There is an alternative reality, in which Rachel Reeves and Sir Keir Starmer spent the last three months talking about Britain’s prospects and taking credit for reduced inflation, an interest rate cut and a recovering economy.

Feeding the national sense of optimism that came with a change of government and capitalizing on the improving economy, they then delivered an Autumn Budget focused on cleaning up the mess in the British tax system.

This could have been promoted as a boost to productivity and a key pillar to support Britain’s growth agenda.

Perhaps in that Budget some tax rates had to rise a little (after all, we need to balance the UK books), but we could be sold slightly higher rates as compensation for a revitalized and fairer tax system.

Take heart: in an alternate reality, Sir Keir Starmer and Rachel Reeves propose a very different scenario for the next budget: one based on optimism.

The clean slate approach could have involved ending the 60 percent tax trap, eliminating the benefit and child care cliffs, revising outdated inheritance tax reliefs, slightly increasing the income tax on capital but reintroduce indexation, and a guarantee that from now on tax thresholds increase with inflation.

All of these measures would make complete sense and could be framed as a foundation for improving productivity and generating decades of future growth.

A combination of positive sentiment and Rachel Reeves setting out her position to improve the tax system would allow for an adjustment to the Chancellor’s tax rules to support investment.

The overall message is that you elected us with a mandate for growth and we can’t tax our way to achieving it, so we will speculate sensibly to build up and set Britain up for success.

Bafflingly, Starmer and Reeves decided that their first 100 days and budget plan would be very different from this parallel universe.

Instead of the much-needed optimism, they have generated miserabilism.

The decision to talk big about the “£22bn black hole” and “painful budget” rhetoric as early as July 29 has led to months of speculation about spending cuts and tax rises.

Business leaders and professional investors are absolutely baffled by this approach.

The Prime Minister and the Chancellor seem to have been on a mission to eradicate all the good humor that existed the morning after the general election.

I’ve had numerous conversations over the past few months with business leaders and professional investors who are absolutely baffled by this approach.

I’m sure Reeves and Starmer had a good reason for this, but whatever it was, it’s been buried under a mountain of negativity.

It has managed to be blamed for the biggest drop in consumer confidence since Russia invaded Ukraine. Meanwhile, the effect can be roughly gauged by looking at how much of its post-election bounce has been returned to UK-focused investment funds and trusts.

Delaying the budget until the economic news looked better and the dust from the election had settled made sense, scaring people while we waited didn’t.

Fiscal promise: Labor pledged in its manifesto not to increase national insurance rates

The protracted run-up to the Autumn Budget has not only allowed every tax increase imaginable to be proposed, but also for most of them to be rejected, either because they are not worth it, are impractical or cause knock-on problems elsewhere. places.

Scraping the barrel, we now find the prospect of possibly one of the worst ways to raise more tax revenue being considered: an increase in employer contributions to national insurance and potentially an NI being imposed on employer contributions. to pensions.

This would be a tax on employment, preventing hiring and wage increases, and potentially reducing pension contributions. It is not a pro-growth policy.

If you squint hard enough, raising employer NI might fit in with Labour’s promise not to raise taxes on workers, but ultimately workers will pay the price.

In the meantime, I’m sure it doesn’t square with the clear statement in Labour’s manifesto: “we will not increase National Insurance, nor basic, higher or additional rates of Income Tax, nor VAT.”

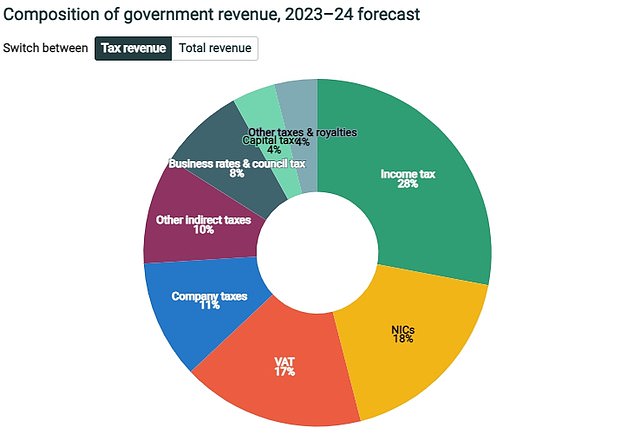

Labour’s big mistake was to corner itself with that silly promise on major taxes which together account for around three-quarters of UK tax revenue.

Big winners: This IFS chart shows how income tax, national insurance, VAT and corporation tax account for the majority of tax revenue.

This was a promise designed to get the party elected that did not adequately consider what it would have to do once in power.

So rather than the Chancellor being a new broom to sweep up the fiscal mess the Tories left us in, the expectations are that Reeves will end up tinkering to raise a bit of revenue and make bad taxes worse.

Of course, that may not happen, we could be in for a positive budget surprise.

I think that, if given room to be brave, Rachel Reeves has the potential to be a good chancellor.

She seems to me to be a politician who understands this, she has spoken out against bad policies and I suspect that she would like to solve the problems of the tax system.

Perhaps the best move would be to leave out the bad news and simply break the manifesto promise by reversing Jeremy Hunt’s latest 2p cut in national insurance for employees.

The UK couldn’t afford that tax cut and the former Chancellor really shouldn’t have done it. Raise NI back to 10p and we’ll still be 2p better off than before Hunt’s first NI cut earlier this year to get it down from 12p.

Reeves could be honest with us, explain that, and say that she hopes to cut NI again in the future when we can afford it.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.