Patients must demand to be seen by a female doctor.

This is according to research that suggests being treated by a woman could save your life.

For every 1,000 patients treated, two more would be expected to survive if treated by a woman, the study found.

Experts from the University of California at Los Angeles stated Their results show that having more female doctors “would benefit patients.”

However, critics trashed the study involving nearly 800,000 health insurance claims in the U.S., arguing that it had many flaws and proved nothing.

For every 1,000 patients treated, two more would be expected to survive if treated by a woman, the study found. Experts from the University of California, Los Angeles, said their results show that having more female doctors would “benefit patients.”

The American team admitted that they were not sure what was causing the effect.

But they noted that male doctors may underestimate the severity of their patients’ illness.

A greater difference in mortality rate was observed among female patients.

Dr Yusuke Tsugawa, lead author of the study, said: “What our findings indicate is that male and female doctors practice medicine differently.”

‘And these differences have a significant impact on patients’ health outcomes.

“It is important to note that female physicians provide high-quality care and therefore having more female physicians benefits patients from a social standpoint.”

He added: “Further research into the underlying mechanisms that link physician gender to patient outcomes, and why the benefit of receiving female treatment is greater for female patients, has the potential to improve patient outcomes.” patients in all areas.

Researchers evaluated more than 775,000 Medicare insurance claims from American patients between 2016 and 2019 and recorded the number of people who had died within 30 days of being seen by a doctor.

They found a small but “significant” difference, with a mortality rate of 8.15 percent among patients treated by a woman.

This figure rose to 8.38 per cent when treated by a male doctor, a difference of around two deaths per 1,000.

While the mortality rate in men was higher overall, there was a smaller difference: 10.15 percent died within 30 days of being seen by a female doctor.

The rate stood at 10.23 percent among men, a difference of about one death in a thousand.

writing in the diary Annals of internal medicineThe researchers also said the “pattern was similar in patient readmission rates.”

Female patients were less likely to be readmitted within 30 days if they had a female doctor.

About 15.23 percent of women with a female doctor were readmitted, compared to 16.71 percent of women with a male doctor.

The team suggested that the effect could also be because female doctors communicate better with their patients, ultimately leading to better diagnoses and treatments.

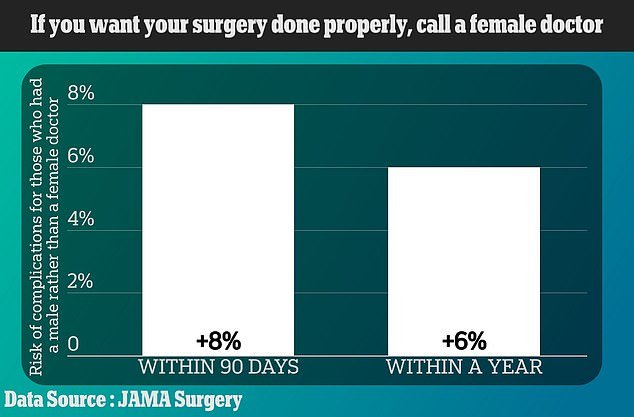

Last year, Canadian researchers also found that patients treated for fractures, hip replacements and heart disease by female surgeons were almost 10 percent less likely to suffer complications such as internal bleeding within 90 days of surgery compared to those served by a man.

Likewise, patients may feel more comfortable engaging in detailed and sensitive conversations with doctors of the same sex.

Scientists have previously found that women who have had a heart attack are more likely to die if treated by a male doctor.

Last year, Canadian researchers also found that patients treated for fractures, hip replacements and heart disease by female surgeons were almost 10 percent less likely to suffer complications such as internal bleeding within 90 days of surgery compared to those served by a man.

However, experts argued today that the paper was merely observational and cannot prove causality.

Dr Gavin Stewart, an expert in evidence-based research methods at the University of Newcastle, said: “The observational study design is a major limitation to this work.”

“Lack of pre-registration” (when scientists record hypotheses, methods, or analysis of a scientific study before conducting it) also raises the “possibilities of undetected bias.”

Researchers should be wary of the study’s conclusions “unless they are corroborated by other studies,” he added.

Female doctors make up around half of the workforce in Britain and just over two-thirds of medical and dental students are women.

But only 17 percent of surgeons are women.