Michael Douglas and Catherine Zeta-Jones, 54, are empty nesters after their two children became adults.

This week, the Oscar-winning actor joked that all they want to see is Dylan and Carys to treat them to a luxurious vacation.

The actor, 79, said Today on Tuesday that his plan works.

“Catherine and I are lucky that our children Dylan and Carys still like to travel with us,” shared Douglas, who recently revealed that he thought Catherine was too good to be true.

‘And so we just finished five weeks in India at Christmas. And we’re always planning for next year, what our trips will be and where we’ll go.’

“It’s just a pleasure,” the Franklin star responded when asked if it’s nice to spend time with her kids.

Michael Douglas and Catherine Zeta-Jones, 54, are empty nesters after their two children became adults

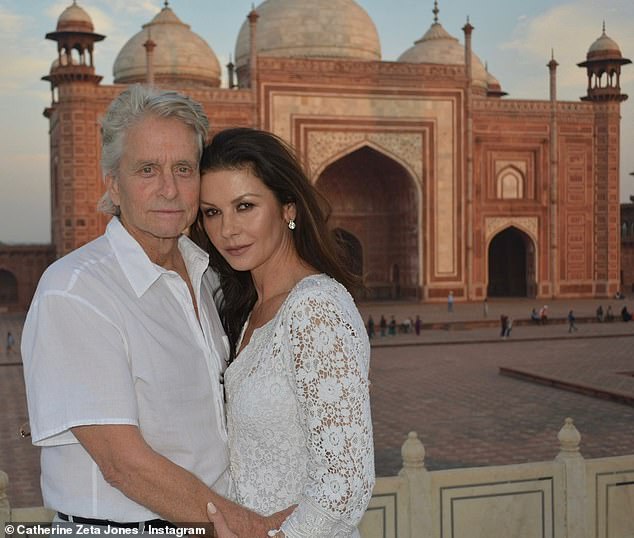

This week, the Oscar-winning actor joked that all they want to see is Dylan and Carys to treat them to a luxurious vacation. Seen in India

The Oscar-winning actress got cheeky and stuck out her tongue when Dylan took another photo in which she raised her selfie stick to the sky.

‘Especially when you’re not forcing them. I said, “Catherine, look, they actually want to go out with us.” I said, “You know, it’s good.”

“But we have good trips,” Douglas joked. “We entice them with good places to go.”

The family was last seen attending a wedding together in Palm Springs, California.

Before that they were in India. In August they traveled to Capri and stayed on a yacht.

He also has son Cameron, 45, with ex-wife Diandra Luker.

In 2022, Zeta-Jones told People that her family is happy

‘Both my daughter and Dylan have been incredibly supportive, not just as an actor, but just me, you know. “I feel very blessed to be able to have them both in my life,” she said.

Michael and Catherine were married in New York City in 2000.

The actor, 79, told Today on Tuesday that his plan is working.

“Catherine and I are lucky that our children Dylan and Carys still like to travel with us,” Douglas shared.

‘And so we just finished five weeks in India at Christmas. And we are always planning for next year, what our trips will be and where we will go.

“It’s just a pleasure,” the Franklin star responded when asked if it’s nice to spend time with her kids.

This comes after Douglas was shocked to discover he is related to Scarlett Johansson.

The Wall Street star appeared on the PBS series Finding Your Roots to delve into her ancestry, and was shocked to discover that the ‘Black Widow’ star, with whom she appeared in 2019’s Avengers: Endgame, is a ‘DNA cousin’ ‘ hers.

When told the news on the show, Michael said: ‘Are you kidding me? Oh, that’s amazing. Alright. This is great. This is great.’

Michael and Catherine are seen here at the Taj Mahal in Agra, India.

The Chicago star was visiting Joshua Tree after playing golf near Santa Barbara.

Finding Your Roots host Henry Louis Gates Jr. broke the news to Michael, telling him that he and the 39-year-old actress “share identical branches of DNA on four different chromosomes.”

Henry said the DNA branches “appear in Scarlett’s maternal lines, which go back to the Jewish communities of Eastern Europe.”

Michael admitted that it was “amazing” to discover that he and Scarlett were related, and that he “looks forward” to seeing her again.

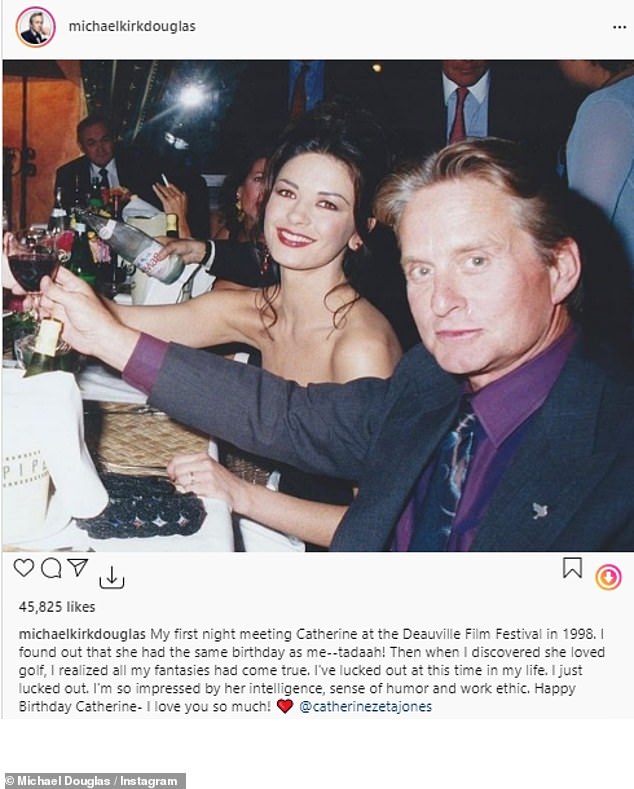

Michael shared a sweet post for his wife while sharing a photo of the two of them in the 1990s.