Former President Donald Trump on Monday mocked the breathless media coverage of his weekend rally in Ohio, accusing news organizations of false outrage over his warning of a “bloodbath” in the auto industry if he does not win a second term.

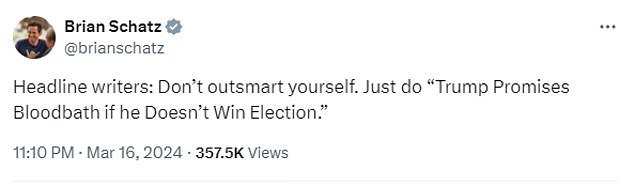

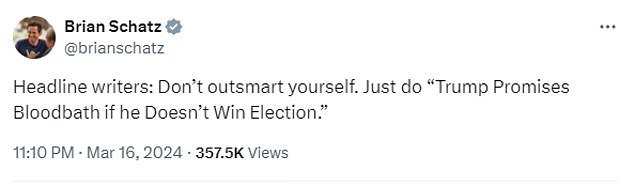

Headlines, political pundits and the Biden campaign have lined up to accuse Trump of threatening political violence if the November election doesn’t go his way.

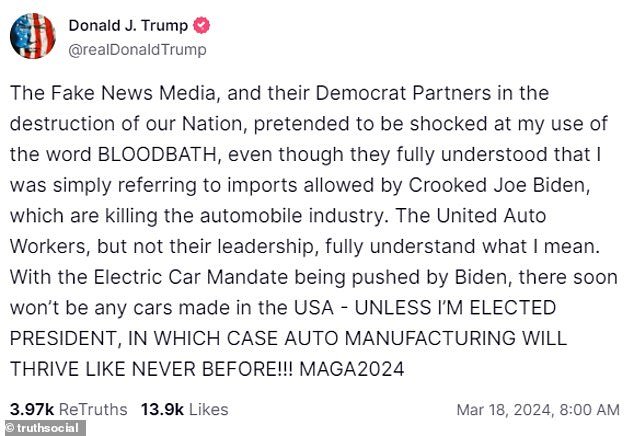

But he defended his comments in an article on Truth Social, noting that he was talking about the impact on U.S. automakers if they weren’t protected from foreign imports.

And he quickly used the attacks to his advantage, sending out a fundraising email accusing his critics of deliberately misquoting him.

“The fake media and their Democratic partners in the destruction of our nation pretended to be shocked by my use of the word bloodbath, even though they perfectly understood that I was simply referring to the imports authorized by crooked Joe Biden , who kill”. the automobile industry,” he says, deploying capital letters with his characteristic abandon.

Former President Donald Trump fired back at coverage of his rally speech Monday morning

“The United Auto Workers, but not their leaders, fully understand what I mean.

“With the electric car mandate pushed by Biden, there will soon be no more cars made in the United States – unless I am elected president, in which case car manufacturing will thrive like never before!!!” MAGA2024.’

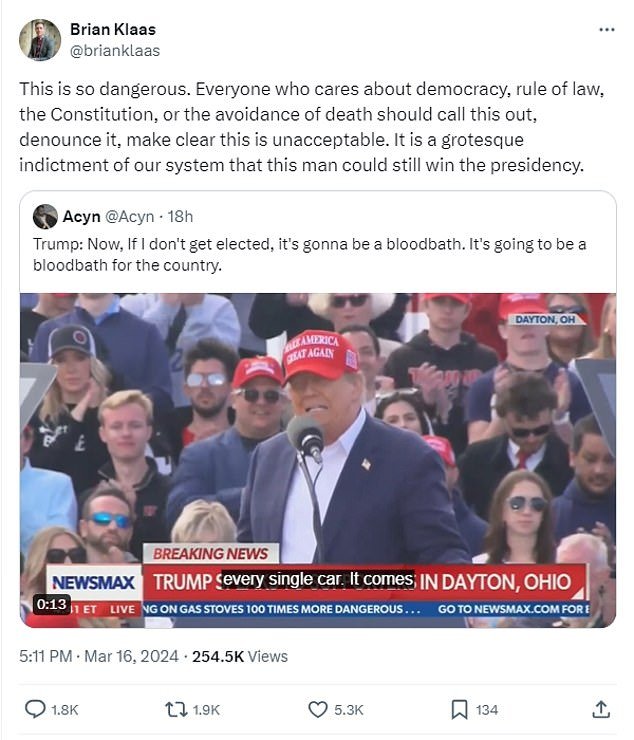

The controversy erupted after Trump delivered a typically fiery speech in Dayton, Ohio, in which we warned that defeat for his campaign would mean the end of American democracy.

