural Promotion Hall.

The watch is being sold through American auction house RR Auction, based in Amherst, New Hampshire.

It was later estimated that 70 percent of Hiroshima’s buildings were destroyed. At least 70,000 people died in the immediate aftermath of the bomb explosion, with more deaths occurring later.

The watch is being sold following the publicity generated by Christopher Nolan’s film Oppenheimer, which last night won seven BAFTA awards, including best film and best director. It tells the life story of troubled scientist Robert J. Oppenheimer, who led the development of the atomic bomb in Los Alamos, New Mexico.

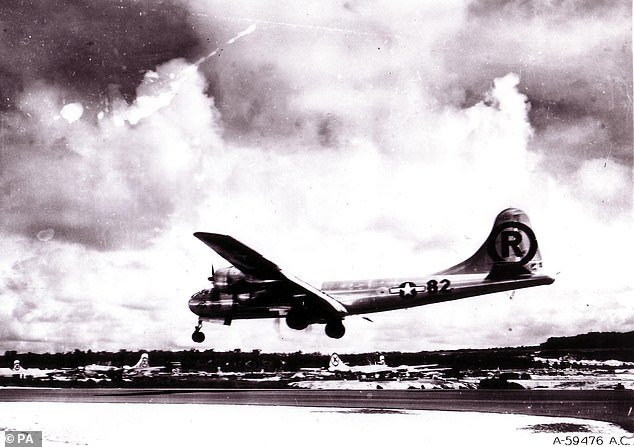

The bomb, called Little Boy, was dropped by the crew (pictured) of the B-29 bomber named Enola Gay and was the first atomic weapon used in the war after successful tests by the United States.

Above is the ‘mushroom-shaped’ cloud that rose into the air after the detonation of the atomic bomb that was dropped on Hiroshima.

Enola Gay is seen landing after her infamous mission to drop a nuclear bomb on Hiroshima in August 1945.

In the research program called the Manhattan Project, the United States defeated Nazi Germany and Japan in developing the atomic bomb.

The first test was carried out in New Mexico in July 1945.

After the moment of detonation, Oppenheimer quoted Hindu scriptures and said, “I have become death, destroyer of worlds.”

The United States then opted to use the technology in Japan after the country’s leaders refused to surrender following the defeat of Nazi Germany in May 1945.

The crew of the Enola Gay carried out their mission to bomb Hiroshima on August 6.

The bomb was detonated at an altitude of 1,750 feet and destroyed an area of approximately 4.7 square miles.

It was later estimated that 70 percent of Hiroshima’s buildings were destroyed.

At least 70,000 people died in the immediate aftermath of the bomb explosion, with more deaths occurring later.

Three days later, the United States dropped a second atomic weapon, Fat Man, on the city of Nagasaki.

It was an act that claimed at least 40,000 more lives and forced the Japanese to finally surrender, ending World War II.

The bomb was detonated at an altitude of 1,750 feet and destroyed an area of approximately 4.7 square miles. Above: The aftermath of the attack

Truman responded indifferently and said, “It doesn’t matter.” He will come out in the wash.

He later told aides that Oppenheimer was “a sniveling scientist,” adding, “I never want to see that son of a bitch in this office again.”

Oppenheimer left Los Alamos in early October 1945 feeling an intense sense of guilt. Meeting with President Harry Truman in the Oval Office, he told him, “I feel like I have blood on my hands.”

Truman responded indifferently and said, “It doesn’t matter.” He will come out in the wash.

He later told aides that Oppenheimer was “a sniveling scientist,” adding, “I never want to see that son of a bitch in this office again.”