“If we don’t win this election, I don’t think there will be another election in this country,” he said.

He also called migrants “animals” and those convicted for their roles in the Jan. 6 attack on the U.S. Capitol “hostages.”

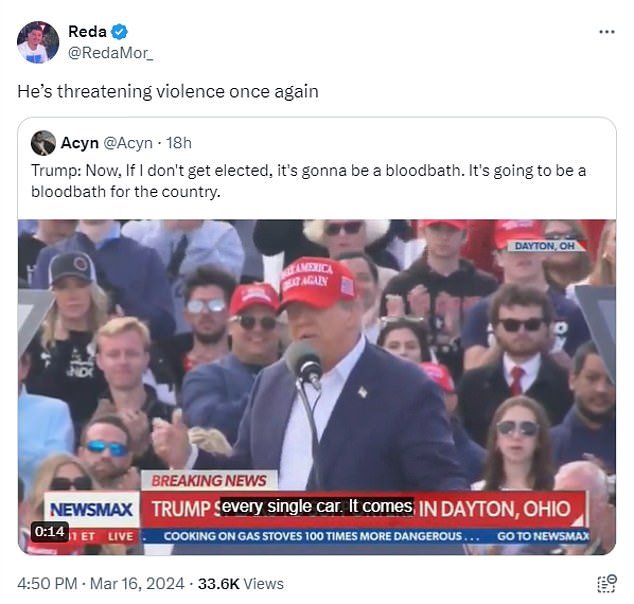

However, it was another part of the speech that provoked the most reactions.

He promised to impose 100 percent tariffs on imported cars to protect American industry from cheap Chinese imports if elected.

“Now, if I am not elected, it will be a bloodbath for everyone… it will be the least that can be done, it will be a bloodbath for the country, it will be the least that can be done,” did he declare. .

In response, the Biden campaign said Trump was “a loser who gets defeated by more than seven million votes and then, instead of appealing to a broader audience, he doubles down on his threats of political violence.”

“Now, if I am not elected, it will be a bloodbath for everyone… it will be the least that can be done, it will be a bloodbath for the country, it will be the least that can be done,” Trump said.

Former Republican President Donald Trump speaks at a campaign rally in Vandalia, Ohio.

And former White House press secretary Jen Psaki rejected the Trump campaign’s defense that he was talking about the auto industry.

“The whole context is that this goes much deeper than just one speech,” she told the audience on her MSNBC show. “This embrace of political violence, this dehumanizing language, is what Donald Trump has been preaching for years.”

Former House Speaker Nancy Pelosi told CNN, “We just have to win this election because he’s even predicting bloodshed.” What does that mean?

“He’s going to demand a bloodbath?” There is something wrong here.

But some Never Trump Republicans said some media outlets had been too quick to judge, warning that it played into the former president’s persecution complex.

Critics including Nancy Pelosi (pictured) and a retired FBI boss called the inflammatory “bloodbath” comment a “threat” – while MAGA supporters said he was taken out of his context because it referred to a crackdown on imports of foreign cars.

His campaign sent out fundraising emails Monday morning.

“They used edited clips to viciously and misquote me. They said you posed a dangerous threat to our country,” they said.

“They even asked Nancy Pelosi to broadcast this hoax live on CNN! She lied directly to the American people!

“Fake news and their allies in the Democratic Party (sic) truly hate our country.”

Trump won enough delegates in the Republican primary last week to secure his party’s nomination.

Polls suggest he has a slight lead over President Joe Biden, even though he faces four criminal cases, including two related to his efforts to overturn the results of the 2020 election.